Form W 3 PR 2014

What is the Form W-3 PR

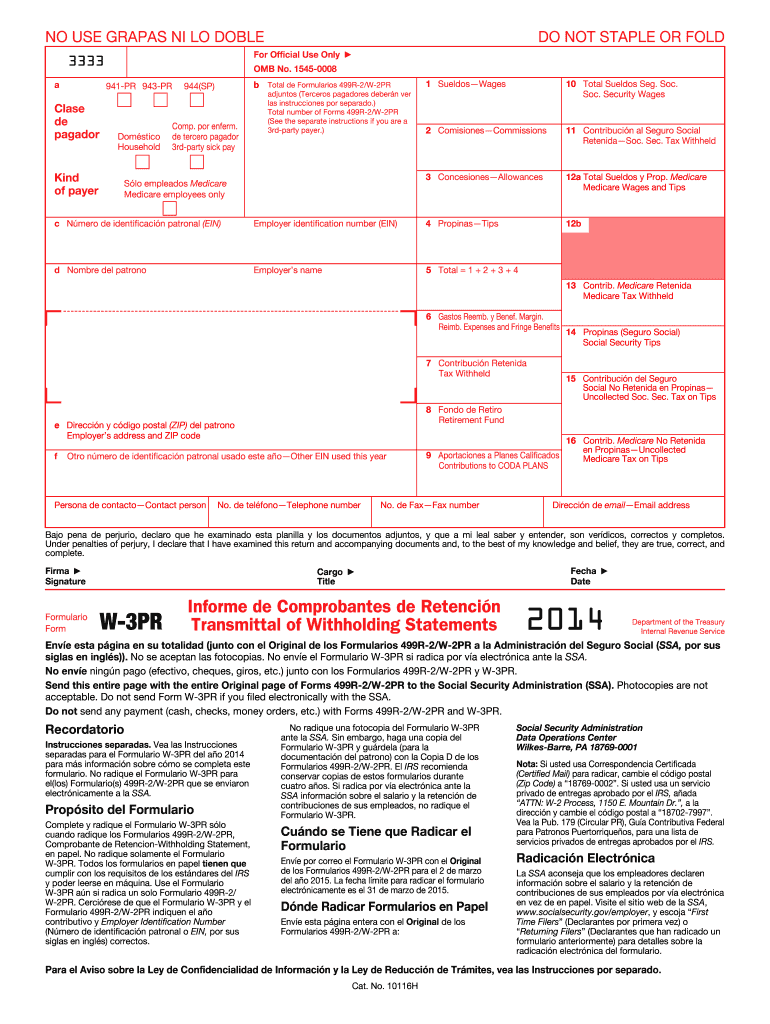

The Form W-3 PR is a transmittal form used by employers in Puerto Rico to report annual wage and tax information to the Internal Revenue Service (IRS). This form summarizes the information reported on Forms W-2 PR, which detail the wages paid to employees and the taxes withheld. It is essential for employers to accurately complete this form to ensure compliance with federal tax regulations.

How to use the Form W-3 PR

To use the Form W-3 PR, employers must first complete all relevant Forms W-2 PR for their employees. After gathering the necessary information from these forms, the employer fills out the W-3 PR, which includes totals for wages, tips, and other compensation, as well as the total taxes withheld. This form must be submitted to the IRS along with the W-2 PR forms by the designated deadline.

Steps to complete the Form W-3 PR

Completing the Form W-3 PR involves several key steps:

- Gather all Forms W-2 PR for your employees.

- Calculate the total wages, tips, and other compensation reported on the W-2 PR forms.

- Calculate the total federal income tax withheld, Social Security tax, and Medicare tax.

- Fill in the required fields on the W-3 PR, including employer information and total amounts.

- Review the form for accuracy before submission.

Legal use of the Form W-3 PR

The Form W-3 PR is legally required for employers in Puerto Rico who have paid wages to employees during the tax year. It serves as an official record of wages and taxes withheld, ensuring compliance with federal tax laws. Failure to file this form can result in penalties and fines from the IRS.

Filing Deadlines / Important Dates

Employers must file the Form W-3 PR by the last day of February following the end of the tax year. For example, for the tax year ending December 31, the form must be submitted by February 28 of the following year. It is crucial to meet this deadline to avoid penalties for late filing.

Form Submission Methods (Online / Mail / In-Person)

The Form W-3 PR can be submitted to the IRS in several ways. Employers can file the form electronically through the IRS e-file system, which is often the fastest method. Alternatively, the form can be mailed to the appropriate IRS address, or it may be submitted in person at designated IRS offices. Each method has its own processing times and considerations for compliance.

Quick guide on how to complete 2014 form w 3 pr

Complete Form W 3 PR effortlessly on any gadget

Digital document handling has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, enabling you to find the right template and securely archive it online. airSlate SignNow provides you with all the necessary tools to create, alter, and electronically sign your documents quickly without holdups. Manage Form W 3 PR on any device using airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

How to modify and electronically sign Form W 3 PR with ease

- Locate Form W 3 PR and click on Get Form to begin.

- Use the tools available to finalize your document.

- Highlight important sections of your documents or obscure confidential information with features that airSlate SignNow offers specifically for that purpose.

- Create your autograph using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, be it via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to losing or misplacing files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your choosing. Alter and electronically sign Form W 3 PR and ensure seamless communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form w 3 pr

Create this form in 5 minutes!

How to create an eSignature for the 2014 form w 3 pr

The best way to make an electronic signature for your PDF file in the online mode

The best way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The way to generate an eSignature for a PDF file on Android

Get more for Form W 3 PR

- Satisfaction release or cancellation of mortgage by corporation hawaii form

- Satisfaction release or cancellation of mortgage by individual hawaii form

- Partial release of property from mortgage for corporation hawaii form

- Partial release of property from mortgage by individual holder hawaii form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy hawaii form

- Warranty deed for parents to child with reservation of life estate hawaii form

- Warranty deed for separate or joint property to joint tenancy hawaii form

- Warranty deed to separate property of one spouse to both spouses as joint tenants hawaii form

Find out other Form W 3 PR

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document