Federal Form 1120 REIT U S Income Tax Return for Real 2023

Understanding the Federal Form 1120 REIT U.S. Income Tax Return

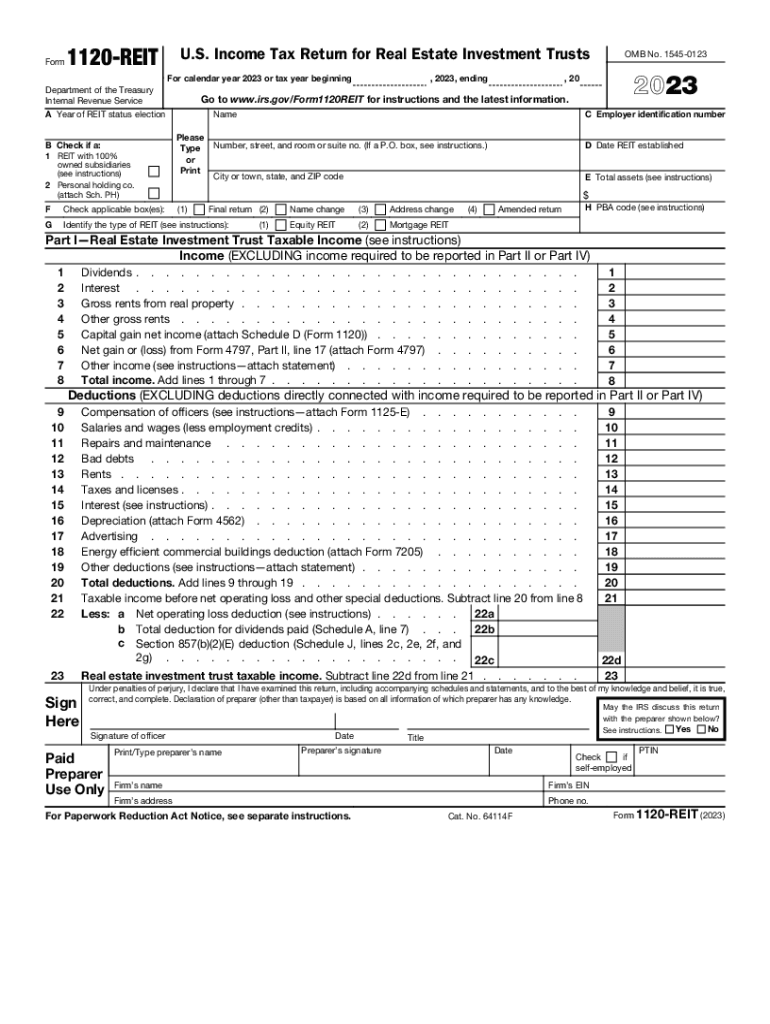

The Federal Form 1120 REIT is specifically designed for Real Estate Investment Trusts (REITs) to report their income, deductions, and tax liabilities to the Internal Revenue Service (IRS). This form is crucial for REITs, which are companies that own, operate, or finance income-producing real estate. By filing this form, REITs can maintain their tax-advantaged status, which allows them to avoid double taxation on income, provided they distribute at least ninety percent of their taxable income to shareholders.

Steps to Complete the Federal Form 1120 REIT

Completing the Federal Form 1120 REIT involves several key steps:

- Gather necessary documents: Collect financial statements, income records, and details of distributions made to shareholders.

- Fill out the form: Enter information such as income, deductions, and credits on the appropriate lines of the form.

- Calculate tax liability: Determine the tax owed based on the income reported and applicable deductions.

- Review for accuracy: Ensure all information is correct to avoid penalties or delays.

- Submit the form: File the completed form with the IRS by the designated deadline.

Key Elements of the Federal Form 1120 REIT

The Federal Form 1120 REIT includes several important sections that require attention:

- Income section: Report all sources of income, including rental income and capital gains.

- Deductions: List allowable deductions, such as operating expenses and interest payments.

- Tax computation: Calculate the tax based on the net income reported.

- Distribution requirements: Document the amounts distributed to shareholders to meet the ninety percent requirement.

Filing Deadlines for the Federal Form 1120 REIT

The filing deadline for the Federal Form 1120 REIT is typically the fifteenth day of the fourth month following the end of the tax year. For calendar year filers, this means the due date is April fifteenth. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential for REITs to adhere to this timeline to avoid penalties and maintain compliance with IRS regulations.

Legal Use of the Federal Form 1120 REIT

The legal use of the Federal Form 1120 REIT is governed by IRS regulations that stipulate how REITs must report their income and distributions. To qualify as a REIT, a company must meet specific criteria, including asset composition, income sources, and distribution requirements. Proper use of this form helps ensure that the REIT maintains its tax-exempt status and complies with federal tax laws.

Obtaining the Federal Form 1120 REIT

The Federal Form 1120 REIT can be obtained directly from the IRS website or through tax preparation software. It is important for businesses to use the most current version of the form to ensure compliance with any recent tax law changes. Additionally, many tax professionals can assist in obtaining and completing the form accurately.

Quick guide on how to complete federal form 1120 reit u s income tax return for real

Complete Federal Form 1120 REIT U S Income Tax Return For Real with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly option to traditional printed and signed documents, allowing you to access the required form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without any holdups. Handle Federal Form 1120 REIT U S Income Tax Return For Real on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Steps to modify and electronically sign Federal Form 1120 REIT U S Income Tax Return For Real effortlessly

- Find Federal Form 1120 REIT U S Income Tax Return For Real and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the stress of missing or misplaced documents, tedious form searching, or mistakes that necessitate reprinting document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Federal Form 1120 REIT U S Income Tax Return For Real to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal form 1120 reit u s income tax return for real

Create this form in 5 minutes!

How to create an eSignature for the federal form 1120 reit u s income tax return for real

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1120 REIT form, and why is it important?

The 1120 REIT form is a tax filing specifically used by Real Estate Investment Trusts (REITs) to report income, deductions, and credits to the IRS. It's essential for ensuring compliance with tax regulations and maximizing potential tax benefits for REIT investors.

-

How can airSlate SignNow help with the 1120 REIT form process?

airSlate SignNow streamlines the process of preparing and signing the 1120 REIT form. Our platform allows you to easily fill out, send, and eSign important documents securely and efficiently, reducing turnaround times and minimizing paperwork.

-

What are the pricing options for using airSlate SignNow for the 1120 REIT form?

airSlate SignNow offers flexible pricing options tailored to fit different business needs, whether you are an individual or a large organization. Subscription plans are available, which provide the essential tools to manage your 1120 REIT form and other documents effectively.

-

Are there any features in airSlate SignNow specifically for the 1120 REIT form?

Yes, airSlate SignNow includes features such as customizable templates and secure eSigning, which are particularly useful for preparing the 1120 REIT form. These tools help ensure that all necessary information is captured accurately and in a compliant manner.

-

Can I store my completed 1120 REIT form with airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your documents, including the completed 1120 REIT form. This feature allows you to access and manage your documents conveniently from anywhere, anytime.

-

Is airSlate SignNow compliant with regulations for the 1120 REIT form?

Yes, airSlate SignNow takes compliance seriously, ensuring that all signatures and document processes meet regulatory requirements. This gives you peace of mind when preparing and submitting your 1120 REIT form.

-

What integrations does airSlate SignNow offer for handling the 1120 REIT form?

airSlate SignNow integrates seamlessly with various applications like Google Drive, Salesforce, and others, allowing for a smooth workflow when preparing your 1120 REIT form. This flexibility enhances productivity by bringing all your tools together.

Get more for Federal Form 1120 REIT U S Income Tax Return For Real

- Resolution authorizing expense accounts form

- Response to request for personnel file form

- How and when to conduct return to work rtw discussions form

- Resolution setting attendance allowance form

- Ppe requirements for eye and face protection quick tips form

- Resolution setting officer salary form

- Sample policy military leave business management daily form

- It is hereby resolved that the company accept a contract with contractor form

Find out other Federal Form 1120 REIT U S Income Tax Return For Real

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later