F8863 PDF Form 8863 Department of the Treasury Internal 2021

Understanding IRS Form 8863

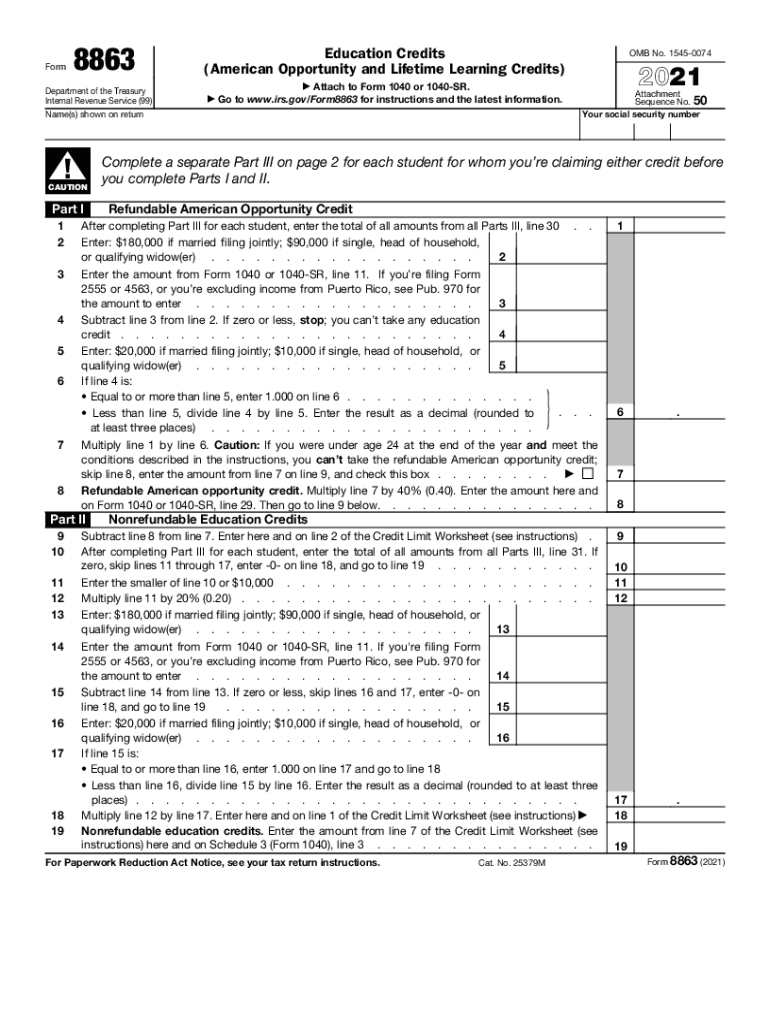

IRS Form 8863, also known as the Education Credits (American Opportunity and Lifetime Learning Credits) form, is used by taxpayers to claim education credits for qualified education expenses. This form allows eligible individuals to reduce their tax liability based on the costs associated with higher education. The American Opportunity Credit can provide a credit of up to two thousand five hundred dollars per eligible student, while the Lifetime Learning Credit offers a credit of up to two thousand dollars per tax return. Understanding the specifics of this form is essential for maximizing potential tax benefits.

Steps to Complete IRS Form 8863

Completing IRS Form 8863 involves several key steps:

- Gather necessary documentation, including Form 1098-T from educational institutions, which reports tuition payments.

- Determine eligibility for the American Opportunity Credit or the Lifetime Learning Credit based on your education expenses and income level.

- Fill out Part I of the form to claim the American Opportunity Credit or Part II for the Lifetime Learning Credit.

- Calculate the credits based on the qualified expenses and complete the necessary calculations.

- Transfer the total credits to your tax return, typically Form 1040.

Obtaining IRS Form 8863

IRS Form 8863 can be obtained directly from the IRS website or through tax preparation software. It is available as a downloadable PDF, which allows taxpayers to fill it out electronically or print it for manual completion. Additionally, many tax professionals can provide this form as part of their services, ensuring that it is filled out correctly to maximize potential credits.

Eligibility Criteria for IRS Form 8863

To qualify for the education credits claimed on IRS Form 8863, taxpayers must meet specific eligibility criteria, including:

- The student must be enrolled at an eligible educational institution.

- Qualified expenses must be incurred for tuition, fees, and course materials.

- Income limits apply; for instance, the American Opportunity Credit phases out for modified adjusted gross incomes above certain thresholds.

- Taxpayers must not have felony drug convictions for the American Opportunity Credit.

Filing Deadlines for IRS Form 8863

Filing deadlines for IRS Form 8863 align with the general tax filing deadlines. Typically, individual tax returns are due on April 15 of each year, unless that date falls on a weekend or holiday. If you are unable to file by this date, you may request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is important to keep track of these dates to ensure timely submission of your tax return and any associated forms.

Legal Use of IRS Form 8863

IRS Form 8863 is legally binding when completed and submitted according to IRS guidelines. To ensure compliance, taxpayers must accurately report their education expenses and adhere to the eligibility requirements outlined by the IRS. Misrepresentation of information or failure to provide accurate documentation can lead to penalties, including the disallowance of claimed credits and potential audits. Utilizing reliable digital tools can help maintain compliance and enhance the accuracy of your submissions.

Quick guide on how to complete f8863pdf form 8863 department of the treasury internal

Complete F8863 pdf Form 8863 Department Of The Treasury Internal effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documentation, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage F8863 pdf Form 8863 Department Of The Treasury Internal on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to amend and eSign F8863 pdf Form 8863 Department Of The Treasury Internal effortlessly

- Locate F8863 pdf Form 8863 Department Of The Treasury Internal and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign F8863 pdf Form 8863 Department Of The Treasury Internal and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f8863pdf form 8863 department of the treasury internal

Create this form in 5 minutes!

How to create an eSignature for the f8863pdf form 8863 department of the treasury internal

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

How to create an e-signature straight from your smartphone

The best way to make an e-signature for a PDF on iOS

How to create an e-signature for a PDF document on Android

People also ask

-

What are IRS forms, and why are they important for businesses?

IRS forms are official documents used for reporting income and expenses to the Internal Revenue Service in the United States. They are crucial for businesses to ensure compliance with tax regulations and avoid potential penalties. Utilizing airSlate SignNow streamlines the process of preparing and submitting IRS forms, making it easier for businesses to manage their tax obligations.

-

How can airSlate SignNow help me with IRS forms?

airSlate SignNow offers a user-friendly platform that allows you to create, send, and eSign IRS forms securely. With features like customizable templates and electronic signatures, you can efficiently manage all your tax documentation. This simplifies your workflow and ensures that you stay compliant with IRS requirements.

-

Are there any costs associated with using airSlate SignNow for IRS forms?

Yes, while airSlate SignNow offers various pricing plans, it provides an affordable solution for businesses needing to manage IRS forms. Depending on your needs, you can choose from different tiers that cater to varying levels of document management and signature requests. Pricing is transparent, and many organizations find it cost-effective considering the time saved.

-

What features does airSlate SignNow offer for managing IRS forms?

airSlate SignNow features include custom templates, reusable forms, advanced security options, and integration capabilities with popular software tools. These features allow businesses to efficiently prepare and manage their IRS forms while ensuring data protection and compliance. Additionally, the platform supports team collaboration, making it easier for multiple users to work on documents.

-

Can I integrate airSlate SignNow with other applications for IRS forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications, which is helpful for businesses handling IRS forms. Integrations with platforms like Google Drive, Dropbox, and CRM systems enhance your document management capabilities. This means you can easily import/export data and maintain a streamlined workflow across different tools.

-

Is it legally binding to eSign IRS forms through airSlate SignNow?

Yes, eSigning IRS forms with airSlate SignNow is legally binding and compliant with e-signature laws. This means that signatures collected through the platform are valid and can be used for official filing. AirSlate SignNow employs advanced encryption technology to ensure that your signed documents are secure and tamper-proof.

-

How does airSlate SignNow ensure the security of my IRS forms?

airSlate SignNow prioritizes the security of your IRS forms through robust encryption and secure data storage practices. The platform complies with industry standards such as GDPR and HIPAA to protect sensitive information. This commitment to security means you can confidently send and store important tax documents without concerns about unauthorized access.

Get more for F8863 pdf Form 8863 Department Of The Treasury Internal

- Instructions for petition for allocation of parental responsibilities colorado form

- Summons to respond to petition for allocation of parental responsibilities colorado form

- Motion allocation form

- Instructions for motion for modification of parental responsibilities colorado form

- Support motion form

- Colorado custody form

- Motion enforce time form

- Instructions to file a motion to concerning parenting time disputes colorado form

Find out other F8863 pdf Form 8863 Department Of The Treasury Internal

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word