Form West Virginia Department of Tax and Revenue BAR 0 West

What is the Form West Virginia Department Of Tax And Revenue BAR 0 West

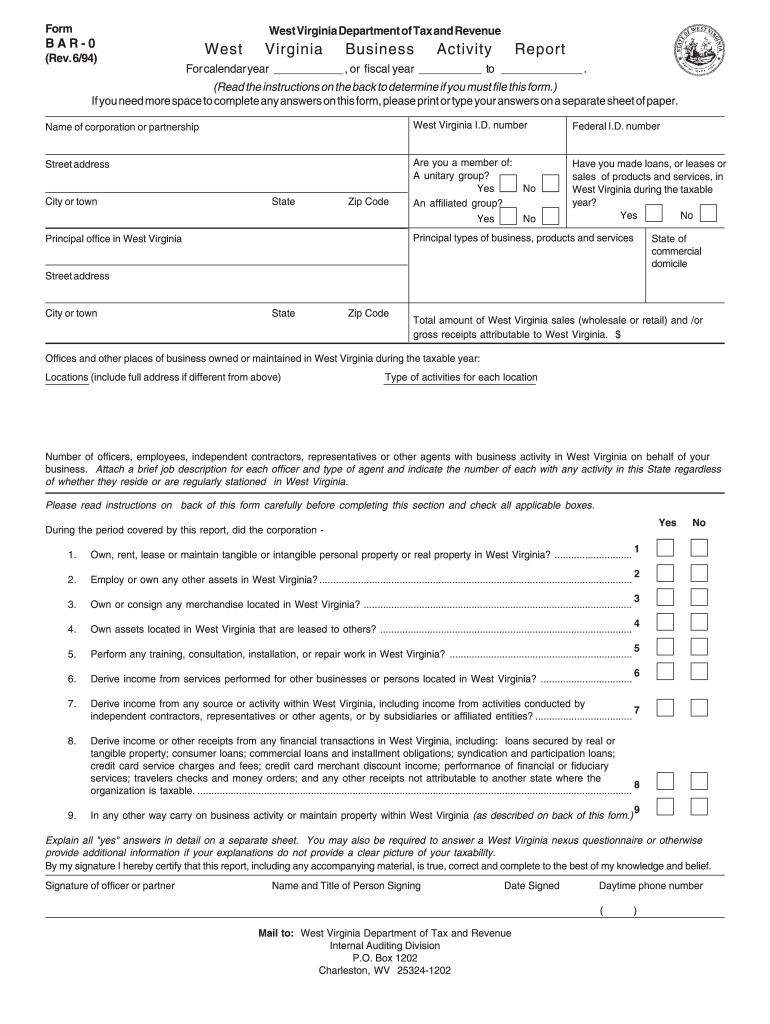

The Form West Virginia Department Of Tax And Revenue BAR 0 West is a specific document utilized for tax-related purposes within the state of West Virginia. It serves as a formal request or declaration to the Department of Tax and Revenue, often related to business activities, tax assessments, or compliance requirements. Understanding its purpose is crucial for individuals and businesses to ensure they meet their tax obligations accurately.

How to use the Form West Virginia Department Of Tax And Revenue BAR 0 West

Using the Form West Virginia Department Of Tax And Revenue BAR 0 West involves several key steps. First, gather all necessary information related to your tax situation, including identification details, financial records, and any relevant prior submissions. Next, fill out the form carefully, ensuring all fields are completed accurately. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the specific requirements outlined by the Department of Tax and Revenue.

Steps to complete the Form West Virginia Department Of Tax And Revenue BAR 0 West

Completing the Form West Virginia Department Of Tax And Revenue BAR 0 West requires attention to detail. Follow these steps:

- Review the form instructions thoroughly to understand the requirements.

- Enter your personal or business information in the designated fields.

- Provide accurate financial data and any supporting documentation as required.

- Double-check all entries for accuracy before submission.

- Submit the form electronically through the appropriate online portal or mail it to the specified address.

Legal use of the Form West Virginia Department Of Tax And Revenue BAR 0 West

The legal use of the Form West Virginia Department Of Tax And Revenue BAR 0 West is essential for compliance with state tax laws. This form must be completed and submitted in accordance with the guidelines established by the West Virginia Department of Tax and Revenue. Failure to use the form correctly can result in penalties, including fines or additional tax assessments. It is crucial to ensure that all information is truthful and complete to maintain legal standing.

Key elements of the Form West Virginia Department Of Tax And Revenue BAR 0 West

Key elements of the Form West Virginia Department Of Tax And Revenue BAR 0 West include:

- Identification information of the taxpayer or business entity.

- Details regarding the specific tax issue or request being addressed.

- Financial information pertinent to the tax situation.

- Signature of the taxpayer or authorized representative, affirming the accuracy of the information provided.

Form Submission Methods (Online / Mail / In-Person)

The Form West Virginia Department Of Tax And Revenue BAR 0 West can be submitted through various methods to accommodate different preferences. Options include:

- Online submission via the West Virginia Department of Tax and Revenue's official website.

- Mailing the completed form to the designated address provided in the instructions.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete form west virginia department of tax and revenue bar 0 west

Prepare Form West Virginia Department Of Tax And Revenue BAR 0 West effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Handle Form West Virginia Department Of Tax And Revenue BAR 0 West on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign Form West Virginia Department Of Tax And Revenue BAR 0 West with ease

- Locate Form West Virginia Department Of Tax And Revenue BAR 0 West and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Edit and eSign Form West Virginia Department Of Tax And Revenue BAR 0 West and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form west virginia department of tax and revenue bar 0 west

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form West Virginia Department Of Tax And Revenue BAR 0 West used for?

The Form West Virginia Department Of Tax And Revenue BAR 0 West is designed to assist businesses in filing their tax obligations accurately and efficiently. This form ensures compliance with state tax regulations and simplifies the reporting process. Using airSlate SignNow, you can prepare and eSign this form seamlessly.

-

How can airSlate SignNow help with the Form West Virginia Department Of Tax And Revenue BAR 0 West?

airSlate SignNow streamlines the completion and submission of the Form West Virginia Department Of Tax And Revenue BAR 0 West, enabling businesses to eSign documents electronically. Our platform saves time, reduces paperwork, and minimizes errors in your tax filings. It's a smart choice for efficient compliance management.

-

Is there a cost associated with using airSlate SignNow for the Form West Virginia Department Of Tax And Revenue BAR 0 West?

Yes, airSlate SignNow operates on a subscription-based pricing model that provides access to its full suite of features, including eSigning the Form West Virginia Department Of Tax And Revenue BAR 0 West. We offer various plans to cater to businesses of all sizes. You can select the plan that best fits your needs and budget.

-

What features does airSlate SignNow offer for managing the Form West Virginia Department Of Tax And Revenue BAR 0 West?

airSlate SignNow offers a variety of features that enhance the management of the Form West Virginia Department Of Tax And Revenue BAR 0 West. These include customizable templates, secure eSigning, and automatic reminders for submission deadlines. Our solution makes it easy to stay organized and on top of your tax obligations.

-

Can I integrate airSlate SignNow with other applications for the Form West Virginia Department Of Tax And Revenue BAR 0 West?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications and platforms, enhancing your ability to manage the Form West Virginia Department Of Tax And Revenue BAR 0 West. Whether it's your CRM, cloud storage, or accounting software, our integrations ensure a smooth workflow that saves time and reduces duplication.

-

What are the benefits of using airSlate SignNow for the Form West Virginia Department Of Tax And Revenue BAR 0 West?

Using airSlate SignNow for the Form West Virginia Department Of Tax And Revenue BAR 0 West offers multiple benefits, including increased efficiency and improved accuracy in document handling. Our platform enhances collaboration and ensures that your tax documents are securely stored and easily accessible. It’s an essential tool for streamlining your tax processes.

-

Is airSlate SignNow secure for handling the Form West Virginia Department Of Tax And Revenue BAR 0 West?

Yes, airSlate SignNow prioritizes security and confidentiality for all your documents, including the Form West Virginia Department Of Tax And Revenue BAR 0 West. We use advanced encryption and secure cloud storage to protect your sensitive information. Trust us to keep your data safe throughout the signing and submission process.

Get more for Form West Virginia Department Of Tax And Revenue BAR 0 West

- 20 survey of fraternal activity individual member worksheet kofc form

- B o y b e s t f r i e n d homefacebook form

- Community health nursing promoting and protecting the public form

- How extreme sports can affect your life insurance policy form

- Equipment and laboratory agreement form

- How do you enter a pop up calendar to a pdf form pdf forms

- Docusign envelope id eb36c2e4 c21f 43ea 87e7 75ce931a390c form

- Louisville metro planning ampamp design services form

Find out other Form West Virginia Department Of Tax And Revenue BAR 0 West

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word