Fillable Online St 810 Sales Tax Form Form ST 810 219 2021

Understanding the ST-810 Sales Tax Form

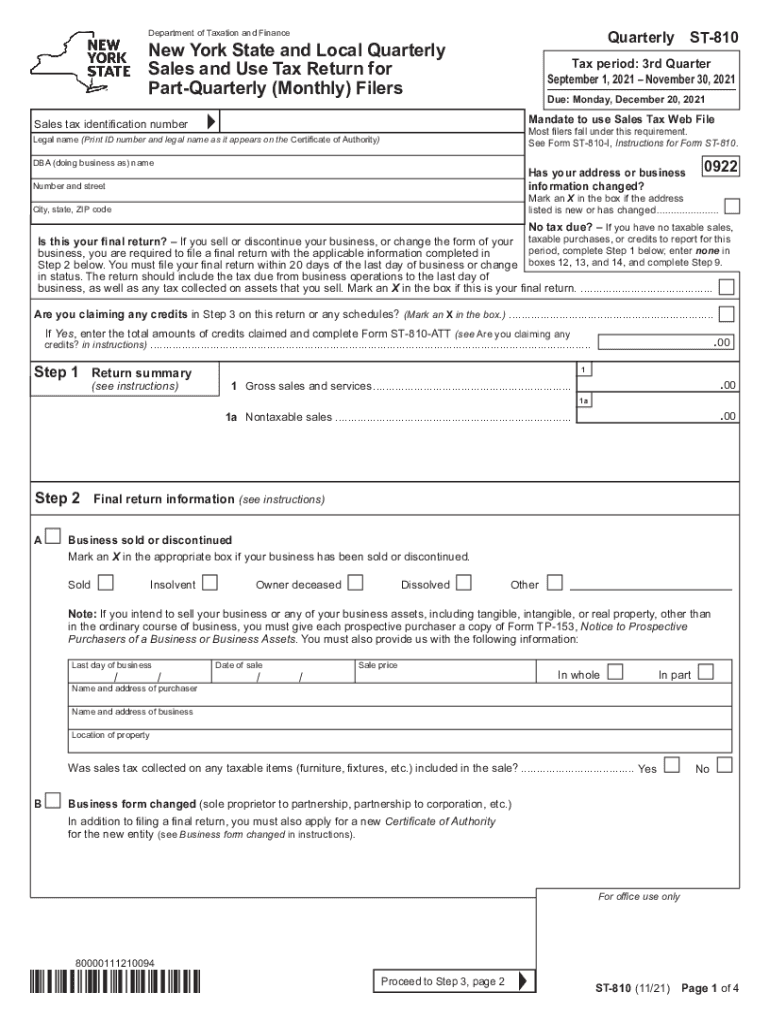

The ST-810 form, also known as the New York Sales Tax Resale Certificate, is essential for businesses engaged in the resale of goods. This form allows sellers to purchase items without paying sales tax, provided that the items will be resold in the regular course of business. It is crucial for maintaining compliance with New York tax regulations and ensuring that businesses do not incur unnecessary tax expenses on inventory intended for resale.

Steps to Complete the ST-810 Sales Tax Form

Completing the ST-810 form involves several straightforward steps. First, ensure you have the necessary information, including your business name, address, and sales tax identification number. Next, accurately fill out the form by providing details about the seller and the items being purchased for resale. It is important to sign and date the form to validate it. Finally, retain a copy for your records and provide the original to the seller to ensure tax-exempt status on your purchases.

Legal Use of the ST-810 Sales Tax Form

The ST-810 form is legally binding when completed correctly. It serves as proof that the purchaser intends to resell the items and is therefore exempt from paying sales tax at the time of purchase. To ensure compliance, businesses must use this form only for qualifying purchases. Misuse of the ST-810 can result in penalties, including back taxes and interest, so it is essential to understand the legal implications of using this form.

Key Elements of the ST-810 Sales Tax Form

Key elements of the ST-810 form include the seller's information, the purchaser's details, and a description of the property being purchased. Additionally, the form requires the purchaser's sales tax identification number, which verifies their eligibility for tax exemption. It is also important to include a signature and date to confirm the accuracy of the information provided. Each section must be filled out completely to avoid issues during tax audits.

Filing Deadlines and Important Dates

While the ST-810 form itself does not have a specific filing deadline, it is essential to use it correctly at the time of purchase to avoid paying sales tax. Businesses should keep track of their sales tax filing deadlines to ensure compliance with state tax regulations. Regularly reviewing these dates helps businesses maintain good standing with the New York State Department of Taxation and Finance.

Examples of Using the ST-810 Sales Tax Form

There are various scenarios where the ST-810 form is applicable. For instance, a retail store purchasing clothing from a wholesaler would use the ST-810 to avoid paying sales tax on items intended for resale. Similarly, a restaurant buying supplies such as plates and utensils for service can utilize the form to exempt these purchases from sales tax. Understanding these examples can help businesses recognize when to apply for the ST-810 form effectively.

Quick guide on how to complete fillable online st 810 sales tax form form st 810 219

Prepare Fillable Online St 810 Sales Tax Form Form ST 810 219 seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Handle Fillable Online St 810 Sales Tax Form Form ST 810 219 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Fillable Online St 810 Sales Tax Form Form ST 810 219 effortlessly

- Find Fillable Online St 810 Sales Tax Form Form ST 810 219 and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive data using tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to deliver your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, bothersome form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign Fillable Online St 810 Sales Tax Form Form ST 810 219 and guarantee excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online st 810 sales tax form form st 810 219

Create this form in 5 minutes!

How to create an eSignature for the fillable online st 810 sales tax form form st 810 219

The way to make an e-signature for your PDF online

The way to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is the ST 810 and how does it work with airSlate SignNow?

The ST 810 is an essential feature of airSlate SignNow that streamlines document signing processes. It allows users to easily prepare, send, and manage electronic signatures on important documents, enhancing workflow efficiency. By leveraging the ST 810, businesses can save time and reduce the hassle of traditional signing methods.

-

What pricing options are available for the ST 810 feature?

airSlate SignNow offers flexible pricing plans that accommodate different business needs, including the ST 810 feature. Users can choose from monthly or annual subscriptions, with costs varying based on the number of users and additional features. This allows companies to select a pricing model that best suits their budget.

-

What are the main benefits of using ST 810 for document signing?

The ST 810 feature provides numerous benefits, including faster turnaround times for document approvals and the ability to track status in real-time. With this functionality, users can ensure that documents are signed promptly, eliminating delays. Additionally, it enhances document security through encrypted signatures.

-

Is the ST 810 feature easy to integrate with other applications?

Yes, the ST 810 feature integrates seamlessly with a variety of third-party applications and platforms. This capability allows businesses to enhance their existing workflows and improve productivity. Whether you are using CRM systems or project management tools, the ST 810 can connect effortlessly.

-

Can I customize the ST 810 workflow for my business needs?

Absolutely! The ST 810 feature allows users to customize workflows to fit their specific business processes. You can set unique signing orders, include multiple signers, and adjust notifications, ensuring that the document signing process aligns with your operational requirements.

-

Does the ST 810 feature ensure compliance with legal standards?

Yes, the ST 810 feature complies with major eSignature laws, including the ESIGN Act and UETA. This means that any documents signed using the airSlate SignNow platform, including those utilizing the ST 810, are legally binding and secure. Businesses can trust in the compliance of their electronic agreements.

-

What types of documents can be signed using the ST 810?

The ST 810 feature supports a wide range of document types, making it versatile for various industries. From contracts and agreements to forms and invoices, users can easily upload and send any document for eSigning. This flexibility helps cater to different business scenarios and document requirements.

Get more for Fillable Online St 810 Sales Tax Form Form ST 810 219

- Letter from tenant to landlord with demand that landlord repair broken windows arkansas form

- Letter from tenant to landlord with demand that landlord repair plumbing problem arkansas form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497296400 form

- Letter from tenant to landlord with demand that landlord repair unsafe or broken lights or wiring arkansas form

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings arkansas form

- Arkansas tenant landlord form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles arkansas form

- Letter from tenant to landlord about landlords failure to make repairs arkansas form

Find out other Fillable Online St 810 Sales Tax Form Form ST 810 219

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement