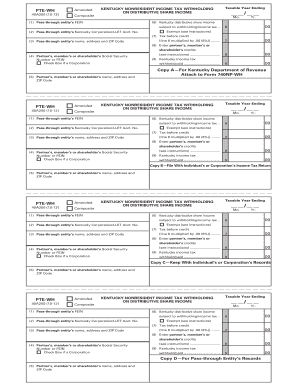

Pte Wh Form

What is the PTE WH?

The PTE WH form, also known as the "Withholding Certificate for Foreign Persons," is a crucial document used in the United States tax system. It is primarily designed for foreign individuals or entities who receive income from U.S. sources. This form allows them to claim a reduced rate of withholding tax or an exemption from withholding based on applicable tax treaties between the U.S. and their home countries. Understanding the PTE WH is essential for ensuring compliance with U.S. tax laws while maximizing potential tax benefits.

How to Obtain the PTE WH

To obtain the PTE WH form, individuals or entities must first determine their eligibility based on their residency status and the nature of the income they receive. The form can be downloaded from the official IRS website. It is important to ensure that the correct version of the form is used, as there may be updates or revisions. After downloading, the form must be completed accurately, providing all necessary information regarding the taxpayer's identity and the income in question.

Steps to Complete the PTE WH

Completing the PTE WH form involves several key steps. First, gather all relevant information, including your taxpayer identification number and details about the income source. Next, fill out the form accurately, ensuring that all sections are completed. Pay special attention to any claims for reduced withholding rates based on tax treaties. After completing the form, review it for accuracy before submitting it to the appropriate withholding agent or financial institution.

Legal Use of the PTE WH

The PTE WH form must be used in compliance with U.S. tax laws to be considered legally valid. This includes ensuring that all claims for reduced withholding are supported by appropriate documentation, such as tax treaties. Failure to use the form correctly can result in higher withholding rates or potential penalties. It is advisable to consult with a tax professional if there are any uncertainties regarding the legal implications of using the PTE WH form.

Key Elements of the PTE WH

Understanding the key elements of the PTE WH form is essential for proper completion. Important components include the taxpayer's name, address, and taxpayer identification number. Additionally, the form requires details about the type of income being received and any applicable tax treaty benefits. Accurate information in these sections helps ensure that the correct withholding rates are applied and that the form is processed efficiently by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the PTE WH form vary depending on the type of income and the withholding agent's requirements. Generally, the form should be submitted before the payment is made to ensure that the correct withholding rate is applied. It is important to stay informed about any changes to deadlines, as failure to submit the form on time can lead to unnecessary withholding and potential tax complications.

Quick guide on how to complete pte wh

Prepare Pte Wh effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed forms, allowing you to access the right template and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Handle Pte Wh on any device using airSlate SignNow's apps for Android or iOS, and enhance any document-based workflow today.

How to edit and eSign Pte Wh with ease

- Find Pte Wh and click on Get Form to begin.

- Make use of the available tools to complete your document.

- Mark important sections of your documents or obscure sensitive information with the specific tools provided by airSlate SignNow.

- Create your signature using the Sign feature, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Pte Wh to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pte wh

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is pte wh and how does it relate to airSlate SignNow?

PTE WH stands for 'Personalized Training Experience Workflow,' and it emphasizes personalized document management. With airSlate SignNow, you can leverage this feature to streamline your document signing processes while ensuring your team gets tailored training on using the eSign solutions effectively.

-

How much does airSlate SignNow cost?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, starting from a free trial to premium plans. The PTE WH feature is included in our pricing packages, ensuring that you can optimize your document workflow without breaking the bank.

-

What are the key features of airSlate SignNow?

Key features of airSlate SignNow include eSignature functionality, document templates, and customizable workflows. The integration of PTE WH helps enhance user training, making it easier for employees to adopt eSigning practices seamlessly.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports integration with various applications such as Google Workspace, Salesforce, and more. This allows for a cohesive workflow where the PTE WH connections can streamline document management and improve efficiency.

-

What benefits does airSlate SignNow offer for businesses?

airSlate SignNow offers a cost-effective solution to manage documents and obtain signatures efficiently. Implementing the PTE WH not only enhances productivity but also ensures compliance and quicker turnaround times for documents, benefiting businesses of all sizes.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow has a mobile app that allows users to manage, sign, and send documents on the go. This mobile capability, tied with the PTE WH feature, ensures that your workflow remains uninterrupted and accessible anytime.

-

How do I get support for airSlate SignNow?

airSlate SignNow provides multiple support channels, including email support, live chat, and a comprehensive knowledge base. The PTE WH service can also guide users through training sessions and troubleshoot common issues effectively.

Get more for Pte Wh

- When recorded return to statutory warranty deed form

- Fulfillment deed statutory warranty deed grantor for form

- In hand paid conveys and quit claims to form

- When recorded return to quit claim deed grantor grantee form

- This document appears if you request a deed transferring form

- Deed and sellers assignment of real estate form

- Deed and purchasers assignment of real estate contract form

- Bargain and sale deed lpb 15 05rpdf fpdf docx form

Find out other Pte Wh

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now