Irs Form 990 Schedule B 2014

What is the Irs Form 990 Schedule B

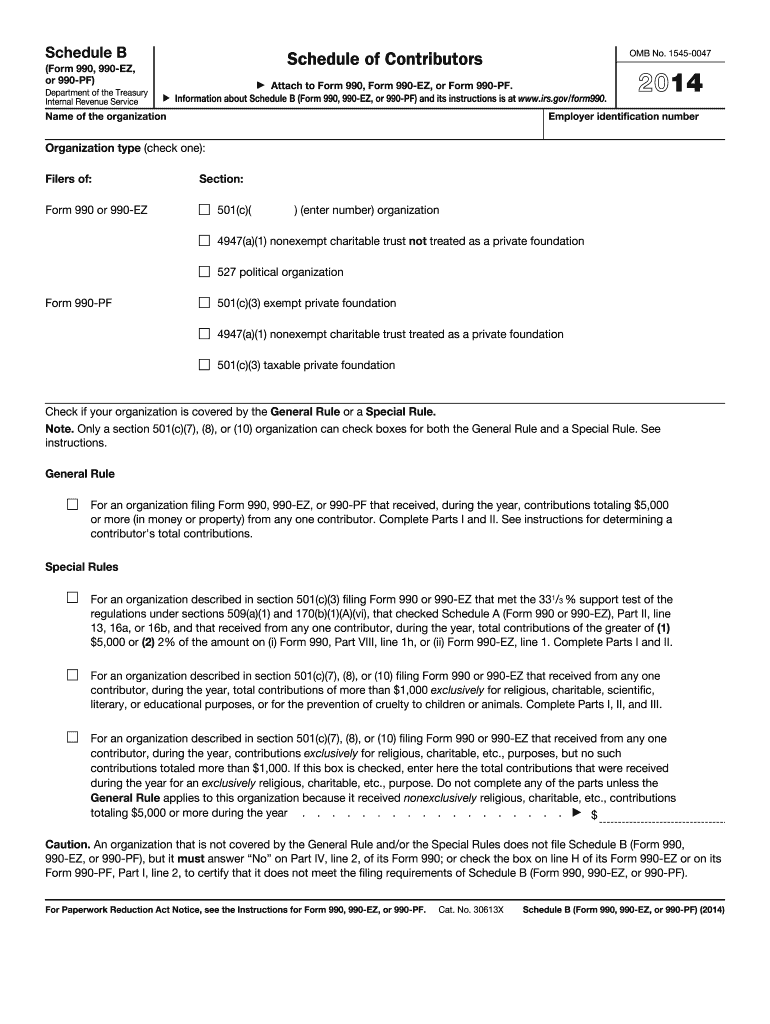

The Irs Form 990 Schedule B is a supplemental form that provides detailed information about a nonprofit organization's contributors. This form is required for organizations that receive significant contributions, ensuring transparency and accountability in financial reporting. Schedule B is filed alongside the main Form 990, which is the annual return for tax-exempt organizations. The information disclosed helps the IRS and the public understand the sources of funding for the organization, which is crucial for maintaining public trust.

How to use the Irs Form 990 Schedule B

To effectively use the Irs Form 990 Schedule B, organizations must accurately report all contributions received during the fiscal year. This includes identifying the donor's name, address, and the amount contributed. Organizations must also disclose any contributions that exceed a certain threshold, typically $100,000. It is essential to ensure that all information is complete and correct, as inaccuracies can lead to compliance issues with the IRS.

Steps to complete the Irs Form 990 Schedule B

Completing the Irs Form 990 Schedule B involves several key steps:

- Gather all relevant information about contributions received during the fiscal year.

- Identify and list each contributor's name and address.

- Record the amount contributed by each donor.

- Ensure that contributions above the reporting threshold are included.

- Review the completed form for accuracy and completeness.

- Attach Schedule B to the main Form 990 before submission.

Legal use of the Irs Form 990 Schedule B

The legal use of the Irs Form 990 Schedule B is crucial for maintaining compliance with federal tax regulations. Organizations must file this form accurately to avoid penalties and ensure their tax-exempt status is upheld. The information provided in Schedule B is subject to public disclosure, which reinforces the need for transparency in how nonprofit organizations operate and fund their activities.

Key elements of the Irs Form 990 Schedule B

Key elements of the Irs Form 990 Schedule B include:

- Donor information: Names and addresses of contributors.

- Contribution amounts: Total funds received from each donor.

- Type of contributions: Cash, property, or other forms of support.

- Disclosure of significant contributors: Those who donate above the reporting threshold.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Form 990 Schedule B align with the main Form 990 submission dates. Typically, organizations must file their returns by the 15th day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this means the deadline is May 15. Extensions may be available, but it is vital to adhere to these timelines to avoid penalties.

Quick guide on how to complete 2014 irs form 990 schedule b

Complete Irs Form 990 Schedule B seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Irs Form 990 Schedule B on any device using airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to modify and electronically sign Irs Form 990 Schedule B with ease

- Find Irs Form 990 Schedule B and click Get Form to commence.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method of sharing your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign Irs Form 990 Schedule B to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 irs form 990 schedule b

Create this form in 5 minutes!

How to create an eSignature for the 2014 irs form 990 schedule b

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is IRS Form 990 Schedule B and when should it be filed?

IRS Form 990 Schedule B is a supplemental schedule used by tax-exempt organizations to report contributions and grants. It must be filed annually along with Form 990, and it provides detailed information about the organization's donors. Timely submission of this form is essential to comply with IRS regulations and maintain tax-exempt status.

-

How can airSlate SignNow help with preparing IRS Form 990 Schedule B?

airSlate SignNow offers a streamlined process for completing IRS Form 990 Schedule B. With our document management features, you can easily gather and eSign contributions and grant details. This ensures that your form is accurately filled out and filed on time, minimizing compliance risks.

-

What features does airSlate SignNow provide for managing IRS Form 990 Schedule B?

airSlate SignNow includes templates, electronic signature capabilities, and robust document tracking, specifically designed for IRS Form 990 Schedule B. This makes it simpler to manage inputs and edits, ensuring that all data is correctly compiled before submission. With these features, organizations can focus on their mission while ensuring compliance.

-

Is airSlate SignNow cost-effective for organizations filing IRS Form 990 Schedule B?

Yes, airSlate SignNow is a cost-effective solution for organizations needing to file IRS Form 990 Schedule B. Our pricing plans are tailored to accommodate different organizational sizes and budgets, providing full access to our features without hidden fees. Investing in our platform can signNowly reduce administrative overhead.

-

Can I access and fill out IRS Form 990 Schedule B on my mobile device using airSlate SignNow?

Absolutely! airSlate SignNow is mobile-friendly, allowing users to access and fill out IRS Form 990 Schedule B from their smartphones or tablets. This flexibility enables professionals to complete necessary documents on the go, ensuring that deadlines are met efficiently and conveniently.

-

What integrations does airSlate SignNow offer to simplify the filing of IRS Form 990 Schedule B?

airSlate SignNow seamlessly integrates with various accounting and nonprofit management software, making it easier to compile the information needed for IRS Form 990 Schedule B. By connecting with your existing tools, you can automate data transfers and reduce manual entry errors, saving valuable time and resources.

-

How secure is the information when preparing IRS Form 990 Schedule B with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols to protect the data you use for IRS Form 990 Schedule B, ensuring that sensitive information remains confidential. Our platform is designed to keep your documents safe, giving you peace of mind as you manage your compliance obligations.

Get more for Irs Form 990 Schedule B

- Legal last will and testament form for married person with adult children from prior marriage hawaii

- Legal last will and testament form for divorced person not remarried with adult children hawaii

- Legal last will and testament form for domestic partner with adult children from prior marriage hawaii

- Legal last will and testament form for civil union partner with adult children from prior marriage hawaii

- Legal last will and testament form for divorced person not remarried with no children hawaii

- Legal last will and testament form for divorced person not remarried with minor children hawaii

- Legal last will and testament form for married person with adult children hawaii

- Legal last will and testament form for domestic partner with adult children hawaii

Find out other Irs Form 990 Schedule B

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now