SUB CONTRACTOR SUB EMPLOYEE FORM

What is the SUB CONTRACTOR SUB EMPLOYEE FORM

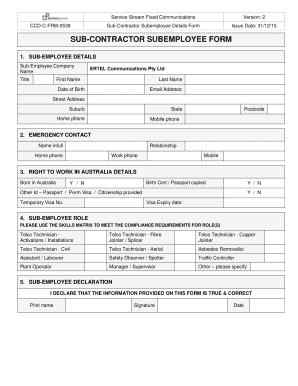

The SUB CONTRACTOR SUB EMPLOYEE FORM is a crucial document used to delineate the relationship between a contractor and a subcontractor or sub-employee. It serves to clarify the terms of engagement, responsibilities, and expectations for both parties involved. This form is essential for ensuring compliance with labor laws and tax regulations, as it helps to establish whether the individual is classified as an independent contractor or an employee under the law.

How to use the SUB CONTRACTOR SUB EMPLOYEE FORM

Using the SUB CONTRACTOR SUB EMPLOYEE FORM involves several key steps. First, ensure you have the correct version of the form, which can typically be obtained from your employer or relevant regulatory body. Next, fill out the required fields accurately, including personal information, job details, and payment terms. Once completed, both parties should review the document to ensure all information is correct before signing. Utilizing electronic signature platforms can streamline this process, making it easier to manage and store the document securely.

Steps to complete the SUB CONTRACTOR SUB EMPLOYEE FORM

Completing the SUB CONTRACTOR SUB EMPLOYEE FORM involves a systematic approach:

- Gather necessary information, such as names, addresses, and tax identification numbers.

- Clearly define the scope of work and payment terms.

- Fill in the form, ensuring all sections are completed accurately.

- Review the completed form with the other party to confirm accuracy.

- Sign the form using a secure electronic signature or in person.

- Keep a copy for your records and provide a copy to the other party.

Legal use of the SUB CONTRACTOR SUB EMPLOYEE FORM

The legal use of the SUB CONTRACTOR SUB EMPLOYEE FORM is critical for both parties to avoid potential disputes and ensure compliance with federal and state regulations. This form must be completed in accordance with the Fair Labor Standards Act (FLSA) and other relevant labor laws. Proper classification of workers as either independent contractors or employees affects tax obligations, benefits eligibility, and liability issues. Failure to use the form correctly may result in legal penalties or disputes over employment status.

Key elements of the SUB CONTRACTOR SUB EMPLOYEE FORM

Key elements of the SUB CONTRACTOR SUB EMPLOYEE FORM include:

- Personal Information: Names and contact details of both parties.

- Scope of Work: Detailed description of the services to be provided.

- Payment Terms: Information on compensation, including rates and payment schedules.

- Duration of Agreement: Start and end dates of the engagement.

- Signatures: Required signatures from both parties to validate the agreement.

Examples of using the SUB CONTRACTOR SUB EMPLOYEE FORM

Examples of using the SUB CONTRACTOR SUB EMPLOYEE FORM include various industries and scenarios:

- A construction company hiring subcontractors for specific projects.

- A marketing agency engaging freelance designers for campaigns.

- A software development firm contracting programmers to complete specific tasks.

In each case, the form helps clarify the working relationship and ensures compliance with relevant laws.

Quick guide on how to complete sub contractor sub employee form

Manage SUB CONTRACTOR SUB EMPLOYEE FORM easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Handle SUB CONTRACTOR SUB EMPLOYEE FORM on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to modify and electronically sign SUB CONTRACTOR SUB EMPLOYEE FORM effortlessly

- Find SUB CONTRACTOR SUB EMPLOYEE FORM and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize necessary sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you'd like to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign SUB CONTRACTOR SUB EMPLOYEE FORM to guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sub contractor sub employee form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a SUB CONTRACTOR SUB EMPLOYEE FORM?

A SUB CONTRACTOR SUB EMPLOYEE FORM is a critical document that helps businesses define the relationship between subcontractors and employees. It ensures compliance with labor laws and provides clarity on roles and responsibilities. Using airSlate SignNow, you can easily create, send, and eSign this form to streamline your hiring process.

-

How can airSlate SignNow help with the SUB CONTRACTOR SUB EMPLOYEE FORM?

airSlate SignNow simplifies the process of creating and processing a SUB CONTRACTOR SUB EMPLOYEE FORM. With our user-friendly interface, businesses can quickly generate the form, customize fields, and send it out for electronic signatures. This not only speeds up the process but also keeps all documentation organized and accessible.

-

What are the benefits of using a SUB CONTRACTOR SUB EMPLOYEE FORM?

Using a SUB CONTRACTOR SUB EMPLOYEE FORM can protect your business from potential legal issues by clearly establishing the working relationship. It also helps in clarifying tax obligations and ensuring compliance with regulations. With airSlate SignNow, these forms can be stored securely and retrieved easily when needed.

-

Is there a cost associated with the SUB CONTRACTOR SUB EMPLOYEE FORM on airSlate SignNow?

Yes, there may be associated costs depending on the plan you choose with airSlate SignNow. Our pricing is designed to be cost-effective, offering value through features like unlimited templates and eSigning options. You can choose a plan that best fits your business size and needs.

-

Can I integrate airSlate SignNow with other software for managing the SUB CONTRACTOR SUB EMPLOYEE FORM?

Absolutely! airSlate SignNow offers seamless integrations with popular tools such as Google Drive, Salesforce, and more. This allows for easy management and storage of your SUB CONTRACTOR SUB EMPLOYEE FORM alongside your existing workflows, saving you time and effort.

-

What features does airSlate SignNow offer for the SUB CONTRACTOR SUB EMPLOYEE FORM?

airSlate SignNow provides a variety of features for the SUB CONTRACTOR SUB EMPLOYEE FORM, including customizable template options, bulk sending capabilities, and advanced tracking of document status. These tools help you manage your forms efficiently and ensure that all parties are informed throughout the signing process.

-

How does airSlate SignNow ensure the security of the SUB CONTRACTOR SUB EMPLOYEE FORM?

airSlate SignNow takes security seriously, employing encryption protocols and secure access controls to protect your SUB CONTRACTOR SUB EMPLOYEE FORM. All documents are stored safely, and you can manage permissions to ensure only authorized users have access. This gives you peace of mind regarding your sensitive business information.

Get more for SUB CONTRACTOR SUB EMPLOYEE FORM

- It 511 individual income tax 500 and 500ez forms and general

- Dorgeorgiagov600 corporation tax return600 corporation tax returngeorgia department of revenue form

- Instructions for form cst 240 ampquotwest virginia claim for refund or credit

- Dorscgovforms siteformsdepartment of revenue sc4506 request for copy of tax return

- Dorscgovforms siteforms1350 department of revenue c 268 certificate of tax

- Scllr1350 state of south carolina department of revenue south carolina income tax rebate 20221350 state of south carolina form

- 2020 r delaware individual resident income tax return form 200 01

- Ct form os 114 online filing

Find out other SUB CONTRACTOR SUB EMPLOYEE FORM

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF