941 Pr Form 2014

What is the 941 Pr Form

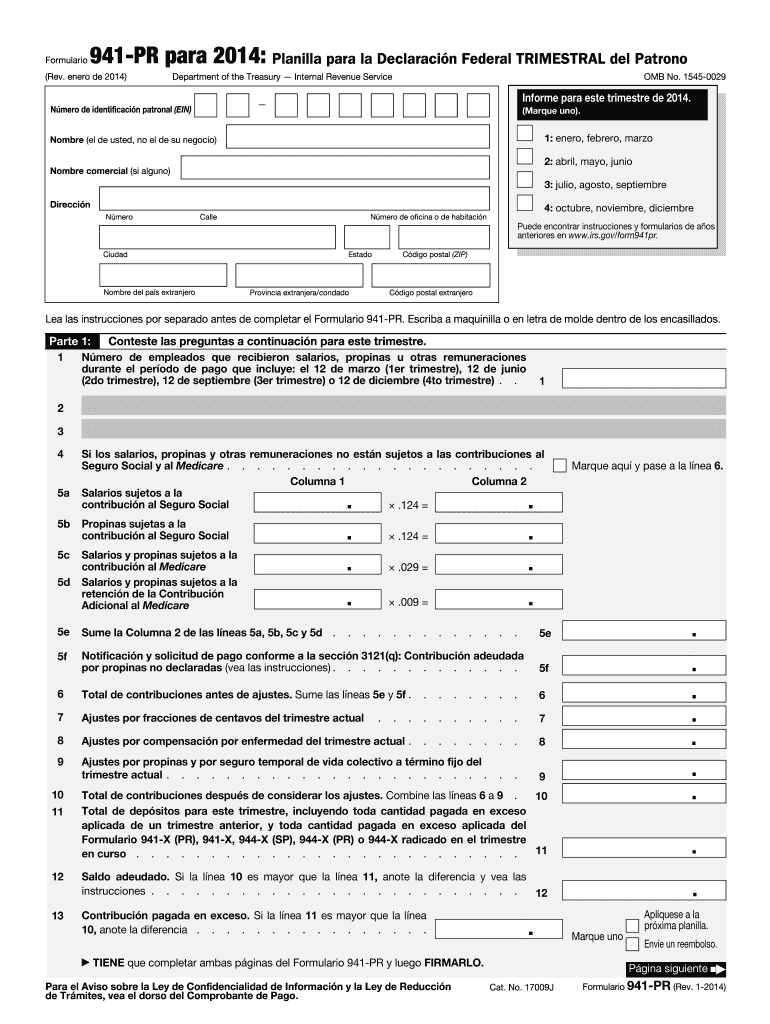

The 941 Pr Form is a tax document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. This form is specifically designed for businesses operating in Puerto Rico and is essential for ensuring compliance with federal tax regulations. Employers must file this form quarterly, providing details on wages paid, taxes withheld, and any adjustments to prior filings.

How to use the 941 Pr Form

Using the 941 Pr Form involves several steps to ensure accurate reporting of employee wages and taxes. Employers should start by gathering necessary information, including total wages paid, the number of employees, and the amount of taxes withheld. After filling out the form, it is crucial to review all entries for accuracy. Once verified, the form can be submitted to the IRS, either electronically or by mail, depending on the employer's preference and requirements.

Steps to complete the 941 Pr Form

Completing the 941 Pr Form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial data, including payroll records for the quarter.

- Fill out the employer identification information accurately.

- Report total wages paid and the corresponding taxes withheld in the appropriate sections.

- Calculate any adjustments for prior quarters if necessary.

- Review the completed form for accuracy and completeness.

- Submit the form by the deadline, ensuring compliance with IRS regulations.

Legal use of the 941 Pr Form

The 941 Pr Form is legally binding when completed and submitted in accordance with IRS guidelines. Employers must ensure that the information reported is truthful and accurate to avoid penalties. The form must be filed quarterly, and failure to comply with these requirements can result in fines and additional scrutiny from tax authorities. Utilizing electronic filing systems can enhance the legal validity of submissions by providing secure and verifiable records.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the 941 Pr Form to avoid penalties. The due dates for filing are typically the last day of the month following the end of each quarter. For example:

- First quarter (January to March): Due April 30

- Second quarter (April to June): Due July 31

- Third quarter (July to September): Due October 31

- Fourth quarter (October to December): Due January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

The 941 Pr Form can be submitted through various methods, providing flexibility for employers. Options include:

- Electronic Filing: Many employers choose to file online through the IRS e-file system, which is secure and efficient.

- Mail: Employers can also print the completed form and send it via postal service to the appropriate IRS address.

- In-Person: While less common, some employers may opt to deliver the form in person at local IRS offices, though this method may require an appointment.

Quick guide on how to complete 941 pr 2014 form

Prepare 941 Pr Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage 941 Pr Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The easiest way to modify and eSign 941 Pr Form without any hassle

- Obtain 941 Pr Form and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow is specifically designed to provide.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a physical ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form, either via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign 941 Pr Form and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 941 pr 2014 form

Create this form in 5 minutes!

How to create an eSignature for the 941 pr 2014 form

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the 941 Pr Form, and why is it important?

The 941 Pr Form is a tax form used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Understanding this form is crucial for compliance with tax regulations, as improper handling can result in penalties. airSlate SignNow provides features that simplify the eSigning process for the 941 Pr Form, ensuring timely submissions.

-

How does airSlate SignNow simplify the process of signing the 941 Pr Form?

airSlate SignNow offers an intuitive interface that allows users to easily send and eSign the 941 Pr Form. With customizable templates and automated workflows, you can streamline the process, reducing turnaround time and minimizing errors. This makes it easier for businesses to manage their tax documentation efficiently.

-

Is there a cost associated with using airSlate SignNow for the 941 Pr Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, ensuring you can find an affordable option for managing the 941 Pr Form. The service is cost-effective, allowing you to save on printing and mailing costs while ensuring compliance. Visit our pricing page to see which plan best fits your requirements.

-

Can I integrate airSlate SignNow with other accounting software for managing the 941 Pr Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, allowing you to manage the 941 Pr Form alongside your other business documents. This integration enhances workflow efficiency, enabling you to keep track of all tax-related filings and important documents in one place.

-

What security measures does airSlate SignNow implement for the 941 Pr Form?

Security is a top priority at airSlate SignNow. All documents, including the 941 Pr Form, are encrypted and stored in secure cloud environments. Additionally, the platform complies with industry standards to ensure that your sensitive information remains protected throughout the eSigning process.

-

How can airSlate SignNow help with the compliance of the 941 Pr Form?

Using airSlate SignNow ensures that your 941 Pr Form is completed accurately and submitted on time, minimizing the risk of compliance issues. With features like reminders and tracking, you can stay organized and ensure all your tax filings meet the necessary regulations. This peace of mind is invaluable for any business.

-

Does airSlate SignNow offer customer support for issues related to the 941 Pr Form?

Yes, airSlate SignNow provides dedicated customer support to assist you with any queries related to the 941 Pr Form. Our support team is available through various channels, including live chat and email, ensuring that you receive timely help whenever needed. We’re here to make your eSigning experience as smooth as possible.

Get more for 941 Pr Form

- Legal last will and testament form for domestic partner with adult and minor children hawaii

- Legal last will and testament form for civil union partner with adult and minor children hawaii

- Mutual wills package with last wills and testaments for married couple with adult and minor children hawaii form

- Legal last will and testament form for a widow or widower with adult children hawaii

- Legal last will and testament form for widow or widower with minor children hawaii

- Legal last will form for a widow or widower with no children hawaii

- Legal last will and testament form for a widow or widower with adult and minor children hawaii

- Legal last will and testament form for divorced and remarried person with mine yours and ours children hawaii

Find out other 941 Pr Form

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online