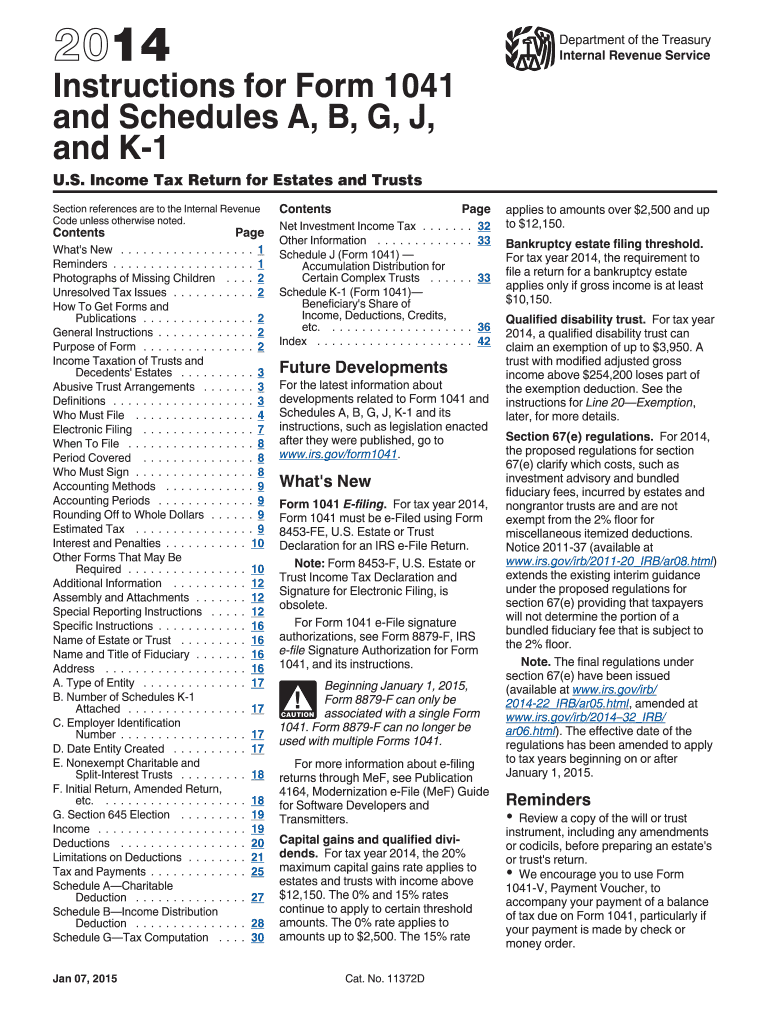

Irs Form 1041 Instructions 2014

What is the IRS Form 1041 Instructions

The IRS Form 1041 Instructions provide detailed guidance for fiduciaries of estates and trusts on how to complete and file the Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. This form is used to report income, deductions, gains, and losses of the estate or trust, as well as to calculate the tax liability. Understanding these instructions is crucial for ensuring compliance with federal tax laws and for accurately reporting financial information.

Steps to Complete the IRS Form 1041 Instructions

Completing the IRS Form 1041 requires careful attention to detail. Here are the essential steps:

- Gather necessary documents: Collect all relevant financial records, including income statements, expense receipts, and prior tax returns.

- Identify the filing status: Determine if the estate or trust is a simple or complex entity, as this affects tax obligations.

- Fill out the form: Accurately enter information about income, deductions, and credits as outlined in the instructions.

- Review calculations: Ensure all figures are correct to avoid errors that could lead to penalties.

- Sign and date the form: The fiduciary must sign the return, confirming the accuracy of the information provided.

How to Obtain the IRS Form 1041 Instructions

The IRS Form 1041 Instructions can be obtained through various methods. They are available for download directly from the IRS website, where you can access the most current version. Additionally, you may request a physical copy by contacting the IRS or visiting a local IRS office. It is essential to use the latest instructions to ensure compliance with any recent changes in tax law.

Legal Use of the IRS Form 1041 Instructions

The IRS Form 1041 Instructions are legally binding guidelines that must be followed when filing taxes for estates and trusts. Adhering to these instructions ensures that the fiduciary fulfills their legal obligations and avoids potential penalties. The instructions also outline the requirements for maintaining proper records and documentation, which are critical in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 1041 are crucial for compliance. Generally, the form is due on the fifteenth day of the fourth month following the close of the tax year. For estates, if the date of death occurs on or before June 30, the due date is the following April 15. If the date of death is after June 30, the due date is the following April 15 of the next year. Extensions may be requested, but it is important to file for an extension before the original due date.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 1041 can be submitted through various methods. It can be filed electronically using IRS-approved software, which often streamlines the process and reduces errors. Alternatively, the form can be mailed to the appropriate IRS address, depending on the state where the fiduciary resides. In-person submissions are generally not available, but consulting with a tax professional can provide additional guidance on the best submission method.

Quick guide on how to complete irs form 1041 instructions 2014

Complete Irs Form 1041 Instructions effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can easily access the necessary form and securely save it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents quickly without any holdups. Handle Irs Form 1041 Instructions on any device using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Irs Form 1041 Instructions with ease

- Locate Irs Form 1041 Instructions and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Modify and eSign Irs Form 1041 Instructions and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 1041 instructions 2014

Create this form in 5 minutes!

How to create an eSignature for the irs form 1041 instructions 2014

The best way to make an eSignature for a PDF in the online mode

The best way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF document on Android OS

People also ask

-

What are the Irs Form 1041 Instructions provided by airSlate SignNow?

The Irs Form 1041 Instructions cover essential details for completing the form accurately. With airSlate SignNow, you'll receive guidance on filling out the form correctly, ensuring compliance with IRS regulations. This simplifies the process for users preparing estate tax returns.

-

How can airSlate SignNow help with filing Irs Form 1041?

airSlate SignNow streamlines document management and e-signature processes, making the submission of Irs Form 1041 faster and more efficient. By utilizing our platform, you can easily collect signatures and securely send your completed form to the IRS. This ensures that your filings are handled promptly and accurately.

-

Is there a cost associated with using airSlate SignNow for Irs Form 1041 Instructions?

Yes, while airSlate SignNow offers a robust solution for managing Irs Form 1041 Instructions, there are various pricing plans available based on your needs. The cost is designed to be cost-effective, providing signNow value for businesses looking to simplify their document processes. You can choose a plan that best fits your budget and usage requirements.

-

What features are included in airSlate SignNow for managing Irs Form 1041?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, enhancing your experience with Irs Form 1041 Instructions. These features allow you to easily create, edit, and store your documents securely while ensuring compliance with IRS standards. This functionality helps reduce paperwork errors and improves efficiency.

-

Can I integrate airSlate SignNow with other accounting software for Irs Form 1041?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, allowing for easier management of Irs Form 1041 Instructions. This means you can sync your financial data and streamline your document workflows without the hassle of manual entry. These integrations enhance productivity and ensure a smooth filing process.

-

What are the benefits of using airSlate SignNow for Irs Form 1041?

Using airSlate SignNow for Irs Form 1041 offers numerous benefits, including improved efficiency, reduced processing time, and enhanced security for sensitive documents. The platform allows for easy collaboration with clients and stakeholders, ensuring everyone involved can review and sign the form electronically. These advantages make it a popular choice amongst businesses.

-

Is airSlate SignNow easy to use for preparing Irs Form 1041 Instructions?

Yes, airSlate SignNow is designed with an intuitive interface, making it easy for anyone to navigate through the process of preparing Irs Form 1041 Instructions. With straightforward tools and guidance available, even users with minimal technical skills can efficiently manage their documents. The user-friendly design helps eliminate confusion and speeds up the filing process.

Get more for Irs Form 1041 Instructions

- Legal last will and testament form for a married person with no children hawaii

- Legal last will and testament form for a domestic partner with no children hawaii

- Legal last will and testament form for married person with minor children hawaii

- Legal last will and testament form for domestic partner with minor children hawaii

- Hawaii will form

- Legal last will and testament form for divorced person not remarried with adult and minor children hawaii

- Legal last will and testament form for civil union partner with adult children hawaii

- Hawaii partner form

Find out other Irs Form 1041 Instructions

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple