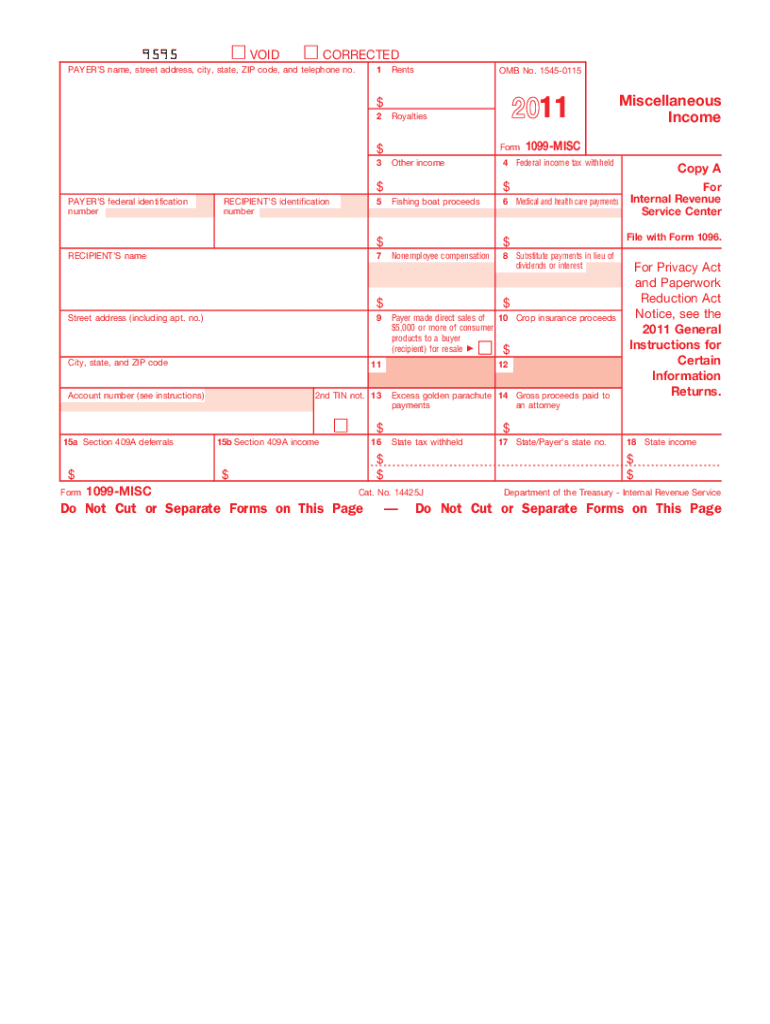

1099 Form 2011

What is the 1099 Form

The 1099 Form is a crucial tax document used in the United States to report various types of income that are not classified as wages, salaries, or tips. It is primarily issued by businesses to independent contractors, freelancers, and other non-employees who have received payments throughout the year. The form helps the Internal Revenue Service (IRS) track income and ensures that all earnings are reported for tax purposes. Various versions of the 1099 Form exist, each designed for specific income types, such as the 1099-MISC for miscellaneous income and the 1099-NEC for non-employee compensation.

How to use the 1099 Form

Using the 1099 Form involves several steps. First, the payer must gather all relevant information about the recipient, including their name, address, and taxpayer identification number (TIN). After compiling this data, the payer fills out the appropriate 1099 Form, detailing the amount paid to the recipient during the tax year. Once completed, the payer must provide a copy to the recipient and submit the form to the IRS. It is essential for both parties to retain copies for their records, as these documents are necessary for accurate tax reporting.

Steps to complete the 1099 Form

Completing the 1099 Form requires careful attention to detail. Follow these steps for accurate completion:

- Determine the correct version of the 1099 Form based on the type of income being reported.

- Collect the recipient's information, including their legal name, address, and TIN.

- Enter the total amount paid to the recipient in the appropriate box on the form.

- Include any other necessary information, such as federal or state tax withheld, if applicable.

- Review the form for accuracy before submitting it to the IRS and providing a copy to the recipient.

Legal use of the 1099 Form

The legal use of the 1099 Form is governed by IRS regulations. It is essential for businesses to issue this form when payments to a non-employee exceed a certain threshold, typically $600 in a calendar year. Failure to issue a 1099 Form when required can result in penalties for the payer. Additionally, recipients must report the income listed on the 1099 Form on their tax returns. Proper use of the form ensures compliance with tax laws and helps avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Form are critical for compliance. Generally, the form must be provided to recipients by January thirty-first of the year following the tax year in which payments were made. The IRS requires that the form be submitted by the end of February if filing by paper or by March thirty-first if filing electronically. Adhering to these deadlines helps avoid penalties and ensures that all parties have adequate time to prepare their tax returns.

Penalties for Non-Compliance

Non-compliance with 1099 Form regulations can lead to significant penalties. If a business fails to file the form or provides incorrect information, the IRS may impose fines. The penalties vary based on how late the form is filed, with higher fines for late submissions compared to those filed on time. Additionally, recipients who do not report income from a 1099 Form may face tax liabilities and potential audits. It is crucial for businesses to maintain accurate records and file timely to avoid these repercussions.

Quick guide on how to complete 2011 1099 form

Complete 1099 Form effortlessly on any gadget

Virtual document management has gained traction among enterprises and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage 1099 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to alter and eSign 1099 Form without hassle

- Find 1099 Form and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to apply your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or save it to your computer.

Forget about misplaced or lost documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any selected device. Modify and eSign 1099 Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 1099 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 1099 form

How to create an eSignature for your PDF document in the online mode

How to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is a 1099 Form and when do I need to use it?

A 1099 Form is a tax document used to report various types of income other than wages, salaries, or tips. You need to use a 1099 Form when you have made payments to independent contractors or freelancers that exceed $600 in a calendar year. Properly managing these documents is crucial for tax compliance and reporting.

-

How can airSlate SignNow help me with 1099 Forms?

airSlate SignNow offers an efficient way to create, send, and eSign 1099 Forms digitally. With our intuitive platform, you can streamline the process of managing 1099 Forms, ensuring they are signed and submitted promptly to avoid any penalties. This saves you time and reduces paperwork while enhancing your workflow.

-

What are the pricing plans for using airSlate SignNow for 1099 Forms?

airSlate SignNow provides flexible pricing plans that accommodate businesses of all sizes, allowing you to select the features that best meet your needs for handling 1099 Forms. Our packages include options for individuals, small businesses, and enterprises, offering cost-effective solutions for everyone. Additionally, we offer a free trial, so you can explore our service risk-free.

-

Is airSlate SignNow compliant with IRS regulations for 1099 Forms?

Yes, airSlate SignNow is designed to be fully compliant with IRS regulations regarding 1099 Forms. We prioritize security and compliance, ensuring that all electronically signed documents meet legal requirements. This gives you peace of mind knowing your 1099 Forms are processed properly and securely.

-

Can I integrate airSlate SignNow with my accounting software for 1099 Forms?

Absolutely! airSlate SignNow easily integrates with popular accounting software, allowing you to automate the generation and management of 1099 Forms. These integrations help streamline your workflow and ensure that all financial data is accurately reflected in your documents without the need for manual entry.

-

What features does airSlate SignNow offer for managing 1099 Forms?

airSlate SignNow includes a range of features specifically for handling 1099 Forms, such as customizable templates, automated reminders for signing, and secure cloud storage. These tools enable you to efficiently manage multiple 1099 Forms while ensuring that they are signed quickly and stored safely for easy access. This enhances your productivity and organization when dealing with tax documents.

-

How secure is my data when using airSlate SignNow for 1099 Forms?

Your data's security is a top priority for airSlate SignNow. We utilize state-of-the-art encryption and adhere to strict compliance protocols to ensure your 1099 Forms and sensitive information are protected. Our rigorous security measures provide assurance that your documents remain confidential and safe.

Get more for 1099 Form

- Last name as it appears on an id form

- Texas association of private and parochial schools studyrescom form

- Home address city state zip form

- Nursing facility services agreement form

- Sports med insurance university of nevada las vegas form

- Health history form denton

- Parent statement of foodenvironmental allergy information

- Bcbs ca appealrm form

Find out other 1099 Form

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online