Nareit Requests the IRS to Permit E Filing of Forms 1120 2024-2026

What is the Nareit Request to the IRS for E-Filing Forms 1120?

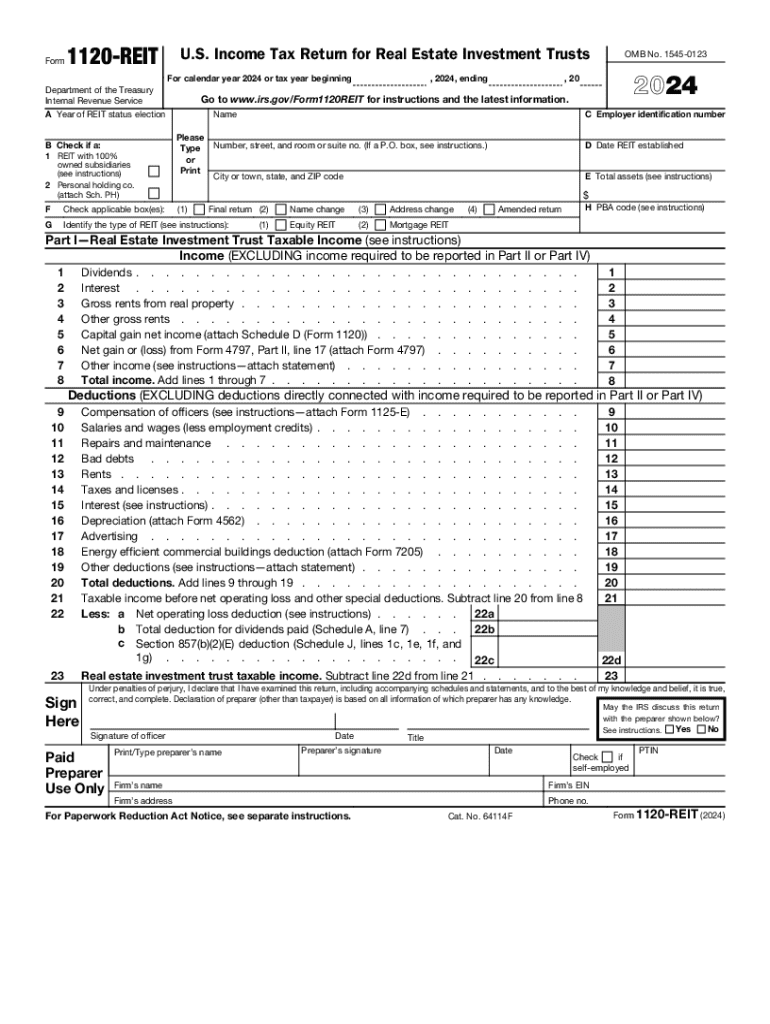

The National Association of Real Estate Investment Trusts (Nareit) has submitted a request to the Internal Revenue Service (IRS) to allow electronic filing of Forms 1120 for Real Estate Investment Trusts (REITs). This request aims to streamline the filing process, making it more efficient and accessible for businesses operating under the REIT structure. E-filing can enhance accuracy, reduce processing times, and minimize the risk of errors associated with paper submissions.

Steps to Complete the Nareit Request for E-Filing Forms 1120

To complete the Nareit request for e-filing Forms 1120, follow these steps:

- Gather all necessary documentation related to your REIT’s financial performance and tax obligations.

- Ensure compliance with IRS guidelines and requirements for filing Forms 1120.

- Prepare the request letter, clearly outlining the reasons for seeking e-filing approval.

- Submit the request to the IRS through the appropriate channels, ensuring all required information is included.

- Monitor the status of your request and respond promptly to any inquiries from the IRS.

IRS Guidelines for E-Filing Forms 1120

The IRS has established specific guidelines for e-filing Forms 1120. These guidelines include:

- Compliance with the IRS e-file program requirements, including software compatibility and data security measures.

- Adherence to deadlines for submission to avoid penalties.

- Proper formatting and completion of all required fields on the forms to ensure acceptance.

Filing Deadlines for Forms 1120

Filing deadlines for Forms 1120 are crucial for maintaining compliance. Generally, the due date for filing is the fifteenth day of the fourth month following the end of the tax year. For example, if your tax year ends on December 31, the form is due by April 15 of the following year. It is important to stay informed about any changes to these deadlines, as extensions may be available under certain circumstances.

Required Documents for E-Filing Forms 1120

When preparing to e-file Forms 1120, ensure you have the following documents ready:

- Financial statements, including balance sheets and income statements.

- Tax records from previous years for reference.

- Any supporting documentation required by the IRS for deductions and credits.

Penalties for Non-Compliance with E-Filing Requirements

Failure to comply with e-filing requirements can result in significant penalties. These may include:

- Late filing penalties, which can accumulate daily until the form is submitted.

- Potential interest on unpaid taxes if the filing is not completed on time.

- Increased scrutiny from the IRS, leading to audits or further investigations.

Create this form in 5 minutes or less

Find and fill out the correct nareit requests the irs to permit e filing of forms 1120

Create this form in 5 minutes!

How to create an eSignature for the nareit requests the irs to permit e filing of forms 1120

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a real investment trust?

A real investment trust is a company that owns, operates, or finances income-producing real estate. These trusts provide investors with a way to earn a share of the income produced through commercial real estate ownership without having to buy, manage, or finance any properties themselves.

-

How does airSlate SignNow integrate with real investment trusts?

airSlate SignNow offers seamless integrations that can enhance the operations of real investment trusts. By using our eSignature solution, real investment trusts can streamline document management, ensuring that all agreements and contracts are signed quickly and securely.

-

What are the benefits of using airSlate SignNow for real investment trusts?

Using airSlate SignNow allows real investment trusts to improve efficiency and reduce paperwork. Our platform provides a user-friendly interface for eSigning documents, which can signNowly speed up transactions and enhance the overall customer experience.

-

Is airSlate SignNow cost-effective for real investment trusts?

Yes, airSlate SignNow is designed to be a cost-effective solution for real investment trusts. With flexible pricing plans, businesses can choose the option that best fits their needs, ensuring they get the most value for their investment in document management.

-

What features does airSlate SignNow offer for real investment trusts?

airSlate SignNow provides a variety of features tailored for real investment trusts, including customizable templates, automated workflows, and secure cloud storage. These features help streamline the signing process and ensure that all documents are easily accessible.

-

Can airSlate SignNow help with compliance for real investment trusts?

Absolutely! airSlate SignNow is built with compliance in mind, ensuring that all eSigned documents meet legal standards. This is particularly important for real investment trusts, which must adhere to strict regulations in their operations.

-

How can real investment trusts benefit from document tracking in airSlate SignNow?

Document tracking is a key feature of airSlate SignNow that benefits real investment trusts by providing real-time updates on the status of documents. This transparency allows businesses to manage their agreements more effectively and ensures that no important steps are overlooked.

Get more for Nareit Requests The IRS To Permit E filing Of Forms 1120

- Horse purchase agreement form

- Factory waiver form

- Standard form 1445

- Form 4b slp

- A christmas carol figurative language worksheet pdf form

- Ionia county dog license form

- Pre primary certificate of nomination by party central committee elections state md form

- Adem ust ullage tank tightness test report form 17181519

Find out other Nareit Requests The IRS To Permit E filing Of Forms 1120

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe