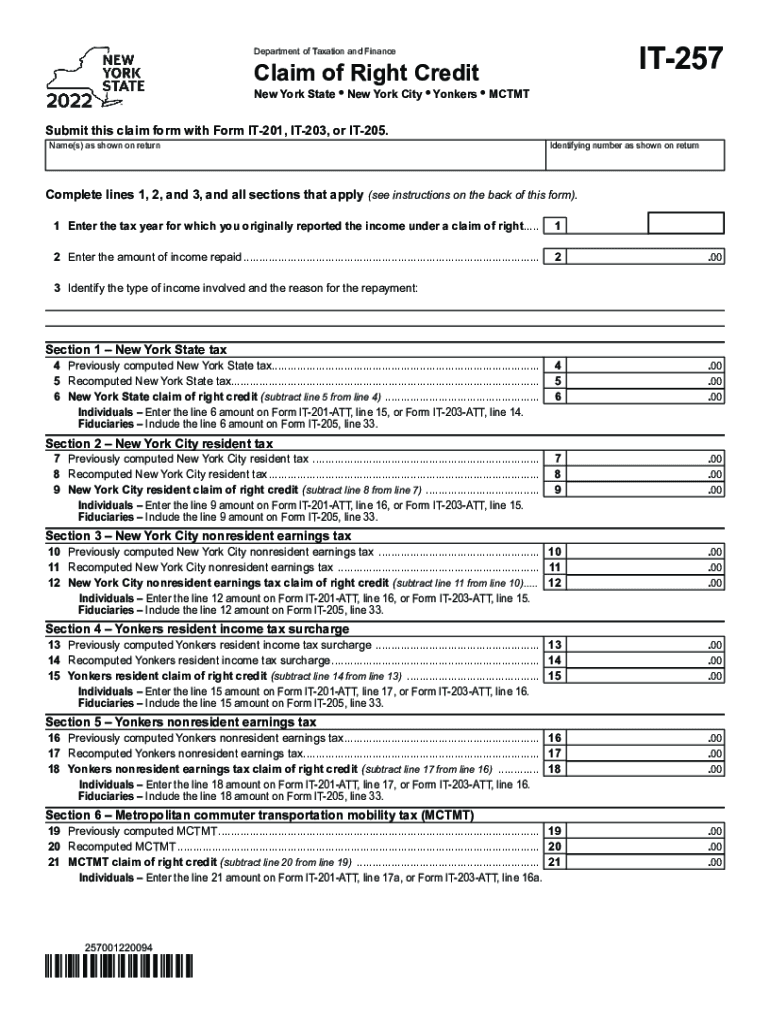

Form it 257 Claim of Right Credit Tax Year 2022

What is the Form IT 257 Claim of Right Credit?

The Form IT 257, known as the Claim of Right Credit, is a tax form used in New York State. It allows taxpayers to claim a credit for income that was previously reported but later returned or repaid. This form is particularly relevant for individuals who have experienced a change in their income situation, such as receiving a refund for income that was initially taxed. The credit helps to alleviate the tax burden by allowing taxpayers to adjust their tax liability based on the changes in their income.

Steps to Complete the Form IT 257 Claim of Right Credit

Completing the IT 257 form involves several key steps. First, gather all necessary documentation, including any records of income received and amounts repaid. Next, accurately fill out the form by providing your personal information, including your Social Security number and the tax year for which you are claiming the credit. Ensure that you detail the income that was reported and subsequently returned. Finally, review the form for accuracy before submitting it to the New York State Department of Taxation and Finance.

Eligibility Criteria for the Form IT 257 Claim of Right Credit

To qualify for the IT 257 Claim of Right Credit, taxpayers must meet specific criteria. The income in question must have been previously reported on a New York State tax return and later repaid or returned. Additionally, the repayment must have occurred within the relevant tax year or the two preceding years. Taxpayers should also ensure that they are not claiming the same income for multiple tax years, as this could lead to complications or penalties.

Legal Use of the Form IT 257 Claim of Right Credit

The IT 257 form is legally binding when completed accurately and submitted in accordance with New York State tax laws. It is essential to retain copies of all related documents, as they may be required for verification purposes. The use of this form is governed by the New York State Department of Taxation and Finance regulations, ensuring that taxpayers can claim their rightful credits while remaining compliant with tax laws.

How to Obtain the Form IT 257 Claim of Right Credit

Taxpayers can obtain the IT 257 form through several channels. It is available for download directly from the New York State Department of Taxation and Finance website. Additionally, physical copies can be requested by contacting the department or visiting local tax offices. It is advisable to ensure you have the most current version of the form to avoid any issues during the filing process.

Form Submission Methods for IT 257 Claim of Right Credit

The completed IT 257 form can be submitted in various ways. Taxpayers have the option to file electronically through the New York State e-file system, which offers a convenient and efficient method for submission. Alternatively, forms can be mailed directly to the appropriate address provided by the New York State Department of Taxation and Finance. In-person submissions may also be possible at designated tax offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete form it 257 claim of right credit tax year 2021

Complete Form IT 257 Claim Of Right Credit Tax Year seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow supplies you with all the tools you need to create, modify, and eSign your documents rapidly without delays. Manage Form IT 257 Claim Of Right Credit Tax Year on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Form IT 257 Claim Of Right Credit Tax Year effortlessly

- Obtain Form IT 257 Claim Of Right Credit Tax Year and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IT 257 Claim Of Right Credit Tax Year and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 257 claim of right credit tax year 2021

Create this form in 5 minutes!

How to create an eSignature for the form it 257 claim of right credit tax year 2021

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NY 257 form, and why is it important?

The NY 257 form is a state-specific document required for certain business and tax reporting obligations in New York. It is important to ensure compliance with state regulations and avoid potential penalties. Proper handling of the NY 257 form can streamline your operational processes and enhance your business's financial health.

-

How can airSlate SignNow help with the NY 257 form?

airSlate SignNow provides you with an intuitive platform to easily prepare and electronically sign the NY 257 form. With its user-friendly interface, you can efficiently manage your documents and ensure they are completed accurately. This not only saves time but also helps maintain compliance with New York state requirements.

-

Is there a cost to use airSlate SignNow for the NY 257 form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including those focusing on the NY 257 form. These plans are designed to be cost-effective while providing robust features. You can select a plan that best fits your budget and document management requirements.

-

Can I integrate airSlate SignNow with other tools for handling the NY 257 form?

Absolutely! airSlate SignNow seamlessly integrates with a variety of popular business tools and applications. This allows you to manage the NY 257 form alongside other documents and workflows, enhancing your overall efficiency and productivity.

-

What features does airSlate SignNow offer for managing forms like the NY 257?

airSlate SignNow includes features such as customizable templates, secure electronic signatures, and real-time document tracking. These functionalities simplify the process of preparing and signing the NY 257 form, making it easily accessible and manageable for users. Additionally, built-in compliance features ensure your documents meet all regulatory standards.

-

How secure is airSlate SignNow when processing the NY 257 form?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption protocols and secure data storage solutions to protect sensitive information associated with the NY 257 form. Users can confidently eSign and manage their documents, knowing that their data is secure.

-

Can I access the NY 257 form on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is designed to be mobile-friendly, allowing users to access and manage the NY 257 form anytime, anywhere. This flexibility means you can sign documents and track progress on the go, ensuring you are always on top of your business paperwork.

Get more for Form IT 257 Claim Of Right Credit Tax Year

- Written revocation of will rhode island form

- Last will and testament for other persons rhode island form

- Notice to beneficiaries of being named in will rhode island form

- Estate planning questionnaire and worksheets rhode island form

- Document locator and personal information package including burial information form rhode island

- Demand to produce copy of will from heir to executor or person in possession of will rhode island form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497325471 form

- Bill of sale of automobile and odometer statement south carolina form

Find out other Form IT 257 Claim Of Right Credit Tax Year

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later