Form 8582 Fill Out and Sign Printable PDF TemplatesignNow 2021

What is the Form 8582?

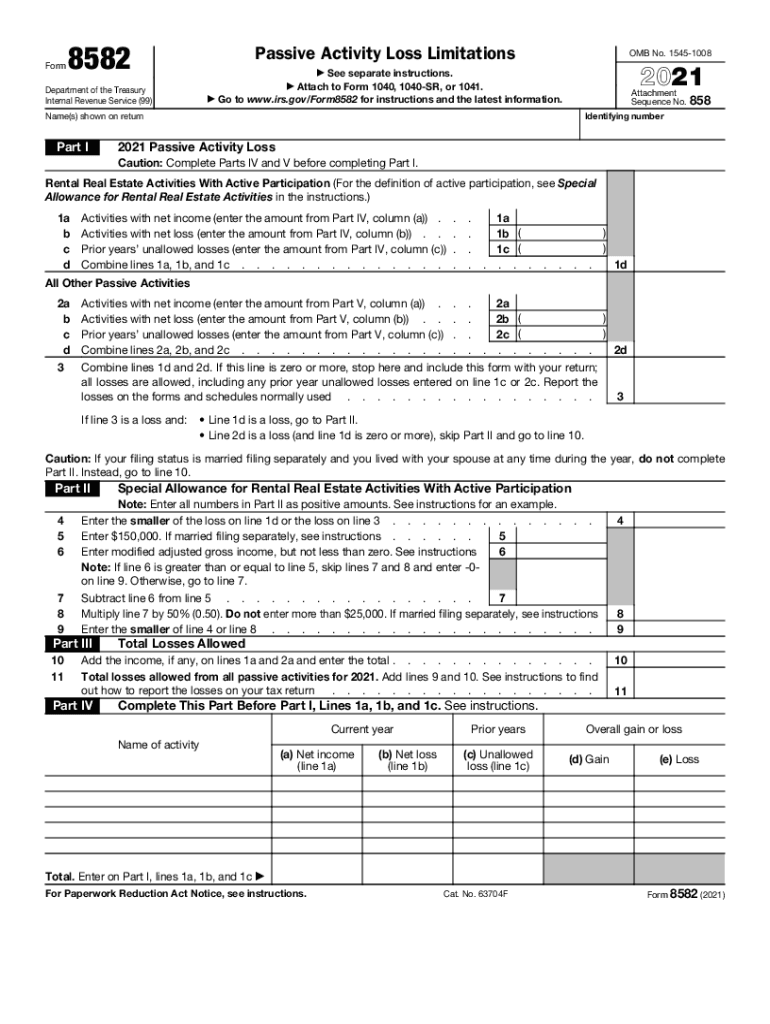

The Form 8582, also known as the Passive Activity Loss Limitations form, is a tax document used by individuals and entities to report passive activity losses. Passive activities generally include rental activities and businesses in which the taxpayer does not materially participate. This form helps taxpayers calculate the amount of passive losses that can be deducted from their taxable income. Understanding how to fill out the 8582 is essential for ensuring compliance with IRS regulations and maximizing potential tax benefits.

Steps to Complete the Form 8582

Completing the Form 8582 involves several key steps:

- Gather all relevant financial information related to your passive activities, including income, losses, and expenses.

- Begin by filling out your personal information at the top of the form, including your name, Social Security number, and tax year.

- Report your passive income and losses on the appropriate lines of the form. Ensure that you categorize each activity correctly.

- Calculate the total passive losses and determine the allowable losses based on IRS guidelines.

- Transfer any disallowed losses to the appropriate section for future use.

- Review the completed form for accuracy before submission.

Legal Use of the Form 8582

The Form 8582 is legally binding when filled out correctly and submitted to the IRS. It must adhere to the guidelines set forth by the Internal Revenue Service. Using this form allows taxpayers to report passive activity losses and ensures compliance with tax laws. Failure to accurately complete and submit the form can result in penalties, disallowed deductions, or audits. Therefore, it is crucial to understand the legal implications of the information provided on this form.

IRS Guidelines for Form 8582

The IRS provides specific guidelines for completing the Form 8582. Taxpayers must follow these instructions closely to avoid errors. Key guidelines include:

- Understanding the definition of passive activities and how they apply to your situation.

- Knowing the limits on passive activity losses and the rules for carryover to future tax years.

- Familiarizing yourself with any changes to tax laws that may affect the completion of the form.

Filing Deadlines for Form 8582

Filing deadlines for the Form 8582 align with the general tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of the following year. If you require additional time, you may file for an extension, but it is important to ensure that the Form 8582 is submitted by the extended deadline to avoid penalties. Keeping track of these dates is essential for maintaining compliance with IRS requirements.

Examples of Using the Form 8582

There are various scenarios where the Form 8582 may be applicable. For instance:

- A taxpayer who owns rental properties but does not actively manage them may use the form to report losses from those properties.

- An investor in a limited partnership that generates passive income can utilize the form to calculate allowable losses.

- Taxpayers who have multiple passive activities must consolidate their income and losses using the form to determine their overall tax liability.

Quick guide on how to complete form 8582 fill out and sign printable pdf templatesignnow

Effortlessly Prepare Form 8582 Fill Out And Sign Printable PDF TemplatesignNow on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed papers, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without interruptions. Handle Form 8582 Fill Out And Sign Printable PDF TemplatesignNow on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Alter and Electronically Sign Form 8582 Fill Out And Sign Printable PDF TemplatesignNow with Ease

- Locate Form 8582 Fill Out And Sign Printable PDF TemplatesignNow and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal confidential information with specialized tools offered by airSlate SignNow.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your edits.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Modify and electronically sign Form 8582 Fill Out And Sign Printable PDF TemplatesignNow to ensure seamless communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8582 fill out and sign printable pdf templatesignnow

Create this form in 5 minutes!

How to create an eSignature for the form 8582 fill out and sign printable pdf templatesignnow

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is the form 8582?

The form 8582 is a tax form used to calculate the allowable amount of passive activity losses that can be deducted. It's crucial for taxpayers who have rental real estate or other passive investments to ensure they meet IRS requirements. Completing the form accurately can help reduce tax liabilities effectively.

-

How can airSlate SignNow assist with form 8582?

airSlate SignNow offers an efficient way to complete and eSign the form 8582 digitally. With our user-friendly platform, you can fill out the form, save it securely, and send it for eSignature all in one place. This simplifies the process and ensures compliance with tax submission standards.

-

Is there a cost associated with using airSlate SignNow for form 8582?

Yes, airSlate SignNow provides cost-effective pricing plans that cater to different business needs. You can choose a plan that fits your budget while gaining access to powerful features for managing documents, including the form 8582. Explore our pricing page for detailed information on plans and features.

-

What features does airSlate SignNow offer for completing form 8582?

Our platform includes features such as templates, customizable fields, and secure eSigning for the form 8582. You can also track document status and get notifications, ensuring you stay informed throughout the process. These features enhance efficiency and accuracy when managing your tax documents.

-

Can I integrate airSlate SignNow with other applications for managing form 8582?

Absolutely! airSlate SignNow can easily integrate with various applications, including CRM systems and cloud storage solutions, to streamline the workflow for your form 8582. This seamless integration helps in keeping all documents organized and accessible, enhancing your operational efficiency.

-

What are the benefits of using airSlate SignNow for form 8582 submissions?

Using airSlate SignNow for your form 8582 submissions offers numerous benefits, including time savings, enhanced convenience, and improved compliance. With digital signatures and cloud storage, you can manage your tax documents securely and efficiently. This minimizes paper usage and fosters a more sustainable business approach.

-

How do I start using airSlate SignNow for my form 8582?

Getting started with airSlate SignNow for your form 8582 is simple. Sign up for an account on our website, choose a suitable pricing plan, and explore the platform to create and manage your forms. Our support resources are also available to help you navigate through the process effectively.

Get more for Form 8582 Fill Out And Sign Printable PDF TemplatesignNow

Find out other Form 8582 Fill Out And Sign Printable PDF TemplatesignNow

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors