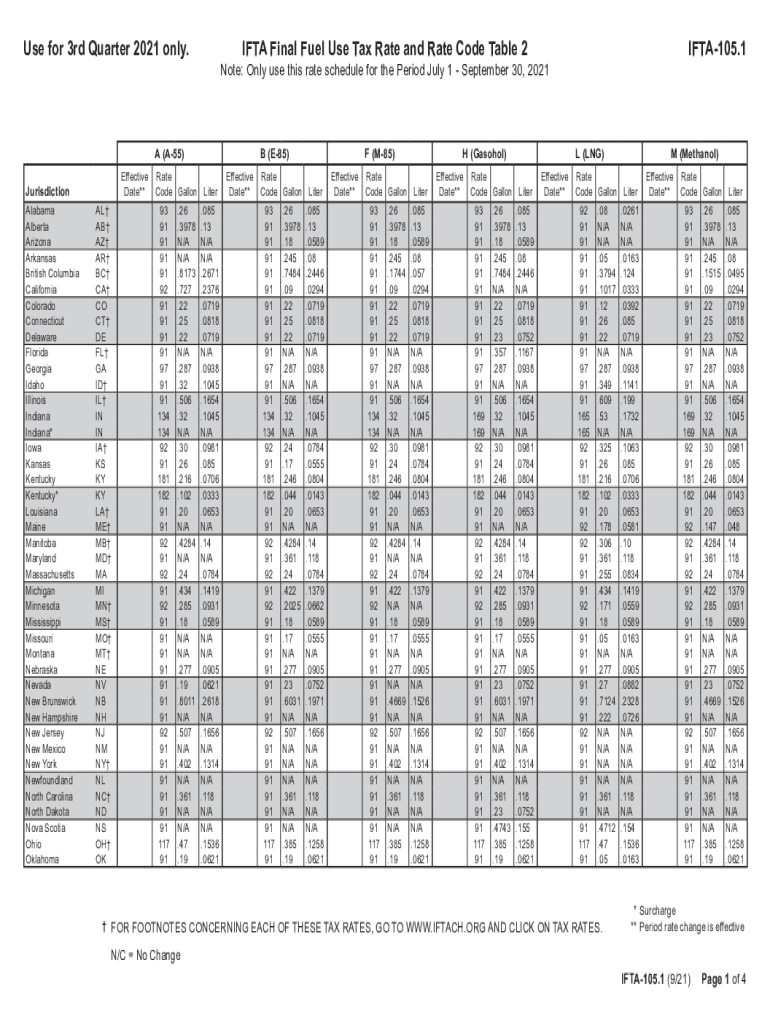

Www Tax Ny GovpdfcurrentformsUse for 3rd Quarter Only IFTA Final Fuel Use Tax Rate 2021

Understanding the IFTA 105 Form

The IFTA 105 form is a crucial document for businesses that operate commercial vehicles across state lines in the United States. This form is used to report and pay fuel taxes to the International Fuel Tax Agreement (IFTA) jurisdictions. It consolidates fuel use tax information for each state where the vehicle has traveled, ensuring compliance with tax obligations. Accurate completion of the IFTA 105 form is essential for maintaining good standing with tax authorities and avoiding penalties.

Steps to Complete the IFTA 105 Form

Completing the IFTA 105 form involves several key steps:

- Gather all necessary information, including mileage records and fuel purchase receipts.

- Calculate total miles traveled in each jurisdiction and total fuel purchased.

- Fill out the IFTA 105 form, ensuring all sections are completed accurately.

- Review the form for errors or omissions before submission.

- Submit the completed form by the designated deadline to avoid penalties.

Filing Deadlines for the IFTA 105 Form

It is important to be aware of the filing deadlines for the IFTA 105 form. Typically, the form is due quarterly, with specific dates set for each quarter. For example:

- First Quarter: January 1 to March 31, due by April 30.

- Second Quarter: April 1 to June 30, due by July 31.

- Third Quarter: July 1 to September 30, due by October 31.

- Fourth Quarter: October 1 to December 31, due by January 31 of the following year.

Required Documents for Filing the IFTA 105 Form

To file the IFTA 105 form, certain documents are necessary to ensure accurate reporting:

- Mileage records that detail the distance traveled in each jurisdiction.

- Receipts for fuel purchases, indicating the amount and type of fuel bought.

- Previous IFTA filings, if applicable, to maintain consistency in reporting.

Legal Use of the IFTA 105 Form

The IFTA 105 form must be completed in accordance with state regulations and federal laws. It is legally binding when filed correctly. Ensuring compliance with the International Fuel Tax Agreement is crucial for businesses operating across state lines, as it helps avoid legal penalties and maintains good standing with tax authorities.

Penalties for Non-Compliance

Failure to file the IFTA 105 form on time or inaccuracies in reporting can lead to significant penalties. These may include:

- Fines imposed by state tax authorities.

- Interest on unpaid taxes.

- Potential audits or increased scrutiny from tax agencies.

Quick guide on how to complete wwwtaxnygovpdfcurrentformsuse for 3rd quarter 2021 only ifta final fuel use tax rate

Complete Www tax ny govpdfcurrentformsUse For 3rd Quarter Only IFTA Final Fuel Use Tax Rate seamlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Www tax ny govpdfcurrentformsUse For 3rd Quarter Only IFTA Final Fuel Use Tax Rate on any platform with airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to edit and electronically sign Www tax ny govpdfcurrentformsUse For 3rd Quarter Only IFTA Final Fuel Use Tax Rate without stress

- Find Www tax ny govpdfcurrentformsUse For 3rd Quarter Only IFTA Final Fuel Use Tax Rate and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious searches for forms, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and electronically sign Www tax ny govpdfcurrentformsUse For 3rd Quarter Only IFTA Final Fuel Use Tax Rate and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwtaxnygovpdfcurrentformsuse for 3rd quarter 2021 only ifta final fuel use tax rate

Create this form in 5 minutes!

How to create an eSignature for the wwwtaxnygovpdfcurrentformsuse for 3rd quarter 2021 only ifta final fuel use tax rate

The way to make an e-signature for your PDF in the online mode

The way to make an e-signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the IFTA 105 form and why is it important?

The IFTA 105 form is a key document used for reporting fuel use by motor carriers operating in multiple jurisdictions. It ensures compliance with Interstate Fuel Tax Agreement guidelines, allowing carriers to accurately report and pay taxes owed. Understanding how to complete the IFTA 105 form can streamline your tax obligations and save your business money.

-

How does airSlate SignNow help with completing the IFTA 105 form?

airSlate SignNow simplifies the process of completing the IFTA 105 form by providing an intuitive eSignature platform. You can easily upload, edit, and send the form for signatures, ensuring all parties can quickly collaborate. This minimizes errors and accelerates the submission process.

-

What are the pricing options for using airSlate SignNow with IFTA 105?

airSlate SignNow offers competitive pricing plans that cater to various business needs, from solo entrepreneurs to large fleets. By choosing a plan tailored for your requirements, you can access features that make preparing your IFTA 105 form both efficient and affordable. Visit our pricing page to explore the options available.

-

Can I integrate airSlate SignNow with other accounting software for my IFTA 105 submissions?

Yes, airSlate SignNow integrates seamlessly with numerous accounting applications, enhancing your ability to manage IFTA 105 submissions. This integration allows for smooth data transfer, reducing manual entry and potential errors. By linking your existing tools, you can streamline the submission process further.

-

Is it secure to use airSlate SignNow for my IFTA 105 form?

Absolutely, security is a top priority for airSlate SignNow. Our platform employs robust encryption and compliance measures to ensure that your IFTA 105 form and sensitive data remain protected. You can trust that your documents are handled with the utmost security.

-

What features does airSlate SignNow offer specifically for the IFTA 105 process?

airSlate SignNow provides essential features for the IFTA 105 process, including customizable templates, automated workflows, and tracking for document progress. These tools enhance accuracy and speed, allowing users to submit their IFTA 105 forms efficiently. By leveraging these features, businesses can focus on growth rather than paperwork.

-

How can airSlate SignNow benefit my business in managing IFTA 105 submissions?

By using airSlate SignNow for your IFTA 105 submissions, you can enhance operational efficiency and reduce turnaround times. The platform's user-friendly interface allows team members to collaborate easily on document preparation and signing. This ultimately leads to better compliance and fewer tax-related headaches.

Get more for Www tax ny govpdfcurrentformsUse For 3rd Quarter Only IFTA Final Fuel Use Tax Rate

- Letter from landlord to tenant as notice that rent was voluntarily lowered in exchange for tenant agreeing to make repairs form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession arkansas form

- Letter from tenant to landlord about illegal entry by landlord arkansas form

- Letter from landlord to tenant about time of intent to enter premises arkansas form

- Arkansas tenant landlord 497296410 form

- Letter from tenant to landlord about sexual harassment arkansas form

- Arkansas tenant landlord 497296412 form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure arkansas form

Find out other Www tax ny govpdfcurrentformsUse For 3rd Quarter Only IFTA Final Fuel Use Tax Rate

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document