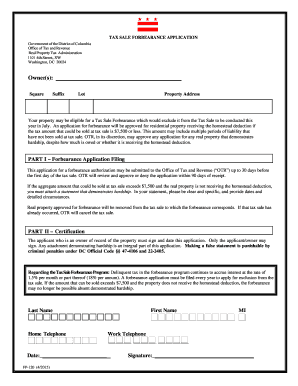

Tax Exemption Form

What is the Tax Exemption

Tax exemptions refer to specific provisions in tax law that allow certain individuals or entities to reduce their taxable income or avoid paying certain taxes altogether. These exemptions can vary widely based on jurisdiction and specific circumstances. In the United States, common examples include exemptions for property taxes, income taxes, and sales taxes. Understanding the criteria for these exemptions is crucial for taxpayers seeking to minimize their tax liabilities.

How to Obtain the Tax Exemption

Obtaining a tax exemption typically involves a formal application process. Taxpayers must gather necessary documentation that supports their eligibility for the exemption. This may include proof of income, residency, or specific qualifying conditions. Once the required documents are prepared, they should be submitted to the appropriate tax authority, which may be a local, state, or federal agency. It is important to check the specific requirements and procedures for the exemption being sought, as these can differ significantly.

Steps to Complete the Tax Exemption

Completing a tax exemption form involves several key steps:

- Identify the type of exemption you are eligible for, such as property tax exemptions or income tax exemptions.

- Gather all necessary documentation, including identification and proof of eligibility.

- Fill out the required tax exemption form accurately, ensuring all information is complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with any required documents to the relevant tax office.

Eligibility Criteria

Eligibility for tax exemptions varies based on the type of exemption and the jurisdiction. Common criteria may include:

- Income level: Some exemptions are available only to low-income individuals or families.

- Property ownership: Certain property tax exemptions require ownership of the property in question.

- Age or disability status: Exemptions may be available for seniors or individuals with disabilities.

- Specific use of property: Properties used for charitable or educational purposes may qualify for exemptions.

Required Documents

When applying for a tax exemption, it is essential to prepare the necessary documentation. Commonly required documents include:

- Proof of income, such as recent tax returns or pay stubs.

- Identification documents, including a driver's license or Social Security number.

- Property ownership documents, such as a deed or mortgage statement.

- Any additional forms specific to the exemption being applied for.

Filing Deadlines / Important Dates

Filing deadlines for tax exemptions can vary significantly by state and type of exemption. It is crucial for taxpayers to be aware of these deadlines to ensure their applications are submitted on time. Missing a deadline may result in the loss of the exemption for that tax year. Typically, deadlines may fall at the end of the tax year or at the beginning of the new tax year, so checking with the local tax office for specific dates is advisable.

Quick guide on how to complete tax exemption

Complete Tax Exemption effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly and efficiently. Manage Tax Exemption on any device using airSlate SignNow's Android or iOS applications and make your document-related tasks easier today.

How to edit and eSign Tax Exemption without any hassle

- Locate Tax Exemption and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign Tax Exemption to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are exemptions tax, and how can SignNow help manage them?

Exemptions tax refers to certain tax reductions that businesses can claim based on specific criteria. airSlate SignNow supports businesses by streamlining document preparation and eSigning processes, helping users efficiently manage their exemptions tax claims and submissions.

-

How does airSlate SignNow simplify the process of submitting exemptions tax documentation?

With airSlate SignNow, businesses can create, send, and eSign all necessary exemptions tax documents quickly and securely. This digital solution reduces paperwork, minimizes human error, and ensures that all submissions are timestamped and legally binding.

-

Are there any specific features of SignNow that assist with exemptions tax?

Yes, airSlate SignNow offers customizable templates for exemptions tax forms, ensuring that users can tailor documents to meet specific needs. Additionally, the platform allows for team collaboration and automated reminders to keep track of important deadlines related to exemptions tax.

-

What is the pricing structure for airSlate SignNow when dealing with exemptions tax documentation?

airSlate SignNow offers a variety of pricing plans to suit different business sizes and needs, including options that are particularly beneficial for handling exemptions tax documentation. With flexible monthly and annual subscriptions, businesses can choose a plan that maximizes their productivity while minimizing costs.

-

Can I integrate airSlate SignNow with other software to streamline exemptions tax processes?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, enhancing your ability to manage exemptions tax efficiently. These integrations help consolidate workflows, reducing the time spent on documentation, and allowing teams to focus on other critical aspects of their business.

-

What are the benefits of using airSlate SignNow for exemptions tax claims?

Using airSlate SignNow for exemptions tax claims provides signNow benefits, including increased efficiency and reduced administrative burdens. The platform’s user-friendly interface and powerful features help ensure that all necessary documentation is completed accurately and promptly, improving overall tax compliance.

-

Is airSlate SignNow compliant with regulations regarding exemptions tax?

Yes, airSlate SignNow is compliant with all necessary regulations, ensuring that businesses can manage their exemptions tax documentation without legal concerns. The platform prioritizes data security and compliance, so you're always up to date with the latest laws and regulations.

Get more for Tax Exemption

- 2022 schedule a form 8804 penalty for underpayment of estimated section 1446 tax by partnerships

- Be filed electronically form

- Am i eligible for the earned income tax credit eitc form

- F1099rpdf attention copy a of this form is provided for

- Reciprocity minnesota department of revenue form

- Wwwrevenuepagovformsandpublicationscorporation tax forms pennsylvania department of revenue

- Substantial presence testinternal revenue service form

- Dp 10 2022 nh department of revenue administration form

Find out other Tax Exemption

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free