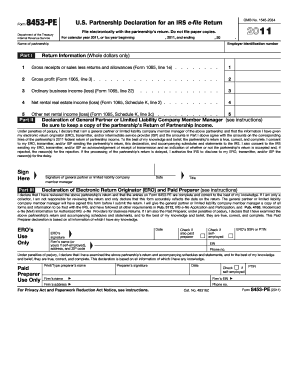

8453 Pe Form

What is the 8453 PE?

The 8453 PE is a form used by taxpayers in the United States to authenticate their electronic tax returns. This form serves as a declaration that the information submitted is accurate and complete, and it is particularly relevant for those filing electronically. The 8453 PE is essential for ensuring compliance with IRS regulations and provides a necessary layer of security and verification for electronic submissions.

Steps to Complete the 8453 PE

Completing the 8453 PE involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including your personal identification details and tax return data. Next, fill out the form carefully, ensuring that all fields are completed accurately. After completing the form, sign it electronically using a trusted eSignature solution to validate your submission. Finally, submit the 8453 PE along with your electronic tax return to the appropriate IRS platform.

Legal Use of the 8453 PE

The legal use of the 8453 PE is grounded in its compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These regulations ensure that electronic signatures are recognized as valid and enforceable. By using the 8453 PE, taxpayers can securely submit their tax returns while meeting all legal requirements, thus safeguarding their submissions against potential disputes.

IRS Guidelines

The IRS provides specific guidelines for the use of the 8453 PE, outlining the requirements for electronic filing and the necessary components of the form. Taxpayers must ensure that they are familiar with these guidelines to avoid errors that could lead to delays or penalties. The IRS emphasizes the importance of accurate information and proper electronic signatures, which are crucial for the acceptance of the form.

Form Submission Methods

The 8453 PE can be submitted through various methods, including online filing through authorized e-file providers, mailing a physical copy to the IRS, or delivering it in person at designated IRS offices. Each method has its own requirements and timelines, so it is important for taxpayers to choose the method that best suits their circumstances and ensures timely processing of their tax returns.

Required Documents

When completing the 8453 PE, taxpayers must have certain documents on hand to provide accurate information. These documents typically include identification numbers, income statements such as W-2s or 1099s, and any other relevant tax documentation. Ensuring that all necessary documents are available will facilitate a smoother completion process and help avoid potential issues with the IRS.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the 8453 PE can result in significant penalties. Taxpayers may face fines or delays in processing their tax returns if the form is not submitted correctly or on time. It is crucial to understand these potential consequences to ensure that all filings are completed accurately and in accordance with IRS regulations.

Quick guide on how to complete 8453 pe

Complete 8453 Pe effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers a perfect environmentally-friendly alternative to traditional printed and signed paperwork, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage 8453 Pe on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to modify and eSign 8453 Pe with ease

- Obtain 8453 Pe and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign 8453 Pe and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8453 pe

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 8453 pe and why do I need it?

The form 8453 pe is a key document that allows taxpayers to e-file their electronic forms securely. It verifies the identity of the taxpayer and ensures the authenticity of the e-filed return. Using airSlate SignNow, you can easily sign this form digitally, streamlining the filing process.

-

How does airSlate SignNow help with form 8453 pe submissions?

airSlate SignNow simplifies the process of signing and submitting the form 8453 pe. With our platform, you can quickly eSign this form and any other tax documents, making it efficient to stay compliant with IRS e-filing requirements. Our user-friendly interface allows for a seamless experience.

-

Is there a cost associated with using airSlate SignNow for form 8453 pe?

Yes, airSlate SignNow offers competitive pricing tailored to meet various business needs. Our plans include features essential for processing documents like the form 8453 pe, ensuring you have an affordable solution for all your e-signature requirements. Visit our pricing page to learn more about subscription options.

-

What features does airSlate SignNow offer to enhance the use of form 8453 pe?

airSlate SignNow provides features such as real-time tracking, unlimited document templates, and reusable fields that make handling the form 8453 pe easier. These features enable you to manage multiple e-signatures efficiently while maintaining document security and compliance. Our platform is designed for businesses of all sizes.

-

Can I integrate airSlate SignNow with other software for my form 8453 pe needs?

Absolutely! airSlate SignNow integrates seamlessly with various applications like CRM systems and file storage services, enhancing the workflow for managing the form 8453 pe. This compatibility allows you to automate the document signing process and keeps your data synchronized across platforms.

-

How secure is the airSlate SignNow platform for handling the form 8453 pe?

Security is a top priority at airSlate SignNow. Our platform utilizes industry-standard encryption protocols to ensure that your form 8453 pe and other sensitive documents are protected. We also comply with various regulatory standards for eSignature security, providing peace of mind for our users.

-

What are the benefits of using airSlate SignNow for the form 8453 pe?

Using airSlate SignNow for the form 8453 pe offers numerous benefits including time savings, enhanced convenience, and improved efficiency in the e-filing process. Our solution reduces the need for physical paperwork and allows you to manage your tax documents from anywhere, anytime, ensuring a smoother filing experience.

Get more for 8453 Pe

Find out other 8453 Pe

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile