Form CT 636 Alcoholic Beverage Production Credit Tax Year 2022

What is the Form CT 636 Alcoholic Beverage Production Credit Tax Year

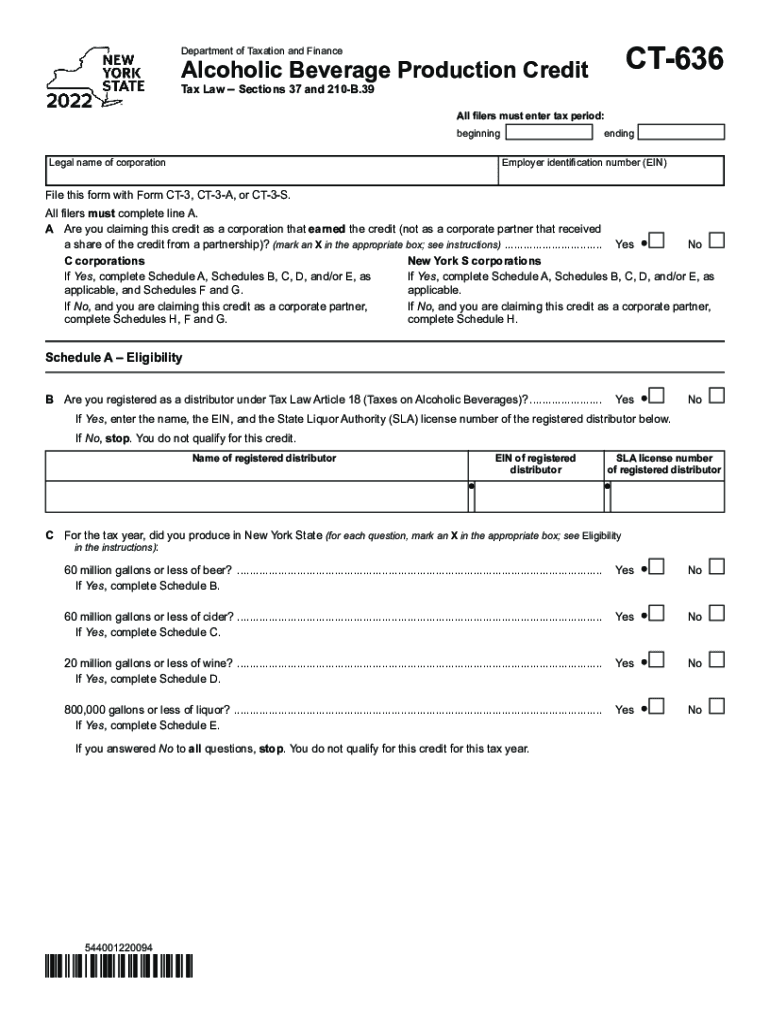

The Form CT 636 is designed for businesses in the alcoholic beverage industry to claim a tax credit for production activities conducted during the tax year. This form allows eligible entities to report their production volumes and calculate the applicable credits, which can significantly reduce their tax liabilities. The tax year for which the form is filed typically aligns with the calendar year, making it essential for businesses to keep accurate records of their production activities throughout the year.

Steps to complete the Form CT 636 Alcoholic Beverage Production Credit Tax Year

Completing the Form CT 636 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to production volumes, including invoices and receipts. Next, fill out the form by entering the required information, such as the business name, address, and tax identification number. Then, calculate the total production volume and the corresponding credit amount based on the provided guidelines. Finally, review the form for any errors before submitting it to the appropriate tax authority.

Eligibility Criteria

To be eligible for the tax credit claimed on Form CT 636, businesses must meet specific criteria set forth by state regulations. Generally, the business must be engaged in the production of alcoholic beverages and must have produced a minimum volume to qualify for the credit. Additionally, the business must be compliant with all relevant tax laws and regulations. It is advisable for businesses to consult with a tax professional to confirm their eligibility before filing.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 636 are critical for ensuring compliance and avoiding penalties. Typically, the form must be submitted by the due date of the business's tax return, which is often April 15 for calendar-year taxpayers. However, businesses should verify specific dates each year, as they may vary based on state regulations or changes in tax law. Keeping track of these deadlines is essential for timely submissions and to maximize available credits.

Legal use of the Form CT 636 Alcoholic Beverage Production Credit Tax Year

The legal use of Form CT 636 hinges on its compliance with state tax laws governing the alcoholic beverage industry. This form must be accurately completed and submitted to claim the production credit legally. Any discrepancies or inaccuracies can lead to audits or penalties. Therefore, it is crucial for businesses to maintain thorough records and ensure that all information reported on the form is truthful and substantiated by appropriate documentation.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting Form CT 636, depending on their preferences and state regulations. The form can typically be filed online through the state tax authority's website, which may offer a streamlined process for electronic submissions. Alternatively, businesses can choose to mail the completed form to the designated tax office. In some cases, in-person submissions may also be allowed, providing another avenue for businesses to ensure their forms are received and processed promptly.

Quick guide on how to complete form ct 636 alcoholic beverage production credit tax year

Complete Form CT 636 Alcoholic Beverage Production Credit Tax Year effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and without delays. Handle Form CT 636 Alcoholic Beverage Production Credit Tax Year on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

The easiest way to modify and eSign Form CT 636 Alcoholic Beverage Production Credit Tax Year with ease

- Locate Form CT 636 Alcoholic Beverage Production Credit Tax Year and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow has specifically designed for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate generating new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form CT 636 Alcoholic Beverage Production Credit Tax Year and ensure excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 636 alcoholic beverage production credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form ct 636 alcoholic beverage production credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer in 636 2022?

In 636 2022, airSlate SignNow provides a range of features including eSigning, document templates, and real-time tracking. These features are designed to streamline your business processes and enhance productivity. The user-friendly interface ensures that businesses can easily adopt the solution without any technical expertise.

-

How does pricing work for airSlate SignNow in 636 2022?

Pricing for airSlate SignNow in 636 2022 is designed to be flexible and cost-effective. Plans are available at various levels to accommodate different business sizes and needs. This allows you to choose a subscription that fits your budget while accessing the powerful features you need.

-

What are the key benefits of using airSlate SignNow in 636 2022?

Using airSlate SignNow in 636 2022 offers signNow benefits, including improved efficiency, reduced paperwork, and enhanced security. By adopting this solution, businesses can speed up document turnaround times, ensuring that important agreements are signed swiftly. Additionally, the compliance features help maintain industry standards.

-

Can airSlate SignNow integrate with other applications in 636 2022?

Yes, airSlate SignNow in 636 2022 can easily integrate with various applications such as Google Drive, Salesforce, and Microsoft Office. This flexibility allows businesses to streamline their workflows and keep all necessary tools connected. Integration enhances your ability to manage documents seamlessly across platforms.

-

Is airSlate SignNow suitable for small businesses in 636 2022?

Absolutely! airSlate SignNow is designed to cater to the needs of small businesses in 636 2022. With its user-friendly interface and affordable pricing, small businesses can efficiently manage their eSigning processes without heavy investment in technology.

-

What kind of support does airSlate SignNow offer in 636 2022?

In 636 2022, airSlate SignNow provides comprehensive customer support including live chat, phone support, and extensive online resources. This ensures that customers can easily resolve any issues or questions they may have while using the platform. Training materials and tutorials are also available to help users maximize their experience.

-

How secure is airSlate SignNow in 636 2022?

Security is a top priority for airSlate SignNow in 636 2022. The platform employs advanced encryption methods and complies with industry regulations to protect sensitive information. This ensures that your documents and data remain safe while facilitating electronic signing and sharing.

Get more for Form CT 636 Alcoholic Beverage Production Credit Tax Year

- Sc odometer form

- Promissory note in connection with sale of vehicle or automobile south carolina form

- Bill of sale for watercraft or boat south carolina form

- Bill of sale of automobile and odometer statement for as is sale south carolina form

- Construction contract cost plus or fixed fee south carolina form

- Painting contract for contractor south carolina form

- Trim carpenter contract for contractor south carolina form

- Fencing contract for contractor south carolina form

Find out other Form CT 636 Alcoholic Beverage Production Credit Tax Year

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast