706me Form

What is the 706me Form

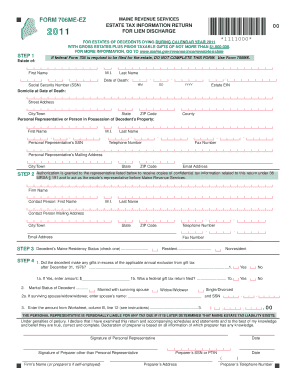

The 706me Form is a crucial document used for estate tax purposes in the United States. It is specifically designed for the reporting of the estate of a deceased individual, allowing the executor or administrator to calculate and report the estate tax owed. This form is essential for compliance with federal tax laws and ensures that the estate is settled according to the decedent's wishes and legal obligations. The 706me Form collects information about the deceased's assets, liabilities, and any deductions that may apply, providing a comprehensive overview of the estate's financial situation.

How to use the 706me Form

Using the 706me Form involves several steps to ensure accurate completion and compliance with tax regulations. First, gather all necessary documentation related to the deceased's assets, liabilities, and any relevant financial information. Next, carefully fill out each section of the form, ensuring that all values are accurate and reflect the current market conditions. It is important to consult IRS guidelines or a tax professional if there are any uncertainties about how to report specific items. Once completed, the form must be submitted to the IRS by the designated deadline to avoid penalties.

Steps to complete the 706me Form

Completing the 706me Form requires attention to detail and adherence to specific guidelines. Follow these steps for effective completion:

- Gather all relevant financial documents, including property deeds, bank statements, and investment accounts.

- Determine the date of death and the value of the estate at that time.

- Complete the identification section, including the decedent's name, Social Security number, and date of death.

- List all assets and their fair market values, including real estate, personal property, and financial accounts.

- Document any debts or liabilities that the estate must settle.

- Calculate deductions, such as funeral expenses and debts, to arrive at the taxable estate value.

- Review the form for accuracy and completeness before submission.

Legal use of the 706me Form

The legal use of the 706me Form is governed by federal tax laws, which require that estates exceeding a certain value file this form. It serves as a formal declaration of the estate's financial status and is used by the IRS to assess any estate tax owed. Proper use of the form ensures compliance with the law and protects the executor from potential legal issues. Additionally, the form must be signed by the executor, affirming that the information provided is accurate and complete, which adds to its legal weight.

Filing Deadlines / Important Dates

Filing the 706me Form within the specified deadlines is critical to avoid penalties and interest. The form must typically be filed within nine months of the date of death. However, if an extension is needed, the executor can file Form 4768 to request an additional six months to submit the form. It is important to note that any estate taxes owed are also due within this nine-month period, so planning ahead is essential to ensure timely payment and compliance.

Required Documents

To complete the 706me Form accurately, several documents are required. These include:

- Death certificate of the decedent.

- Documents detailing the decedent's assets, such as property deeds, bank statements, and investment account statements.

- Records of any outstanding debts or liabilities of the estate.

- Documentation for any deductions, including funeral expenses and medical bills incurred before death.

- Previous tax returns, if applicable, to provide context for income and deductions.

Quick guide on how to complete 706me form

Effortlessly prepare 706me Form on any device

Digital document management has gained traction among companies and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and electronically sign your documents without any hassles. Manage 706me Form from any device using airSlate SignNow apps for Android or iOS and enhance any document-related tasks today.

The easiest way to modify and electronically sign 706me Form with ease

- Obtain 706me Form and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or conceal sensitive information with features that airSlate SignNow specifically offers for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign 706me Form while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 706me form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 706me Form?

The 706me Form is a document used for estate tax purposes in the United States. It allows taxpayers to report the value of an estate subject to federal estate tax. Understanding the details of the 706me Form can help in effective estate planning.

-

How can airSlate SignNow help with the 706me Form?

airSlate SignNow simplifies the process of eSigning and sending the 706me Form for all parties involved. Our platform ensures that documents are securely signed and easily shared, streamlining the workflow associated with estate tax documentation.

-

What are the pricing options for airSlate SignNow when handling documents like the 706me Form?

airSlate SignNow offers various pricing plans tailored to meet the needs of different users and businesses. Pricing options are designed to be cost-effective, making it accessible for those needing to manage the 706me Form efficiently.

-

Are there any features specific to the 706me Form in airSlate SignNow?

Yes, airSlate SignNow includes features such as templates, automated reminders, and status tracking specifically for documents like the 706me Form. These tools enhance the user experience and ensure compliance with necessary regulations.

-

Can I integrate airSlate SignNow with other applications while working on the 706me Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing users to manage the 706me Form alongside other tools. This connectivity enhances productivity and centralizes your document management workflow.

-

What benefits does airSlate SignNow provide for businesses managing the 706me Form?

airSlate SignNow empowers businesses by providing a cost-effective and efficient way to manage important documents like the 706me Form. The platform enhances collaboration, ensures security, and streamlines the signing process, which is vital for tax compliance.

-

Is the 706me Form legally binding when signed through airSlate SignNow?

Yes, signatures obtained via airSlate SignNow on the 706me Form are legally binding and comply with eSignature laws. Our platform ensures secure signing processes that are recognized in court, providing peace of mind for users.

Get more for 706me Form

- Magnesium compounds are used in the production of uranium for nuclear reactors draw the bohr model for magnesium form

- How to write abatement notice form

- Cricket tournament rules and regulations pdf form

- Transforming linear functions worksheet

- Confidential information cif washington state courts

- Sterling mobile home financing form

- Rhs 8 4 form

- Allstate supplement request form

Find out other 706me Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form