It 3 Instructions for it 3 Ohio Department of Taxation State of Ohio Tax Ohio Form

What is the IT 3 Instructions For IT 3 Ohio Department Of Taxation State Of Ohio Tax Ohio

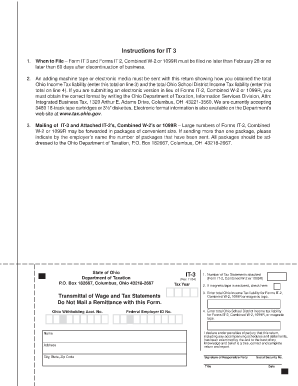

The IT 3 Instructions provide guidance for completing the IT 3 form, which is essential for reporting income tax withheld for employees in Ohio. This form is specifically designed for employers to report Ohio income tax withholding. Understanding the IT 3 Instructions is crucial for ensuring compliance with state tax regulations and for accurate reporting of withheld taxes to the Ohio Department of Taxation.

Steps to complete the IT 3 Instructions For IT 3 Ohio Department Of Taxation State Of Ohio Tax Ohio

Completing the IT 3 form involves several key steps:

- Gather necessary information, including employee details and withholding amounts.

- Access the IT 3 Instructions to understand specific requirements and guidelines.

- Fill out the IT 3 form accurately, ensuring all fields are completed as per the instructions.

- Review the completed form for accuracy before submission.

- Submit the form electronically or via mail, following the guidelines provided in the instructions.

Legal use of the IT 3 Instructions For IT 3 Ohio Department Of Taxation State Of Ohio Tax Ohio

The IT 3 Instructions are legally binding when completed accurately and submitted in compliance with Ohio tax laws. The form must be filled out according to the guidelines to ensure that it is accepted by the Ohio Department of Taxation. Utilizing a reliable electronic signature solution can further enhance the legal validity of the submission, as it complies with eSignature laws such as ESIGN and UETA.

Key elements of the IT 3 Instructions For IT 3 Ohio Department Of Taxation State Of Ohio Tax Ohio

Several key elements are essential for understanding the IT 3 Instructions:

- Identification of the employer and employees involved.

- Accurate reporting of tax withheld from employee wages.

- Compliance with state-specific tax regulations and deadlines.

- Clear instructions on submission methods and required documentation.

Filing Deadlines / Important Dates

Employers must be aware of specific filing deadlines associated with the IT 3 form. Typically, the form should be submitted by the last day of the month following the end of the quarter in which the taxes were withheld. Keeping track of these deadlines is crucial to avoid penalties and ensure compliance with Ohio tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The IT 3 form can be submitted using various methods, including:

- Online submission through the Ohio Department of Taxation's website.

- Mailing the completed form to the appropriate address as indicated in the IT 3 Instructions.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete it 3 instructions for it 3 ohio department of taxation state of ohio tax ohio

Effortlessly prepare IT 3 Instructions For IT 3 Ohio Department Of Taxation State Of Ohio Tax Ohio on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without any delays. Manage IT 3 Instructions For IT 3 Ohio Department Of Taxation State Of Ohio Tax Ohio on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign IT 3 Instructions For IT 3 Ohio Department Of Taxation State Of Ohio Tax Ohio with ease

- Locate IT 3 Instructions For IT 3 Ohio Department Of Taxation State Of Ohio Tax Ohio and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign IT 3 Instructions For IT 3 Ohio Department Of Taxation State Of Ohio Tax Ohio and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 3 instructions for it 3 ohio department of taxation state of ohio tax ohio

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the IT 3 Instructions for IT 3 Ohio Department of Taxation?

The IT 3 Instructions for IT 3 Ohio Department of Taxation provide detailed guidance on how to complete the IT 3 form accurately. These instructions are essential for ensuring compliance with Ohio state taxes and facilitating seamless filing. Understanding these instructions can help taxpayers avoid errors and potential penalties.

-

How can airSlate SignNow help with submitting IT 3 forms?

airSlate SignNow simplifies the process of submitting IT 3 forms by allowing users to eSign documents securely and efficiently. Our platform enables easy access to IT 3 Instructions for IT 3 Ohio Department of Taxation, making it simpler to ensure all required information is correctly captured. This efficiency can save time and reduce hassle during tax season.

-

Is there a cost associated with using airSlate SignNow for IT 3 form submissions?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Our solutions are designed to be cost-effective while providing the necessary tools to facilitate the processing of important tax documents, including the IT 3 Instructions for IT 3 Ohio Department of Taxation. Flexible pricing means you can choose a plan that works for your budget.

-

What features are available in airSlate SignNow for tax document management?

airSlate SignNow comes equipped with a range of features designed to streamline tax document management, including eSignature capabilities, customizable templates, and secure storage. Users can easily access IT 3 Instructions for IT 3 Ohio Department of Taxation directly from the platform to ensure accurate compliance. These features enhance usability and efficiency for managing important paperwork.

-

Can I integrate airSlate SignNow with other software for tax filing?

Absolutely! airSlate SignNow can be integrated with various accounting and tax preparation software, enhancing the overall workflow for submitting IT 3 forms. This integration allows users to combine powerful features of the software with the IT 3 Instructions for IT 3 Ohio Department of Taxation, ensuring a seamless submission process. Utilizing these integrations can help streamline your tax management efforts.

-

What benefits does airSlate SignNow provide for small businesses when handling IT 3 forms?

Small businesses can greatly benefit from using airSlate SignNow for handling IT 3 forms by gaining access to a user-friendly platform that simplifies document management. This solution supports compliance with the IT 3 Instructions for IT 3 Ohio Department of Taxation while also being economically viable. Small businesses can save time and resources, allowing them to focus on growth and operations.

-

How secure is the data I handle through airSlate SignNow?

Security is a top priority at airSlate SignNow. We implement industry-standard encryption and secure access protocols to ensure that all data, including documents related to IT 3 Instructions for IT 3 Ohio Department of Taxation, remains confidential. Users can have peace of mind knowing their sensitive tax information is protected.

Get more for IT 3 Instructions For IT 3 Ohio Department Of Taxation State Of Ohio Tax Ohio

- Notice intent get form

- Connecticut affidavit of original contractor by individual form

- Connecticut assignment of mortgage by corporate mortgage holder form

- Connecticut notice of intent not to renew at end of specified term from landlord to tenant for residential property form

- Connecticut provisions form

- Ct assignment 481379322 form

- Connecticut rental form

- Creditors matrix form

Find out other IT 3 Instructions For IT 3 Ohio Department Of Taxation State Of Ohio Tax Ohio

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple