Form 1120 REIT IRS Gov Irs 2015

What is the Form 1120 REIT IRS gov Irs

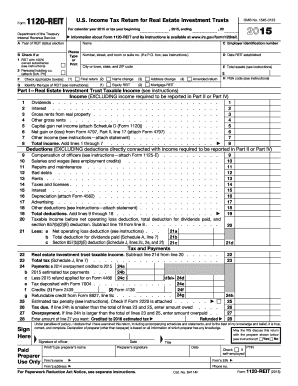

The Form 1120 REIT is a tax return specifically designed for Real Estate Investment Trusts (REITs) operating in the United States. This form is essential for REITs to report their income, deductions, and tax liabilities to the IRS. It is a requirement for any corporation that qualifies as a REIT under the Internal Revenue Code. By filing this form, REITs can ensure compliance with federal tax regulations while taking advantage of the unique tax benefits afforded to them.

How to use the Form 1120 REIT IRS gov Irs

Using the Form 1120 REIT involves several steps to ensure accurate reporting of a REIT's financial activities. First, gather all necessary financial data, including income from property rentals and any capital gains. Next, complete the form by entering the required information in the designated sections, such as income, deductions, and tax credits. After filling out the form, review it for accuracy before submission. It is crucial to ensure that all calculations are correct to avoid potential penalties.

Steps to complete the Form 1120 REIT IRS gov Irs

Completing the Form 1120 REIT involves a systematic approach:

- Gather financial statements, including balance sheets and income statements.

- Fill in the basic information about the REIT, such as name, address, and Employer Identification Number (EIN).

- Report total income, including rents and dividends.

- List allowable deductions, such as operating expenses and depreciation.

- Calculate the taxable income and applicable tax credits.

- Sign and date the form, ensuring that the person signing has the authority to do so.

Filing Deadlines / Important Dates

The filing deadline for the Form 1120 REIT is typically the fifteenth day of the third month after the end of the REIT's tax year. For most REITs operating on a calendar year basis, this means the form is due by March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is important for REITs to adhere to this timeline to avoid late filing penalties.

Legal use of the Form 1120 REIT IRS gov Irs

The legal use of the Form 1120 REIT is governed by the Internal Revenue Code, which outlines the requirements for REITs. To maintain their status and the associated tax benefits, REITs must comply with specific regulations, including the distribution of at least ninety percent of their taxable income to shareholders. Accurate completion and timely filing of the form are essential to uphold the legal standing of the REIT and avoid potential legal repercussions.

Key elements of the Form 1120 REIT IRS gov Irs

Several key elements are essential when completing the Form 1120 REIT:

- Income Reporting: Accurate reporting of all sources of income, including rental income and capital gains.

- Deductions: Identification of allowable deductions that can reduce taxable income.

- Tax Credits: Any applicable tax credits that can further reduce tax liability.

- Signature: The form must be signed by an authorized individual, typically an officer of the REIT.

Quick guide on how to complete 2015 form 1120 reit irsgov irs

Effortlessly Prepare Form 1120 REIT IRS gov Irs on Any Device

Digital document management has become increasingly prevalent among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without delays. Handle Form 1120 REIT IRS gov Irs on any device with airSlate SignNow's applications for Android or iOS and streamline any document-related process now.

How to Edit and eSign Form 1120 REIT IRS gov Irs with Ease

- Locate Form 1120 REIT IRS gov Irs and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize pertinent sections of your documents or hide sensitive information with specialized tools offered by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details carefully and then click the Done button to save your modifications.

- Select how you wish to share your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1120 REIT IRS gov Irs and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 1120 reit irsgov irs

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 1120 reit irsgov irs

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is Form 1120 REIT and how does it relate to IRS.gov?

Form 1120 REIT is a tax form specifically designed for Real Estate Investment Trusts (REITs) to report their income, deductions, and credits to the IRS. It is filed with the IRS.gov, offering a streamlined process for REITs to fulfill their tax obligations. Understanding how to fill out this form correctly can enhance compliance and benefit your business.

-

How does airSlate SignNow facilitate the eSigning of Form 1120 REIT?

airSlate SignNow provides a cost-effective solution that allows businesses to electronically sign Form 1120 REIT seamlessly. Our platform ensures that documents are securely signed while maintaining compliance with all IRS.gov requirements. This simplifies the submission process for stakeholders involved.

-

What are the pricing options for airSlate SignNow services?

airSlate SignNow offers various pricing tiers tailored to different business needs, ensuring that everyone can access the features necessary to manage Form 1120 REIT efficiently. Each plan includes eSigning capabilities, document management, and secure storage, making it a budget-friendly choice for both small and large enterprises.

-

What features does airSlate SignNow offer that assist with tax forms like Form 1120 REIT?

Our platform includes features such as customizable templates, document tracking, and real-time collaboration that simplify the process of filling out and eSigning Form 1120 REIT. Additionally, you can integrate with other apps to streamline your workflow. This ease of use ensures that your team spends less time on paperwork and more on what matters.

-

Can airSlate SignNow integrate with other applications that I use for tax preparation?

Yes, airSlate SignNow seamlessly integrates with popular accounting and business management software, enhancing your overall workflow. This means that you can manage your Form 1120 REIT submissions directly from your existing tools, ensuring that everything is synced efficiently and reducing the risk of errors.

-

Is airSlate SignNow compliant with IRS regulations for Form 1120 REIT?

Absolutely! airSlate SignNow is designed with compliance in mind, ensuring that all eSignatures and document handling meet IRS regulations, particularly for Form 1120 REIT. Maintaining compliance with IRS.gov standards protects your business and instills confidence in your clients.

-

What benefits does electronic signing provide for Form 1120 REIT?

Using airSlate SignNow for electronic signing of Form 1120 REIT offers numerous benefits, including faster turnaround times and the elimination of paper-based processes. This not only helps in expediting tax submissions but also reduces costs associated with printing and mailing. Moreover, it provides a secure and verifiable audit trail for your records.

Get more for Form 1120 REIT IRS gov Irs

- Bill of sale for watercraft or boat district of columbia form

- Bill of sale of automobile and odometer statement for as is sale district of columbia form

- Construction contract cost plus or fixed fee district of columbia form

- Painting contract for contractor district of columbia form

- Trim carpenter contract for contractor district of columbia form

- Fencing contract for contractor district of columbia form

- Hvac contract for contractor district of columbia form

- Landscape contract for contractor district of columbia form

Find out other Form 1120 REIT IRS gov Irs

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy