Debt Snowball PDF Form

What is the Debt Snowball PDF?

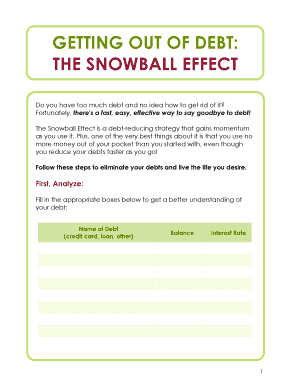

The debt snowball PDF is a financial tool designed to help individuals manage and eliminate their debts systematically. This method involves listing all debts from the smallest to the largest, allowing users to focus on paying off the smallest debts first. The psychological benefit of this approach is that paying off smaller debts quickly can provide motivation and a sense of accomplishment, encouraging users to tackle larger debts over time. The debt snowball PDF serves as a structured template that can be filled out digitally, making it easy to track progress and stay organized.

How to Use the Debt Snowball PDF

To effectively use the debt snowball PDF, begin by gathering information about all your debts, including balances, interest rates, and minimum monthly payments. Once you have this information, fill out the PDF by listing your debts in ascending order based on their total amounts. After completing the form, focus on making extra payments towards the smallest debt while maintaining minimum payments on larger debts. As each debt is paid off, the freed-up funds can be redirected to the next smallest debt, creating a snowball effect that accelerates debt repayment.

Steps to Complete the Debt Snowball PDF

Completing the debt snowball PDF involves several straightforward steps:

- Gather all relevant financial information regarding your debts.

- List each debt on the PDF, starting with the smallest balance.

- Include the total amount owed, interest rate, and minimum payment for each debt.

- Identify how much extra money you can allocate towards the smallest debt each month.

- Regularly update the PDF as debts are paid off to track your progress.

Legal Use of the Debt Snowball PDF

The debt snowball PDF is legally valid as a personal financial planning tool. When completed and signed, it can serve as a record of your debt repayment strategy. Although it does not require formal submission to any regulatory body, ensuring that all information is accurate and up-to-date is crucial. Using a trusted platform for filling out and storing this PDF can enhance its validity, particularly if electronic signatures are used, complying with relevant eSignature laws.

Key Elements of the Debt Snowball PDF

Several key elements should be included in the debt snowball PDF to ensure its effectiveness:

- Debt List: A comprehensive list of all debts, ordered by balance.

- Payment Details: Information on minimum payments and interest rates for each debt.

- Extra Payment Strategy: A plan for how much extra will be paid towards the smallest debt.

- Progress Tracking: Sections to mark debts as paid off and to update remaining balances.

Examples of Using the Debt Snowball PDF

Using the debt snowball PDF can vary based on individual financial situations. For instance, a user with three debts totaling $1,000, $3,000, and $5,000 might focus on the $1,000 debt first. By allocating any extra funds towards this debt while making minimum payments on the others, they can pay it off quickly. Once the smallest debt is eliminated, the user can redirect the funds previously used for that payment towards the next smallest debt, continuing the cycle until all debts are cleared.

Quick guide on how to complete debt snowball pdf

Effortlessly Prepare Debt Snowball Pdf on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without delays. Manage Debt Snowball Pdf on any device using the airSlate SignNow apps available for Android or iOS, and streamline any document-related operation today.

Easily Edit and eSign Debt Snowball Pdf

- Obtain Debt Snowball Pdf and click Get Form to begin.

- Use the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Debt Snowball Pdf to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the debt snowball pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a debt snowball worksheet PDF?

A debt snowball worksheet PDF is a financial tool designed to help individuals organize and track their debts. By using this worksheet, users can visualize their debt repayment strategy, focusing on paying off the smallest debts first to create momentum. This method is effective in promoting financial discipline and reducing overall debt.

-

How can the debt snowball worksheet PDF benefit me?

By utilizing a debt snowball worksheet PDF, you can gain a clearer understanding of your financial situation and prioritize your debts effectively. This method not only helps in creating a structured repayment plan but also boosts motivation as you see debts being paid off. Overall, it promotes healthier financial habits.

-

Is the debt snowball worksheet PDF free to download?

Yes, the debt snowball worksheet PDF is available for free download from our website. We believe in empowering our users to take control of their finances without any cost barriers. Get started today by accessing the worksheet and beginning your journey towards debt freedom.

-

Can I customize the debt snowball worksheet PDF?

Absolutely! Our debt snowball worksheet PDF is designed to be user-friendly, allowing for easy customization. You can input your own debt amounts and payment schedules, providing you with a personalized approach to managing your finances.

-

What features does the debt snowball worksheet PDF include?

The debt snowball worksheet PDF includes sections for listing out your debts, minimum payments, and total balance. Additionally, it features a calculation space for tracking your progress as you eliminate debts over time. This helps keep you motivated and on track with your financial goals.

-

How does airSlate SignNow integrate with my financial planning?

AirSlate SignNow offers seamless integration with various financial planning tools that can enhance your experience with the debt snowball worksheet PDF. You can easily eSign necessary documents online, ensuring that your financial agreements are secure and organized. This integration simplifies your financial management process.

-

What makes airSlate SignNow an effective choice for document signing?

AirSlate SignNow is an easy-to-use and cost-effective solution for sending and eSigning documents. With its user-friendly interface, businesses can streamline their signing process, which complements the use of resources like the debt snowball worksheet PDF. Our platform ensures that your documents are handled efficiently and securely.

Get more for Debt Snowball Pdf

- Important information on county of hawaii

- Form bb 1 rev 9 state of hawaii basic business application forms

- Tax information retirees

- Nonresident request for release from withholding 44017 form

- Ia w 4 employee withholding allowance certificate tax iowa form

- Iowa department of revenue confirms changes to individual form

- Credit for nonresident or part year residentiowa form

- Affidavit and agreement for reissuance of warrant form

Find out other Debt Snowball Pdf

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile