Ginnie Mae Form 11709

What is the Ginnie Mae Form 11709

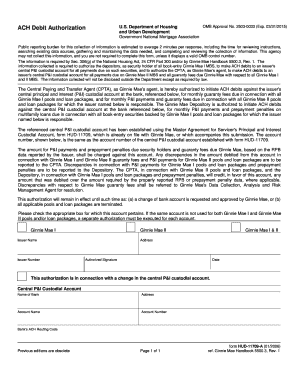

The Ginnie Mae Form 11709, also known as the GNMA 11709, is a critical document used in the mortgage industry. It serves as a request for a mortgage-backed securities guarantee from the Government National Mortgage Association (Ginnie Mae). This form is essential for lenders seeking to secure government backing for their mortgage loans, ensuring that they can offer competitive rates and terms to borrowers. The form captures vital information about the loan, borrower, and property, facilitating the processing and approval of mortgage-backed securities.

How to use the Ginnie Mae Form 11709

Using the Ginnie Mae Form 11709 involves several steps that ensure accurate completion and submission. First, gather all necessary information regarding the loan and borrower, including details like loan amount, interest rate, and borrower identification. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once completed, the form can be submitted electronically through a secure platform or printed and mailed to the appropriate Ginnie Mae office. Proper usage of this form is crucial for lenders to ensure compliance and secure the necessary guarantees.

Steps to complete the Ginnie Mae Form 11709

Completing the Ginnie Mae Form 11709 requires attention to detail. Here are the steps to follow:

- Gather required documentation, including borrower information and loan details.

- Access the Ginnie Mae Form 11709, either online or in a printed format.

- Fill in the borrower’s name, address, and Social Security number accurately.

- Provide details about the mortgage loan, including the amount and terms.

- Review the form for accuracy and completeness before submission.

- Submit the form electronically or via mail, ensuring it reaches the correct Ginnie Mae office.

Legal use of the Ginnie Mae Form 11709

The legal use of the Ginnie Mae Form 11709 is governed by federal regulations that ensure the integrity of mortgage-backed securities. This form must be completed accurately to comply with the requirements set forth by Ginnie Mae. Electronic signatures are acceptable if the submission is made through a compliant platform that adheres to the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Proper legal use ensures that lenders can rely on the guarantees provided by Ginnie Mae, thus facilitating smoother transactions.

Key elements of the Ginnie Mae Form 11709

Several key elements must be included in the Ginnie Mae Form 11709 to ensure its validity:

- Borrower’s personal information, including name and Social Security number.

- Details of the mortgage loan, such as loan amount and interest rate.

- Property information, including address and type of dwelling.

- Certification statements that confirm the accuracy of the provided information.

- Signature of the authorized representative from the lending institution.

Form Submission Methods

The Ginnie Mae Form 11709 can be submitted through various methods to accommodate different preferences and needs. The primary submission methods include:

- Online Submission: This method allows for quick and efficient processing through secure electronic platforms.

- Mail Submission: For those who prefer a traditional approach, the form can be printed and mailed to the designated Ginnie Mae office.

- In-Person Submission: Some lenders may choose to submit the form in person at Ginnie Mae offices for immediate assistance.

Quick guide on how to complete ginnie mae form 11709

Manage Ginnie Mae Form 11709 effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly substitution for conventional printed and signed papers, allowing you to obtain the required form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without interruptions. Handle Ginnie Mae Form 11709 on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and eSign Ginnie Mae Form 11709 without effort

- Obtain Ginnie Mae Form 11709 and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your method of delivering your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Edit and eSign Ginnie Mae Form 11709 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ginnie mae form 11709

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ginnie Mae Form 11709?

The Ginnie Mae Form 11709 is a vital document used in the securitization process of mortgage-backed securities. It is essential for ensuring compliance with Ginnie Mae's guidelines and facilitates a streamlined application process. Understanding how to fill out this form accurately is crucial for lenders and loan servicers.

-

How does airSlate SignNow assist with the Ginnie Mae Form 11709?

airSlate SignNow simplifies the process of completing and submitting the Ginnie Mae Form 11709 by providing an intuitive eSignature platform. Users can quickly fill out, sign, and send the form while ensuring compliance with Ginnie Mae's requirements. This saves time and reduces the chances of errors.

-

Is there a cost associated with using airSlate SignNow for the Ginnie Mae Form 11709?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The costs are designed to be cost-effective, ensuring businesses get value for their investment when handling essential documents like the Ginnie Mae Form 11709. You can select a plan that suits your usage and budget.

-

What features does airSlate SignNow provide for managing the Ginnie Mae Form 11709?

airSlate SignNow provides several robust features for managing the Ginnie Mae Form 11709, including cloud storage, customizable templates, and a user-friendly interface. These features are designed to enhance the efficiency of document management and ensure a smooth signing process. Users can easily access and manage all their forms in one place.

-

Can I track the status of my Ginnie Mae Form 11709 submissions using airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of their Ginnie Mae Form 11709 submissions in real-time. You'll receive notifications about document status, ensuring you are always aware of who has signed and when. This feature increases transparency and helps streamline the approval process.

-

How does airSlate SignNow ensure the security of the Ginnie Mae Form 11709?

Security is a top priority for airSlate SignNow, and we implement various measures to protect the Ginnie Mae Form 11709 and other sensitive documents. Our platform utilizes advanced encryption and secure cloud storage, ensuring that your documents are safe from unauthorized access. Users can confidently manage their forms knowing they are secure.

-

Are there integrations available for submitting the Ginnie Mae Form 11709?

Yes, airSlate SignNow offers various integrations with popular software systems that can facilitate the submission of the Ginnie Mae Form 11709. Whether you're using a CRM, document management system, or other tools, integrating airSlate SignNow can streamline your workflow. This enhances efficiency and ensures seamless data transfer.

Get more for Ginnie Mae Form 11709

- Bus permission slip form

- How to become a superstar student 2nd edition form

- Consumer staples portfolio classticker fidelity advisor consumer form

- Fidelity emerging europe middle east africa emea fund class form

- Fidelity california municipal income fund classticker fidelity advisor form

- Fundticker fidelity california short intermediate tax bond form

- Setting up and administering your plan fidelity form

- Supplement to the fidelity advisor total bond fund institutional form

Find out other Ginnie Mae Form 11709

- Sign Document for Procurement Computer

- Sign Document for Procurement Mobile

- Sign Document for Procurement Later

- Sign Document for Procurement Myself

- Sign Document for Procurement Free

- Sign Document for Procurement Simple

- Sign Document for Procurement Fast

- Sign Document for Procurement Safe

- How Can I Sign Document for Procurement

- Can I Sign Document for Procurement

- Sign Form for Procurement Online

- Sign Form for Procurement Mobile

- Sign Form for Procurement Now

- Sign Form for Procurement Free

- Sign Form for Procurement Easy

- Sign Form for Procurement Safe

- Can I Sign Form for Procurement

- Sign PPT for Procurement Online

- Sign PPT for Procurement Computer

- Sign PPT for Procurement Mobile