Irs Form 990 2015

What is the Irs Form 990

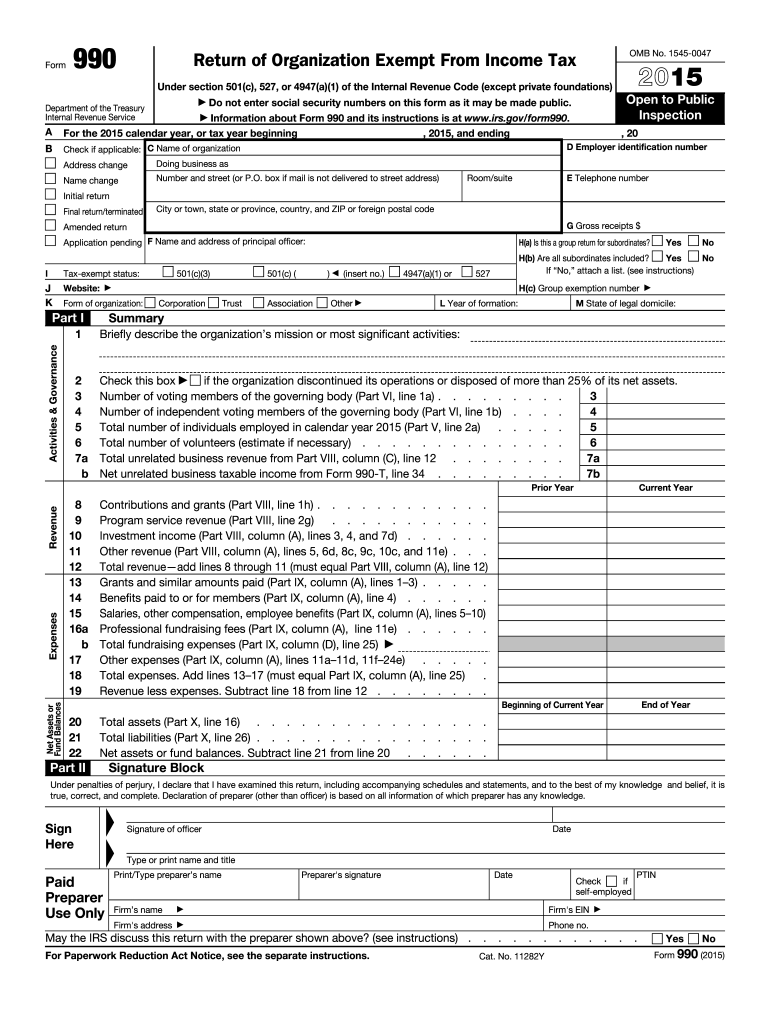

The Irs Form 990 is an annual information return that tax-exempt organizations, non-profits, and certain other entities must file with the Internal Revenue Service (IRS). This form provides the IRS and the public with a comprehensive overview of the organization’s financial activities, governance, and compliance with federal tax regulations. It includes details such as revenue, expenses, and the organization's mission, which helps ensure transparency and accountability in the non-profit sector.

How to use the Irs Form 990

Using the Irs Form 990 involves several key steps. Organizations must first gather all necessary financial data, including income statements, balance sheets, and details of program services. Once the information is compiled, the organization can begin filling out the form, ensuring that all sections are completed accurately. After completing the form, it must be reviewed for accuracy and compliance with IRS guidelines before submission. Organizations can file the form electronically or via mail, depending on their preference and eligibility.

Steps to complete the Irs Form 990

Completing the Irs Form 990 requires careful attention to detail. Here are the essential steps:

- Gather financial records, including income, expenses, and assets.

- Review IRS instructions for the specific form version being used.

- Fill out the form, ensuring all required sections are completed.

- Include schedules that apply to your organization, such as Schedule A for public charities.

- Review the completed form for accuracy and completeness.

- File the form by the deadline, either electronically or by mail.

Key elements of the Irs Form 990

The Irs Form 990 consists of several key elements that provide valuable information about the organization. These include:

- Part I: Summary of the organization's mission and activities.

- Part II: Signature and information about the organization’s officers and directors.

- Part III: Statement of program service accomplishments.

- Part IV: Financial data, including revenue and expenses.

- Schedules: Additional information required for specific types of organizations.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Irs Form 990 to avoid penalties. The standard due date for filing is the fifteenth day of the fifth month after the end of the organization’s fiscal year. For example, if the fiscal year ends on December 31, the form is due on May 15 of the following year. Organizations can apply for a six-month extension, but this must be done before the original due date.

Penalties for Non-Compliance

Failure to file the Irs Form 990 on time can result in significant penalties. The IRS imposes fines based on the organization’s gross receipts. For example, organizations that fail to file for three consecutive years may lose their tax-exempt status. It is crucial for organizations to adhere to filing requirements to maintain compliance and avoid financial repercussions.

Quick guide on how to complete irs 2015 form 990

Complete Irs Form 990 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Irs Form 990 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and electronically sign Irs Form 990 with ease

- Locate Irs Form 990 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive content using tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Irs Form 990 to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 2015 form 990

Create this form in 5 minutes!

How to create an eSignature for the irs 2015 form 990

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is IRS Form 990 and why is it important for nonprofits?

IRS Form 990 is a crucial tax document that nonprofit organizations must file annually to provide transparency about their financial activities. It helps ensure accountability and allows the public to evaluate a nonprofit's performance. Understanding and filing IRS Form 990 correctly is essential for maintaining your organization’s tax-exempt status.

-

How can airSlate SignNow help with filing IRS Form 990?

airSlate SignNow streamlines the process of collecting signatures and managing documents related to IRS Form 990. With its user-friendly interface, you can easily prepare, send, and eSign your Form 990, ensuring that all necessary parties can review and approve it quickly. This automation helps reduce errors and saves time during tax season.

-

What features does airSlate SignNow offer for managing IRS Form 990?

airSlate SignNow offers a variety of features tailored for managing IRS Form 990, including customizable templates, secure eSigning, and document tracking. These features ensure that you can create accurate forms and track their status in real-time, which is essential for compliance with IRS regulations.

-

Is there a cost associated with using airSlate SignNow for IRS Form 990?

Yes, airSlate SignNow offers several pricing plans that cater to different organizational needs. You can choose a plan that fits your budget and includes all the necessary tools to efficiently manage IRS Form 990 and other documents. This cost-effective solution is designed to help nonprofits save time and resources.

-

Can I integrate airSlate SignNow with other software for managing IRS Form 990?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software used by nonprofits, allowing you to streamline your workflow for IRS Form 990. These integrations enhance data accuracy and reduce redundancy, making it easier to manage all your essential documents in one place.

-

What are the benefits of using airSlate SignNow for IRS Form 990 eSigning?

Using airSlate SignNow for eSigning IRS Form 990 provides numerous benefits, including increased efficiency, enhanced security, and improved compliance. The platform allows you to gather signatures quickly and securely, ensuring your Form 990 is filed on time and accurately. This can signNowly reduce the stress associated with tax filing.

-

How secure is airSlate SignNow when handling IRS Form 990?

airSlate SignNow prioritizes security and compliance, utilizing advanced encryption and secure data storage to protect your IRS Form 990 and sensitive information. This commitment to security means you can confidently eSign and manage your documents without worrying about unauthorized access or data bsignNowes.

Get more for Irs Form 990

- Camp cedar springs informed consent form

- Bike to school agreement and consent form

- Form 211 choicerequesttransferdocx

- 2018 19 orca card conditions of use form seattle public schools

- Facilities use and scheduling issaquah school district form

- Claims wheaton world wide moving form

- Mphaonline form

- Learning for life and exploring annual health and medical record form

Find out other Irs Form 990

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed