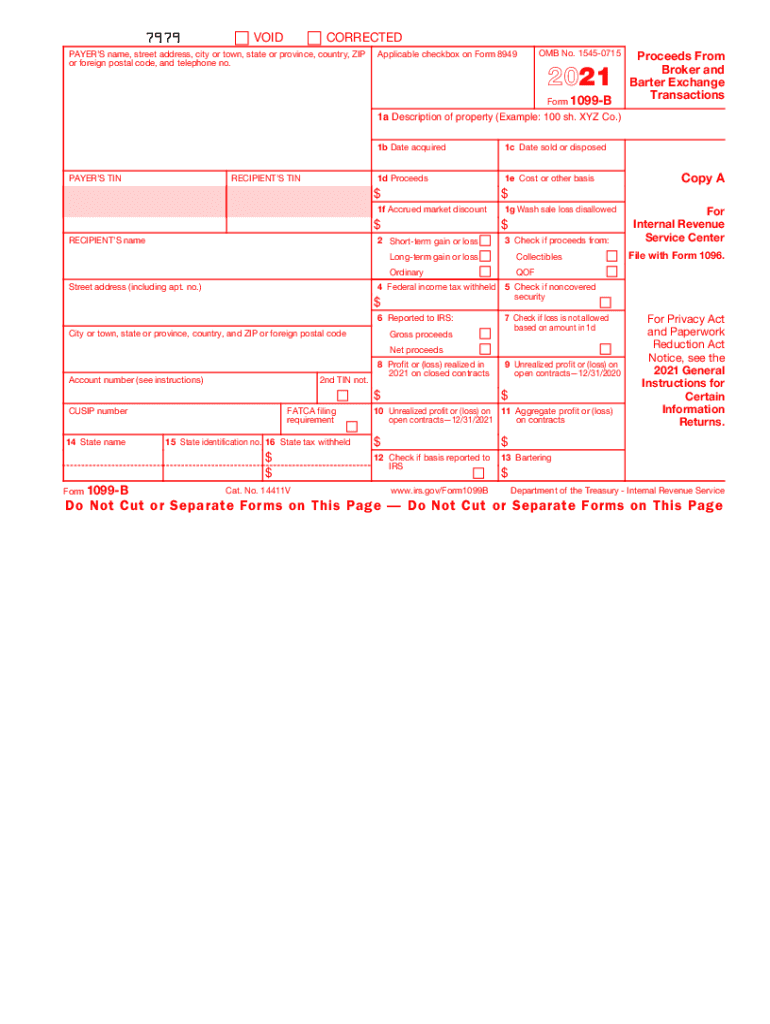

Form 1099 B Proceeds from Broker and Barter Exchange Transactions 2021

What is the Form 1099-B Proceeds From Broker And Barter Exchange Transactions

The Form 1099-B is a federal tax form used to report proceeds from broker and barter exchange transactions. This form is essential for taxpayers who have engaged in transactions involving the sale of stocks, bonds, commodities, or other securities. The IRS requires brokers and barter exchanges to provide this form to taxpayers and the IRS to ensure accurate reporting of capital gains and losses. Understanding what the 1099-B form entails is crucial for proper tax filing and compliance.

How to Use the Form 1099-B Proceeds From Broker And Barter Exchange Transactions

Using the Form 1099-B involves several steps. First, taxpayers should gather all relevant transaction records, including purchase and sale dates, amounts, and any associated costs. Once the form is received from the broker or barter exchange, individuals should review it for accuracy. The information reported on the 1099-B will be used to calculate capital gains or losses on Schedule D of the individual tax return. It is important to ensure that all transactions are reported correctly to avoid potential issues with the IRS.

Steps to Complete the Form 1099-B Proceeds From Broker And Barter Exchange Transactions

Completing the Form 1099-B involves several steps:

- Gather transaction details, including dates, amounts, and costs.

- Obtain the Form 1099-B from your broker or barter exchange.

- Review the form for accuracy, ensuring all transactions are listed.

- Fill out your tax return using the information from the 1099-B.

- File your tax return by the deadline, ensuring all forms are submitted correctly.

IRS Guidelines

The IRS provides specific guidelines for the use of Form 1099-B. Taxpayers must report all proceeds from transactions listed on the form, including both short-term and long-term gains. The IRS also requires that any adjustments to the basis of the securities sold be accurately reflected. Familiarity with IRS guidelines ensures compliance and helps avoid penalties related to improper reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099-B are critical for compliance. Typically, brokers must provide the form to taxpayers by January 31 of the year following the transactions. Additionally, the IRS requires that the form be filed by the end of February if submitted on paper, or by March 31 if filed electronically. Being aware of these deadlines helps taxpayers avoid late filing penalties.

Penalties for Non-Compliance

Failure to comply with the reporting requirements of Form 1099-B can result in significant penalties. The IRS imposes fines for late filing, incorrect information, or failure to file altogether. These penalties can vary based on how late the form is filed and the size of the business. Understanding these potential consequences emphasizes the importance of accurate and timely filing.

Quick guide on how to complete 2021 form 1099 b proceeds from broker and barter exchange transactions

Effortlessly Prepare Form 1099 B Proceeds From Broker And Barter Exchange Transactions on Any Device

Web-based document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without hassle. Manage Form 1099 B Proceeds From Broker And Barter Exchange Transactions on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

The most efficient way to modify and electronically sign Form 1099 B Proceeds From Broker And Barter Exchange Transactions effortlessly

- Find Form 1099 B Proceeds From Broker And Barter Exchange Transactions and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form—via email, SMS, invitation link, or download it to your computer.

Put an end to the worry of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Form 1099 B Proceeds From Broker And Barter Exchange Transactions and maintain exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1099 b proceeds from broker and barter exchange transactions

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1099 b proceeds from broker and barter exchange transactions

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

The best way to make an e-signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is a 1099 b form and why should I use it?

A 1099 b form is a tax form used to report proceeds from broker and barter exchange transactions. Utilizing airSlate SignNow can help streamline the signing and management process of your 1099 b forms, ensuring compliance and accuracy in your tax reporting.

-

How can airSlate SignNow help me manage my 1099 b filings?

With airSlate SignNow, you can easily eSign and send your 1099 b forms electronically. This service not only enhances the efficiency of your paperwork but also keeps your documents organized, ensuring you meet deadlines without hassle.

-

Is there a cost associated with using airSlate SignNow for 1099 b forms?

airSlate SignNow offers various pricing plans that cater to different business needs. Whether you need a basic plan for occasional 1099 b filings or a more comprehensive solution for regular use, there’s an affordable option available for you.

-

Can I integrate airSlate SignNow with other software for my 1099 b management?

Yes, airSlate SignNow easily integrates with various software applications you might be using for financial management. This means you can synchronize your 1099 b document processes with your existing tools for greater efficiency and accuracy.

-

What are the benefits of using airSlate SignNow to handle my 1099 b documents?

Using airSlate SignNow for your 1099 b documents provides several benefits, including quicker turnaround times and improved document security. Additionally, you can track the signing process in real-time and access templates to make future filings easier.

-

Is the eSigning process for 1099 b forms secure with airSlate SignNow?

Absolutely! airSlate SignNow employs advanced encryption and security measures to ensure that your 1099 b forms are safe during the eSigning process. You can trust that your sensitive information is protected from unauthorized access.

-

Can I use airSlate SignNow for bulk signing of 1099 b forms?

Yes, airSlate SignNow allows you to handle bulk signing of your 1099 b forms efficiently. This feature is perfect for businesses that need to process multiple 1099 b forms simultaneously, saving you time and reducing administrative workload.

Get more for Form 1099 B Proceeds From Broker And Barter Exchange Transactions

Find out other Form 1099 B Proceeds From Broker And Barter Exchange Transactions

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement