Payroll Risk Assessment Template Form

What is the Payroll Risk Assessment Template

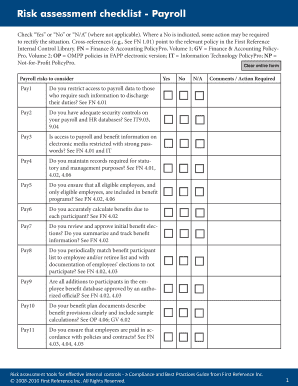

The payroll risk assessment template is a structured document designed to identify and evaluate potential risks associated with payroll processes within an organization. It serves as a critical tool for businesses to ensure compliance with legal regulations and to mitigate financial and operational risks. This template typically includes sections for detailing specific risks, assessing their impact, and outlining control measures to address them. By utilizing this template, organizations can systematically analyze their payroll systems and enhance their overall payroll risk management strategies.

How to Use the Payroll Risk Assessment Template

Using the payroll risk assessment template involves several key steps to ensure thorough evaluation and documentation of payroll-related risks. Begin by identifying the various components of your payroll system, including employee classifications, payment methods, and compliance requirements. Next, assess each component for potential risks, such as errors in employee classification or delays in payment processing. Document these risks in the template, noting their potential impact on the organization. Finally, outline control measures and assign responsibilities for monitoring and mitigating these risks. Regularly review and update the template to reflect any changes in payroll processes or regulations.

Key Elements of the Payroll Risk Assessment Template

The payroll risk assessment template comprises several essential elements that contribute to its effectiveness. Key components include:

- Risk Identification: A section dedicated to listing potential risks associated with payroll processes.

- Risk Assessment: An evaluation of the likelihood and impact of each identified risk.

- Control Measures: Recommendations for actions to mitigate identified risks.

- Responsibilities: Designation of individuals or teams responsible for monitoring and managing each risk.

- Review Schedule: A timeline for regular reviews and updates of the risk assessment.

Steps to Complete the Payroll Risk Assessment Template

Completing the payroll risk assessment template involves a systematic approach. Follow these steps:

- Gather Information: Collect data on payroll processes, employee classifications, and compliance requirements.

- Identify Risks: List potential risks associated with each payroll component.

- Assess Risks: Evaluate the likelihood and potential impact of each risk on the organization.

- Document Control Measures: Outline strategies to mitigate identified risks.

- Assign Responsibilities: Allocate specific tasks to team members for monitoring and managing risks.

- Set Review Dates: Establish a schedule for regular updates and reviews of the assessment.

Legal Use of the Payroll Risk Assessment Template

The payroll risk assessment template must comply with various legal standards to ensure its validity. In the United States, adherence to federal and state employment laws is crucial. This includes regulations related to wage and hour laws, tax compliance, and employee classification. Additionally, the template should align with the requirements set forth by the IRS and other governing bodies to ensure that payroll practices are legally sound. By using a legally compliant payroll risk assessment template, organizations can protect themselves from potential legal liabilities and ensure ethical payroll practices.

Examples of Using the Payroll Risk Assessment Template

Practical examples of utilizing the payroll risk assessment template can illustrate its effectiveness. For instance, a company may identify a risk of misclassifying employees as independent contractors. By documenting this risk in the template, the organization can assess the potential financial penalties and develop strategies to ensure proper classification. Another example could involve evaluating the risk of payroll data breaches. The template can help outline necessary security measures, such as encryption and access controls, to protect sensitive employee information. These examples demonstrate how the template can facilitate proactive risk management in payroll processes.

Quick guide on how to complete payroll risk assessment template

Complete Payroll Risk Assessment Template seamlessly on any device

Digital document management has increasingly become favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the needed form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly without delays. Manage Payroll Risk Assessment Template on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Payroll Risk Assessment Template effortlessly

- Find Payroll Risk Assessment Template and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and bears the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced files, tedious document searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign Payroll Risk Assessment Template to ensure smooth communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll risk assessment template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a payroll risk assessment template?

A payroll risk assessment template is a structured document designed to identify, evaluate, and manage risks associated with payroll processes. By using this template, businesses can document potential payroll issues and implement safeguards to mitigate risks effectively.

-

How can the payroll risk assessment template benefit my business?

Using a payroll risk assessment template can signNowly enhance your payroll management by identifying vulnerabilities early on. This proactive approach helps minimize errors and ensures compliance with regulations, ultimately saving time and reducing costs.

-

Is the payroll risk assessment template customizable?

Yes, the payroll risk assessment template is fully customizable to meet your business's unique needs. You can easily modify it to include specific risks relevant to your organization and tailor the assessment process accordingly.

-

What features does the payroll risk assessment template offer?

The payroll risk assessment template typically includes key sections for risk identification, analysis, and mitigation strategies. It may also feature checklists, risk rating scales, and action plan templates to streamline your assessment process.

-

How does the payroll risk assessment template integrate with other tools?

The payroll risk assessment template can be integrated with various HR and payroll management software, enhancing its utility. This seamless integration allows for better data flow and more accurate risk assessments based on real-time payroll data.

-

What is the pricing for the payroll risk assessment template?

Pricing for the payroll risk assessment template can vary based on the provider and the features included. airSlate SignNow offers competitive pricing plans that ensure businesses of all sizes can access a comprehensive payroll risk assessment template without breaking the bank.

-

Can I collaborate with my team using the payroll risk assessment template?

Absolutely! The payroll risk assessment template allows for collaboration among team members by enabling multiple users to review and edit the document. This functionality helps foster teamwork and ensures a comprehensive evaluation of payroll risks.

Get more for Payroll Risk Assessment Template

- Dms 024 form

- Request for i20 email sample form

- Residential rental city of highland form

- Competency based performance review peopleinaid

- Marion county cca form

- For a vacant office to be lakecountyindems form

- Blank lottery check template form

- Certificate of destruction computer electronic recycling inc form

Find out other Payroll Risk Assessment Template

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself