Rmploeer Sher Withdrawal Forms

What is the Rmploeer Sher Withdrawal Forms

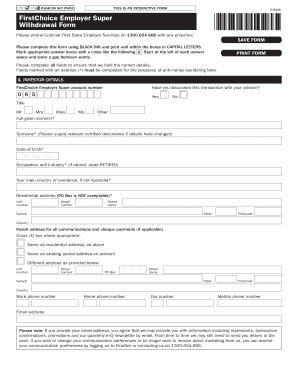

The Rmploeer Sher Withdrawal Forms are essential documents used by individuals to formally request the withdrawal of funds from their retirement accounts or pension plans. These forms serve as a legal means to initiate the process of accessing retirement savings, ensuring that all necessary information is documented and submitted correctly. The forms typically require details such as the account holder's information, the amount to be withdrawn, and the reason for the withdrawal, which may include retirement, financial hardship, or other qualifying events.

How to use the Rmploeer Sher Withdrawal Forms

Using the Rmploeer Sher Withdrawal Forms involves several straightforward steps. First, individuals should obtain the correct form from their retirement plan provider or financial institution. Next, fill out the required sections accurately, ensuring that all personal information is current and complete. After completing the form, review it for any errors before submitting it to the appropriate department, either electronically or by mail, depending on the institution's guidelines. It is crucial to keep a copy of the submitted form for personal records.

Steps to complete the Rmploeer Sher Withdrawal Forms

Completing the Rmploeer Sher Withdrawal Forms involves a systematic approach to ensure accuracy and compliance. Here are the key steps:

- Obtain the form from your retirement plan provider.

- Fill in your personal details, including your name, address, and account number.

- Specify the amount you wish to withdraw and the reason for the withdrawal.

- Sign and date the form to validate your request.

- Submit the form as per your provider's instructions, either online or via mail.

Legal use of the Rmploeer Sher Withdrawal Forms

The Rmploeer Sher Withdrawal Forms are legally binding documents that must be completed in accordance with federal and state regulations. To ensure legal compliance, individuals must provide accurate information and adhere to any specific requirements set forth by their retirement plan. Additionally, the use of electronic signatures is permitted, provided that the eSignature complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This legal framework ensures that electronically signed documents hold the same weight as traditional paper forms.

Required Documents

When completing the Rmploeer Sher Withdrawal Forms, certain documents may be required to support your request. These typically include:

- A copy of a government-issued ID for identity verification.

- Proof of financial hardship, if applicable, such as bank statements or pay stubs.

- Any additional documentation requested by your retirement plan provider.

Having these documents ready can expedite the processing of your withdrawal request.

Form Submission Methods (Online / Mail / In-Person)

The submission methods for the Rmploeer Sher Withdrawal Forms vary based on the retirement plan provider's policies. Common submission options include:

- Online: Many providers offer a secure portal for electronic submission, allowing for quicker processing.

- Mail: Completed forms can often be sent via postal service to the designated address provided by the retirement plan.

- In-Person: Some individuals may choose to submit their forms directly at their financial institution's branch office.

It is advisable to check with your provider for the preferred method of submission to ensure timely processing of your withdrawal request.

Quick guide on how to complete rmploeer sher withdrawal forms

Complete Rmploeer Sher Withdrawal Forms effortlessly on any device

The management of online documents has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Rmploeer Sher Withdrawal Forms on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Rmploeer Sher Withdrawal Forms effortlessly

- Find Rmploeer Sher Withdrawal Forms and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Alter and electronically sign Rmploeer Sher Withdrawal Forms to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rmploeer sher withdrawal forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Rmploeer Sher Withdrawal Forms?

Rmploeer Sher Withdrawal Forms are essential documents that facilitate the process of withdrawing funds or benefits from employer-sponsored plans. These forms ensure all necessary information is documented correctly, allowing for a smooth transaction. By using airSlate SignNow, you can eSign these forms quickly and securely.

-

How much does airSlate SignNow cost for Rmploeer Sher Withdrawal Forms?

The pricing for airSlate SignNow varies depending on the features you need. We offer flexible plans that cater to different business sizes and requirements, ensuring affordability while providing essential functionality for Rmploeer Sher Withdrawal Forms. Visit our pricing page to find a plan that suits your needs.

-

What features does airSlate SignNow offer for Rmploeer Sher Withdrawal Forms?

airSlate SignNow provides a range of features designed to streamline the signing process of Rmploeer Sher Withdrawal Forms. Key features include customizable templates, secure eSigning, and automated reminders to ensure timely completion. These features enhance productivity and ensure that your documents are handled efficiently.

-

How do Rmploeer Sher Withdrawal Forms benefit my business?

Utilizing Rmploeer Sher Withdrawal Forms through airSlate SignNow can signNowly improve efficiency within your business. By digitizing and automating the signing process, you reduce paperwork and the potential for errors. This leads to quicker withdrawals and enhances overall customer satisfaction.

-

Can airSlate SignNow integrate with other software for Rmploeer Sher Withdrawal Forms?

Yes, airSlate SignNow offers seamless integrations with various software applications to handle Rmploeer Sher Withdrawal Forms efficiently. These integrations allow you to connect with popular CRM, cloud storage, and project management tools, streamlining your workflow. Check our integrations page for a comprehensive list.

-

Is it secure to use airSlate SignNow for Rmploeer Sher Withdrawal Forms?

Absolutely! airSlate SignNow prioritizes security for all transactions, including Rmploeer Sher Withdrawal Forms. We use advanced encryption, authentication measures, and comply with industry standards to protect your sensitive data.

-

How can I track the status of Rmploeer Sher Withdrawal Forms sent through airSlate SignNow?

You can easily track the status of Rmploeer Sher Withdrawal Forms sent via airSlate SignNow using our intuitive dashboard. The platform provides real-time updates on document status, including when a form is viewed or signed, ensuring you stay informed throughout the process.

Get more for Rmploeer Sher Withdrawal Forms

Find out other Rmploeer Sher Withdrawal Forms

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF