A4 Form

What is the A4 Form

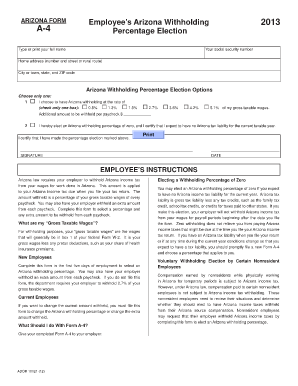

The A4 form is a specific document used primarily for tax purposes in the United States. It serves as a foundational tool for individuals and businesses to report various financial activities to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and is often required during the filing process. Understanding its purpose and requirements is crucial for accurate and timely submissions.

How to use the A4 Form

Using the A4 form involves several straightforward steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, accurately fill out the form, ensuring that all information is current and correct. It is important to follow the instructions provided with the form closely, as this will help prevent errors that could lead to delays or penalties. Once completed, the form can be submitted electronically or via mail, depending on individual preferences and requirements.

Steps to complete the A4 Form

Completing the A4 form requires careful attention to detail. Here are the steps to follow:

- Begin by downloading the A4 form from the IRS website or obtaining a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, including wages, dividends, and any other sources of income.

- Deduct any eligible expenses to arrive at your taxable income.

- Review the form for accuracy and completeness before submission.

Legal use of the A4 Form

The A4 form must be used in accordance with IRS regulations to be considered legally valid. This includes ensuring that all information is truthful and that the form is submitted by the appropriate deadlines. Failing to comply with these regulations can result in penalties, including fines or audits. Utilizing a reliable eSignature solution can further enhance the legal standing of the completed form, as it provides verification of identity and intent.

Key elements of the A4 Form

Several key elements are essential for the A4 form to be valid. These include:

- Personal Information: Accurate identification of the filer, including name and Social Security number.

- Income Reporting: A comprehensive list of all income sources.

- Expense Deductions: Detailed documentation of any deductions claimed.

- Signature: The form must be signed by the filer or an authorized representative.

Form Submission Methods

The A4 form can be submitted through various methods, accommodating different preferences. Options include:

- Online Submission: Many individuals choose to file electronically through IRS-approved software, which can streamline the process and reduce errors.

- Mail: The form can also be printed and mailed to the appropriate IRS address, ensuring that it is sent well before the filing deadline.

- In-Person: Some may opt to deliver the form in person at local IRS offices, which can be beneficial for receiving immediate assistance.

Quick guide on how to complete a4 form

Prepare A4 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly option to traditional printed and signed paperwork, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without unnecessary delays. Manage A4 Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to modify and eSign A4 Form effortlessly

- Locate A4 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your edits.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious browsing, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign A4 Form and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the a4 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an A4 form in the context of airSlate SignNow?

An A4 form in the context of airSlate SignNow refers to standard document formats that businesses often use for eSigning. This size accommodates a variety of documents, making it ideal for contracts, agreements, and forms that require signatures. Using airSlate SignNow, you can easily upload, send, and sign your A4 forms electronically.

-

How does airSlate SignNow simplify signing A4 forms?

airSlate SignNow simplifies signing A4 forms by allowing users to send documents for eSignature in just a few clicks. The platform offers an intuitive interface where you can drag and drop fields onto your A4 forms, ensuring that signers know where to sign. This streamlined process helps reduce turnaround time and enhance efficiency.

-

What are the pricing options for using airSlate SignNow with A4 forms?

airSlate SignNow offers several pricing plans tailored to different business needs, including options for those focusing on A4 forms. Plans typically range from basic to advanced features, ensuring flexibility for businesses of all sizes. To find the plan that best suits your requirements for managing A4 forms, visit the airSlate SignNow pricing page.

-

Can I integrate airSlate SignNow with other applications for handling A4 forms?

Yes, airSlate SignNow supports numerous integrations with popular applications, enabling seamless handling of A4 forms. You can connect it with CRM systems, cloud storage services, and other productivity tools. This integration capability enhances your workflow and ensures that your A4 forms are easily accessible alongside other business tools.

-

What benefits do I gain from using airSlate SignNow for A4 forms?

Using airSlate SignNow for A4 forms provides numerous benefits, including increased efficiency, reduced paper use, and quicker transaction times. With eSigning, your A4 forms can be processed and returned in a fraction of the time compared to traditional methods. Additionally, enhanced security features ensure that your documents remain safe throughout the signing process.

-

Is it easy to set up and use airSlate SignNow for A4 forms?

Yes, setting up airSlate SignNow for A4 forms is straightforward and user-friendly. The platform is designed to be intuitive, allowing even non-technical users to navigate easily. Once set up, you can start managing and sending your A4 forms for signatures promptly.

-

What kind of security features does airSlate SignNow offer for A4 forms?

airSlate SignNow prioritizes security, especially for sensitive A4 forms. The platform includes features such as encryption, secure document storage, and audit trails to track all activities related to your documents. These security measures ensure that your A4 forms are protected throughout the entire signing process.

Get more for A4 Form

Find out other A4 Form

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy