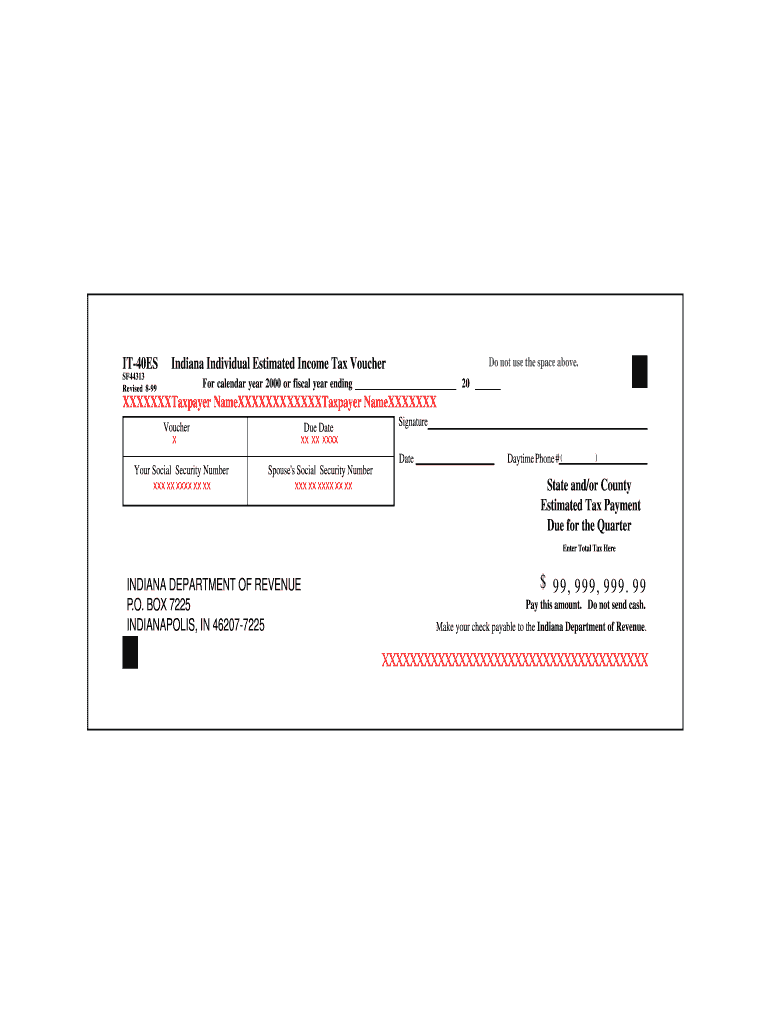

It 40es Form

What is the IT 40ES?

The IT 40ES form is a crucial document used for estimated tax payments in the United States. This form allows individuals and businesses to report and pay estimated income taxes quarterly. It is particularly relevant for those who do not have taxes withheld from their income, such as self-employed individuals, freelancers, and certain business entities. By utilizing the IT 40ES, taxpayers can avoid penalties for underpayment and ensure compliance with tax obligations.

How to Use the IT 40ES

To use the IT 40ES form effectively, taxpayers should first determine their estimated tax liability for the year. This involves calculating expected income, deductions, and credits. Once the estimated tax is determined, the taxpayer can fill out the IT 40ES form, indicating the amount they plan to pay for each quarter. It is essential to submit these payments on time to avoid interest and penalties, ensuring that the estimated tax aligns with the actual income earned throughout the year.

Steps to Complete the IT 40ES

Completing the IT 40ES form involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your expected annual income and any applicable deductions.

- Determine your estimated tax liability using the current tax rates.

- Fill out the IT 40ES form, entering your estimated tax payment amounts for each quarter.

- Review the form for accuracy and completeness before submission.

Legal Use of the IT 40ES

The IT 40ES form is legally binding when completed and submitted according to IRS guidelines. It is essential for taxpayers to adhere to the requirements set forth by the Internal Revenue Service to ensure that their estimated payments are recognized as valid. This includes submitting the form by the designated deadlines and maintaining accurate records of payments made throughout the year.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the IT 40ES form to avoid penalties. Estimated tax payments are typically due on the fifteenth day of April, June, September, and January of the following year. It is crucial to mark these dates on your calendar and ensure that payments are submitted on time to maintain compliance with tax regulations.

Required Documents

When preparing to complete the IT 40ES form, certain documents are necessary to ensure accurate reporting. These may include:

- Previous year's tax return for reference.

- Income statements such as W-2s or 1099s.

- Documentation of any deductions or credits that may apply.

Who Issues the Form

The IT 40ES form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. Taxpayers can obtain the form directly from the IRS website or through tax preparation software that includes IRS forms. It is important to ensure that the most current version of the form is used to comply with tax regulations.

Quick guide on how to complete it 40es

Complete It 40es effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow provides all the resources you require to generate, alter, and electronically sign your documents swiftly without delays. Manage It 40es on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The most convenient way to alter and electronically sign It 40es with ease

- Find It 40es and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your preference. Edit and electronically sign It 40es and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 40es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 40es?

airSlate SignNow is a user-friendly platform that empowers businesses to send and eSign documents efficiently. It 40es enhances this process by providing a seamless electronic signature experience, ensuring your documents are handled swiftly and securely.

-

What are the main features of airSlate SignNow?

airSlate SignNow offers various features such as document templates, team collaboration tools, and advanced security options. When considering it 40es, users can benefit from features designed to simplify the signing process and improve overall workflow efficiency.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow varies based on the chosen plan, catering to different business needs. It 40es provides flexible pricing options to ensure businesses can find a cost-effective solution that meets their document signing requirements.

-

What benefits does airSlate SignNow offer to businesses?

By utilizing airSlate SignNow, businesses can streamline their document workflows, reduce turnaround times, and decrease printing costs. It 40es allows companies to focus on core activities while simplifying document management with an intuitive eSigning solution.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow can be integrated with a variety of third-party applications, enhancing its functionality. This integration capability ensures that it 40es supports your existing software ecosystem, making it easier to manage documents across platforms.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow prioritizes the security of your documents, employing industry-standard encryption and compliance measures. It 40es guarantees that sensitive information remains protected throughout the signing process.

-

How can I get started with airSlate SignNow?

Getting started with airSlate SignNow is straightforward; simply sign up for an account on their website. With it 40es, you can immediately access a range of features that facilitate quick document sending and eSigning.

Get more for It 40es

Find out other It 40es

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist