Form 1040 Schedule A&B Itemized Deductions and Interest

What is the Form 1040 Schedule A&B Itemized Deductions And Interest

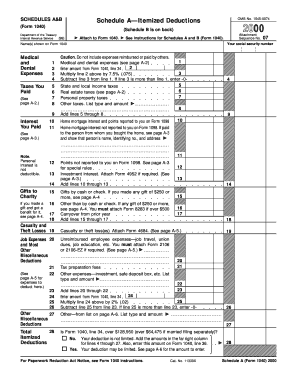

The Form 1040 Schedule A&B is a crucial component of the U.S. tax system, specifically designed for individuals who choose to itemize their deductions instead of taking the standard deduction. Schedule A allows taxpayers to report various itemized deductions, such as medical expenses, state and local taxes, mortgage interest, and charitable contributions. Schedule B, on the other hand, focuses on reporting interest and dividend income. Together, these schedules help taxpayers accurately report their financial situation, potentially lowering their overall tax liability.

How to use the Form 1040 Schedule A&B Itemized Deductions And Interest

Using the Form 1040 Schedule A&B involves several steps. First, you need to determine if itemizing your deductions is more beneficial than taking the standard deduction. If you decide to itemize, gather all necessary documentation, including receipts and statements for deductible expenses. Complete Schedule A by entering the amounts for each type of deduction. For Schedule B, report any interest or dividends earned during the tax year. Ensure that all information is accurate and complete before submitting your tax return.

Steps to complete the Form 1040 Schedule A&B Itemized Deductions And Interest

Completing the Form 1040 Schedule A&B requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts for deductible expenses.

- Determine your eligibility to itemize deductions based on your financial situation.

- Fill out Schedule A by entering your itemized deductions in the appropriate sections.

- Complete Schedule B by reporting any interest and dividend income.

- Double-check all entries for accuracy before incorporating them into your main Form 1040.

IRS Guidelines

The IRS provides specific guidelines for filling out the Form 1040 Schedule A&B. It is essential to follow these guidelines to ensure compliance and avoid potential penalties. The IRS outlines what qualifies as deductible expenses and the necessary documentation required to support your claims. Additionally, the IRS updates these guidelines periodically, so it is important to refer to the latest instructions when preparing your tax return.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for timely submission of the Form 1040 Schedule A&B. Generally, individual tax returns are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers can request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To complete the Form 1040 Schedule A&B accurately, certain documents are necessary. These include:

- W-2 forms from employers showing income and withheld taxes.

- 1099 forms for interest and dividend income.

- Receipts for deductible expenses, such as medical bills, property taxes, and charitable donations.

- Mortgage statements detailing interest paid on loans.

Quick guide on how to complete form 1040 schedule aampb itemized deductions and interest

Complete Form 1040 Schedule A&B Itemized Deductions And Interest effortlessly on any gadget

Web-based document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 1040 Schedule A&B Itemized Deductions And Interest on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Form 1040 Schedule A&B Itemized Deductions And Interest without hassle

- Find Form 1040 Schedule A&B Itemized Deductions And Interest and click Get Form to commence.

- Use the tools we offer to finalize your document.

- Highlight pertinent sections of the documents or redact sensitive data using tools provided by airSlate SignNow specifically designed for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow satisfies all your document management needs with just a few clicks from any device of your choice. Edit and eSign Form 1040 Schedule A&B Itemized Deductions And Interest and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040 schedule aampb itemized deductions and interest

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Form 1040 Schedule A & B Itemized Deductions and Interest?

Form 1040 Schedule A & B Itemized Deductions and Interest are important tax forms that allow you to itemize your deductions and report various types of interest income. Utilizing these forms can help taxpayers maximize their deductions and minimize their taxable income. Understanding the details of these forms will ensure you take advantage of all eligible tax benefits.

-

How can airSlate SignNow assist with completing Form 1040 Schedule A & B?

airSlate SignNow offers an easy-to-use platform that simplifies the process of completing and eSigning Form 1040 Schedule A & B. With our intuitive interface, you can quickly fill out these forms and ensure all necessary deductions are included. This efficiency helps streamline your tax preparation process, saving you time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for Form 1040 Schedule A & B?

Yes, airSlate SignNow offers various pricing plans to fit different needs. While there is a nominal fee to access our advanced features for eSigning and document management, the investment can lead to signNow savings when handling taxes with Form 1040 Schedule A & B Itemized Deductions and Interest. We also provide a risk-free trial to experience our service before committing to a plan.

-

What features does airSlate SignNow provide for users of Form 1040 Schedule A & B?

airSlate SignNow provides features like secure eSigning, document templates, and easy document sharing specifically designed for Form 1040 Schedule A & B. Our platform also supports cloud storage and integration with other applications to enhance your workflow. These features ensure that managing your tax forms is not only simplified but also secure and efficient.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with a variety of tax preparation and accounting software. This integration allows you to manage Form 1040 Schedule A & B Itemized Deductions and Interest alongside your other financial tools, resulting in a more streamlined tax filing process and minimizing the time spent on paperwork.

-

What benefits does using airSlate SignNow provide for tax professionals handling Form 1040 Schedule A & B?

For tax professionals, using airSlate SignNow enhances efficiency when handling Form 1040 Schedule A & B. Professionals can easily manage multiple client documents, streamline the eSigning process, and ensure compliance with tax regulations. This not only improves client satisfaction but also maximizes productivity within your practice.

-

Is airSlate SignNow compliant with data security regulations for handling taxes?

Yes, airSlate SignNow is fully compliant with data security regulations, ensuring that your sensitive information, including details regarding Form 1040 Schedule A & B Itemized Deductions and Interest, is protected. We utilize advanced encryption protocols and secure cloud storage to safeguard your documents. Trust in our platform to keep your data safe while simplifying your tax tasks.

Get more for Form 1040 Schedule A&B Itemized Deductions And Interest

Find out other Form 1040 Schedule A&B Itemized Deductions And Interest

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe