Instruction 4797 Form 2014

What is the Instruction 4797 Form

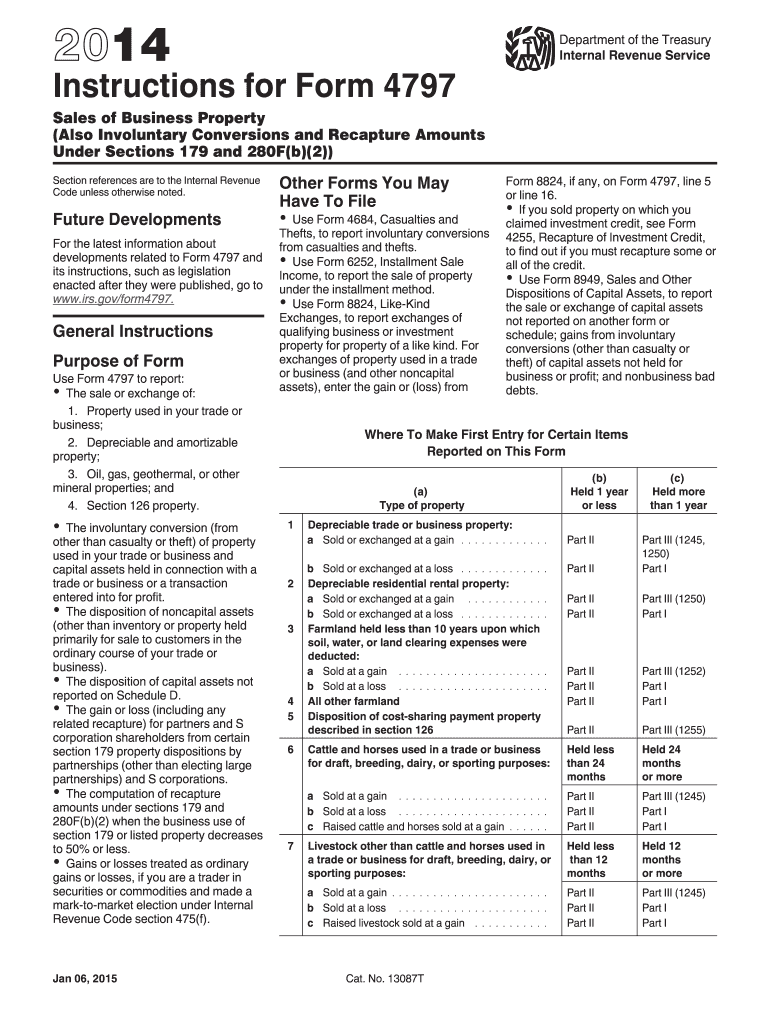

The Instruction 4797 Form is a crucial document used by taxpayers in the United States to report the sale or exchange of business property. This form is primarily utilized for reporting gains or losses from the disposition of assets, including real estate and other tangible properties. It is essential for individuals and businesses to accurately complete this form to ensure compliance with IRS regulations and to properly calculate any tax liabilities resulting from the sale of these assets.

How to use the Instruction 4797 Form

Using the Instruction 4797 Form involves several steps to ensure accurate reporting of transactions. Taxpayers must first gather all relevant information regarding the property sold, including purchase price, selling price, and any associated costs. Next, complete the form by detailing the nature of the transaction, including whether it was a sale, exchange, or involuntary conversion. Finally, ensure that all calculations for gains or losses are correctly reflected before submitting the form with your tax return.

Steps to complete the Instruction 4797 Form

Completing the Instruction 4797 Form requires careful attention to detail. Follow these steps for accurate completion:

- Begin by entering your name, address, and taxpayer identification number at the top of the form.

- Provide information about the property sold, including its description and date acquired.

- Document the selling price and any adjustments, such as selling expenses.

- Calculate the gain or loss by subtracting the adjusted basis from the selling price.

- Transfer your calculated gain or loss to the appropriate section of your tax return.

Legal use of the Instruction 4797 Form

The legal use of the Instruction 4797 Form is governed by IRS regulations. It is essential for taxpayers to use this form to report any taxable events related to the sale of business property. Failure to accurately report these transactions can lead to penalties and interest on unpaid taxes. The form also serves as a means to document the financial impact of property sales, which is vital for both personal and business financial records.

Filing Deadlines / Important Dates

Filing deadlines for the Instruction 4797 Form align with the general tax return deadlines. Typically, individual taxpayers must file their forms by April fifteenth of the following tax year. However, if you are unable to meet this deadline, you may request an extension. It is important to keep track of any changes to deadlines announced by the IRS, especially in light of special circumstances or changes in tax law.

Examples of using the Instruction 4797 Form

There are various scenarios where the Instruction 4797 Form is applicable. For instance, if a business sells a piece of equipment that has depreciated over time, the owner must report the sale on this form. Another example includes the sale of a commercial property, where the gain or loss must be calculated and reported. Each situation requires careful documentation to ensure compliance and accuracy in reporting.

Quick guide on how to complete 2014 instruction 4797 form

Effortlessly set up Instruction 4797 Form on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without complications. Manage Instruction 4797 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Instruction 4797 Form effortlessly

- Obtain Instruction 4797 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Instruction 4797 Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 instruction 4797 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 instruction 4797 form

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the Instruction 4797 Form?

The Instruction 4797 Form is used to report the sale of business property, detailing transactions related to depreciable property and real estate. This form is crucial for taxpayers who are engaged in selling or exchanging property. Understanding how to properly fill out the Instruction 4797 Form can help you avoid mistakes and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with the Instruction 4797 Form?

airSlate SignNow allows you to easily eSign and send your Instruction 4797 Form digitally, streamlining your document management process. With our platform, you can ensure that your submissions are secure and compliant. Our intuitive interface makes it simple to fill out and send the Instruction 4797 Form without hassle.

-

Is there a cost associated with using airSlate SignNow for the Instruction 4797 Form?

While airSlate SignNow offers various subscription plans, the costs can vary depending on the features you choose. Generally, you can find a plan that suits your business needs, whether you are sending a single Instruction 4797 Form or multiple documents. We also provide a free trial, allowing you to evaluate our solution before committing to a plan.

-

What features does airSlate SignNow offer for managing the Instruction 4797 Form?

airSlate SignNow offers a range of features to facilitate the management of the Instruction 4797 Form, including customizable templates, eSignature capabilities, and secure storage. Our platform also supports collaborative functions so teams can work together on the same document. These features ensure a smooth workflow for preparing and submitting your forms.

-

Can I integrate airSlate SignNow with other applications while handling the Instruction 4797 Form?

Yes, airSlate SignNow integrates seamlessly with a variety of applications, including popular CRMs and cloud storage services. This flexibility allows you to manage and send your Instruction 4797 Form alongside other critical documents in your workflow. Our integrations enhance productivity and help you maintain organized records.

-

Where can I find instructions for filling out the Instruction 4797 Form?

Instructions for filling out the Instruction 4797 Form can typically be found on the IRS website or through various tax preparation resources. If you're using airSlate SignNow, we provide helpful guides and tips to assist you in filling out the form correctly. Accessing these resources ensures you will complete the Instruction 4797 Form accurately.

-

How secure is airSlate SignNow when submitting the Instruction 4797 Form?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure servers to protect your data, ensuring that your Instruction 4797 Form and any personal information remain confidential. Additionally, our compliance with industry standards provides you with peace of mind when sending sensitive documents.

Get more for Instruction 4797 Form

- Quitclaim deed two individuals to one individual hawaii form

- Legal last will and testament form for single person with no children hawaii

- Legal last will and testament form for a single person with minor children hawaii

- Legal last will and testament form for single person with adult and minor children hawaii

- Legal last will and testament form for single person with adult children hawaii

- Legal last will and testament for married person with minor children from prior marriage hawaii form

- Legal last will and testament for civil union partner with minor children from prior marriage hawaii form

- Legal last will and testament for domestic partner with minor children from prior marriage hawaii form

Find out other Instruction 4797 Form

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy