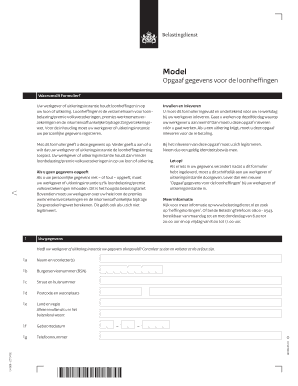

Model Opgaaf Gegevens Voor De Loonheffingen Form

What is the Model Opgaaf Gegevens Voor De Loonheffingen

The Model Opgaaf Gegevens Voor De Loonheffingen, commonly referred to as the loonheffingsformulier, is a crucial document used in the Netherlands to report employee earnings and tax deductions. This form is essential for employers to accurately calculate the payroll taxes owed to the government. It includes detailed information about the employee's personal data, income, and applicable tax credits. Understanding this form is vital for ensuring compliance with tax regulations and for the proper management of payroll processes.

How to Use the Model Opgaaf Gegevens Voor De Loonheffingen

To effectively use the Model Opgaaf Gegevens Voor De Loonheffingen, employers must gather all necessary employee information, including names, addresses, and tax identification numbers. The form should be filled out with accurate details regarding the employee's earnings, deductions, and any applicable tax credits. Once completed, it should be submitted to the relevant tax authority. Utilizing digital tools can streamline this process, ensuring that the form is filled out correctly and submitted on time.

Steps to Complete the Model Opgaaf Gegevens Voor De Loonheffingen

Completing the Model Opgaaf Gegevens Voor De Loonheffingen involves several key steps:

- Gather necessary employee information, including personal identification and income details.

- Fill out the form accurately, ensuring all sections are completed.

- Review the information for accuracy to avoid any potential errors.

- Submit the completed form to the appropriate tax authority by the designated deadline.

Following these steps can help ensure compliance and prevent any issues with tax reporting.

Legal Use of the Model Opgaaf Gegevens Voor De Loonheffingen

The legal use of the Model Opgaaf Gegevens Voor De Loonheffingen is governed by tax laws that require employers to report employee earnings and withholdings accurately. This form must be completed in accordance with the regulations set forth by the tax authority to ensure that all payroll taxes are calculated and remitted correctly. Failure to comply with these legal requirements can result in penalties and fines, making it essential for employers to understand their obligations regarding this form.

Required Documents

To complete the Model Opgaaf Gegevens Voor De Loonheffingen, several documents are typically required:

- Employee identification documents, such as a Social Security card or tax identification number.

- Records of employee earnings, including pay stubs or salary agreements.

- Documentation of any applicable tax credits or deductions that may affect the payroll calculations.

Having these documents ready can facilitate the accurate completion of the form.

Penalties for Non-Compliance

Employers who fail to submit the Model Opgaaf Gegevens Voor De Loonheffingen accurately or on time may face significant penalties. These can include fines, interest on unpaid taxes, and potential audits by tax authorities. It is crucial for businesses to adhere to deadlines and ensure that all information reported is correct to avoid these consequences. Staying informed about the latest tax laws and regulations can help mitigate the risk of non-compliance.

Quick guide on how to complete model opgaaf gegevens voor de loonheffingen 257771697

Effortlessly Prepare Model Opgaaf Gegevens Voor De Loonheffingen on Any Device

Online document management has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage Model Opgaaf Gegevens Voor De Loonheffingen on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to Edit and eSign Model Opgaaf Gegevens Voor De Loonheffingen with Ease

- Find Model Opgaaf Gegevens Voor De Loonheffingen and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as an old-fashioned wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from your chosen device. Edit and eSign Model Opgaaf Gegevens Voor De Loonheffingen and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the model opgaaf gegevens voor de loonheffingen 257771697

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loonheffingsformulier and why is it important?

The loonheffingsformulier is a crucial document for employers in the Netherlands as it reports payroll taxes to the tax authorities. Understanding how to correctly fill out a loonheffingsformulier can ensure compliance and avoid fines. airSlate SignNow simplifies the process of managing and signing this document electronically.

-

How does airSlate SignNow support the loonheffingsformulier process?

airSlate SignNow provides a streamlined platform for creating, sending, and electronically signing the loonheffingsformulier. This eliminates the hassle of paperwork and ensures that all signatures are securely captured. With our solution, you can track the document’s status in real-time.

-

Is there a cost associated with using airSlate SignNow for the loonheffingsformulier?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes features that facilitate the easy handling of the loonheffingsformulier, ensuring that you can manage your payroll documents efficiently without any hidden costs.

-

Can I integrate airSlate SignNow with other software for handling loonheffingsformulier?

Absolutely! airSlate SignNow integrates seamlessly with various HR and accounting software, allowing you to manage your loonheffingsformulier alongside other essential business functions. This integration streamlines your workflow, enabling you to save time and improve accuracy.

-

What are the key benefits of using airSlate SignNow for loonheffingsformulier management?

Using airSlate SignNow for your loonheffingsformulier ensures secure and efficient handling of payroll documents. Benefits include easy electronic signing, automated reminders, and compliance assurance, which reduce the risk of errors and enhance productivity in your operations.

-

How secure is the loonheffingsformulier information stored in airSlate SignNow?

Security is a top priority for airSlate SignNow. We employ advanced encryption and data protection measures to ensure that your loonheffingsformulier information is safe. Additionally, access controls and audit trails provide further assurance of data integrity.

-

What types of businesses can benefit from using airSlate SignNow for loonheffingsformulier?

Any business in the Netherlands that employs staff can benefit from using airSlate SignNow for managing loonheffingsformulier. Whether you are a small startup or a large corporation, our platform is designed to scale with your needs and simplify the payroll process.

Get more for Model Opgaaf Gegevens Voor De Loonheffingen

Find out other Model Opgaaf Gegevens Voor De Loonheffingen

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure

- Sign Virginia Lodger Agreement Template Safe

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online