6252 Form 2015

What is the 6252 Form

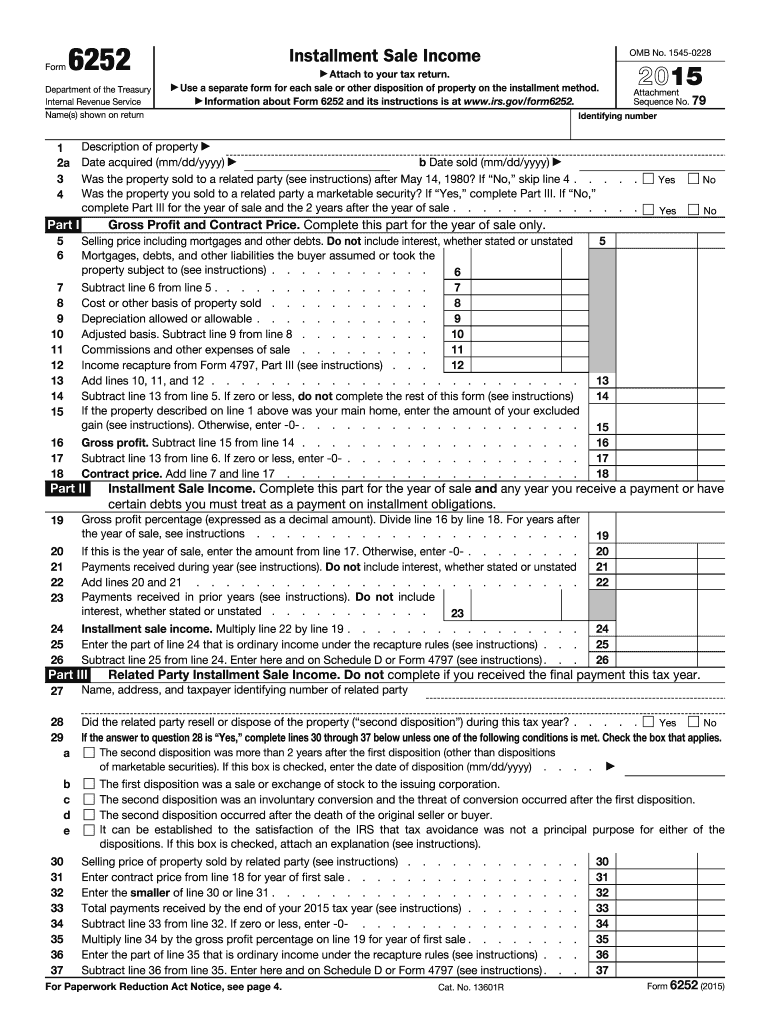

The 6252 Form, officially known as the "Installment Sale Income" form, is used by taxpayers in the United States to report income from the sale of property when the sale is structured as an installment sale. This form allows sellers to report the income received in the year of the sale, along with the income expected to be received in future years. It is particularly relevant for individuals and businesses that sell property and receive payments over time, rather than in a lump sum. The form ensures that taxpayers accurately report their income while complying with IRS regulations.

How to use the 6252 Form

Using the 6252 Form involves several steps to ensure accurate reporting of income from installment sales. First, gather all relevant information regarding the sale, including the total selling price, the amount received in the current year, and the remaining balance due. Next, fill out the form by providing details about the property sold, the buyer, and the terms of the installment sale. It's important to calculate the gross profit percentage, which will determine the amount of income to report each year. Finally, submit the completed form with your annual tax return to the IRS.

Steps to complete the 6252 Form

Completing the 6252 Form requires careful attention to detail. Follow these steps:

- Gather necessary documents, including the sales contract and payment schedule.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about the property sold, including its description and selling price.

- Calculate the total payments received during the tax year and the remaining payments.

- Determine your gross profit percentage by dividing the gross profit by the selling price.

- Report the income received for the current tax year based on the gross profit percentage.

- Review the completed form for accuracy before submission.

Legal use of the 6252 Form

The legal use of the 6252 Form is governed by IRS guidelines, which stipulate that taxpayers must report installment sale income accurately to avoid penalties. The form must be filed in conjunction with your annual tax return, ensuring that all income is reported in accordance with tax laws. Failure to use the form correctly can result in legal repercussions, including audits and fines. It is essential to maintain accurate records of all transactions related to the installment sale to support your reported income.

Filing Deadlines / Important Dates

Filing deadlines for the 6252 Form align with the general tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of the following year. If you require additional time, you may file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. It's crucial to stay informed about any changes to tax laws or deadlines that may affect your filing obligations.

Form Submission Methods

The 6252 Form can be submitted through various methods, including:

- Online: File electronically using tax software that supports the form.

- Mail: Send a paper copy of the form along with your tax return to the appropriate IRS address.

- In-Person: Visit a local IRS office to submit your form directly, if preferred.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 6252 Form. These guidelines include instructions on how to calculate installment sale income, the importance of maintaining accurate records, and the need to report any changes in payment terms. Familiarizing yourself with these guidelines can help ensure compliance and reduce the risk of errors in your tax reporting.

Quick guide on how to complete 2015 6252 form

Complete 6252 Form seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage 6252 Form on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to modify and eSign 6252 Form effortlessly

- Locate 6252 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign 6252 Form to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 6252 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 6252 form

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the 6252 Form, and why is it important?

The 6252 Form is a tax document used to report the sale of a capital asset where part of the payment is received in installments. It is essential for individuals and businesses that need to accurately report capital gains and ensure compliance with tax regulations. Using airSlate SignNow, you can easily eSign and send your 6252 Form securely.

-

How does airSlate SignNow simplify the process of managing the 6252 Form?

airSlate SignNow streamlines the management of the 6252 Form by allowing users to create, send, and eSign documents quickly and efficiently. Our user-friendly interface ensures that you can complete your forms without hassle, while our secure platform keeps your information protected.

-

Are there any costs associated with using airSlate SignNow to manage the 6252 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including a free trial to get started with eSigning your 6252 Form. Our plans are cost-effective and designed to provide value, ensuring you can manage your documents without overspending.

-

Can I integrate airSlate SignNow with other tools for processing the 6252 Form?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, including CRM and document management systems. This allows you to streamline your workflow when preparing and submitting the 6252 Form alongside other important documents.

-

What security measures does airSlate SignNow offer for the 6252 Form?

When using airSlate SignNow for your 6252 Form, your documents are protected with advanced encryption and secure storage. We prioritize the security of your sensitive information, ensuring that your eSigned documents are safe from unauthorized access.

-

Is it possible to track the status of my 6252 Form using airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking features that allow you to monitor the status of your 6252 Form. You'll receive notifications when your document is viewed, signed, or completed, making it easier to manage your paperwork.

-

How can airSlate SignNow help with compliance regarding the 6252 Form?

airSlate SignNow helps ensure compliance with the 6252 Form by providing an easy-to-use platform for eSigning and storing your documents. Our solution includes tools that help you maintain accurate records, which can be crucial for tax audits and filings.

Get more for 6252 Form

- Student records review and update verification certification form

- Apprenticeship programs florida department of education form

- Partner agency referral tips form

- North carolina dietetic association ncdamemberclicksnet ncda memberclicks form

- Sampson county concealed carry permit form

- Dma 5167pdf county analysis non compliance with processing thresholds or thresholds for denials withdrawals inquires form

- North carolina assumed form

- North carolina lighting incentive application form

Find out other 6252 Form

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure