Tc106sup Form

What is the TC106A?

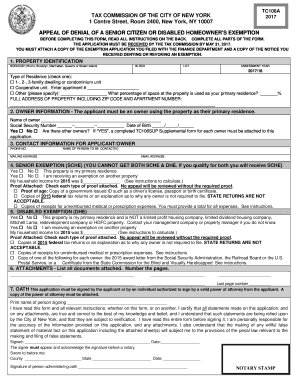

The TC106A is a form used primarily for tax-related purposes in the United States. It is often associated with the TC106SUP supplemental form, which provides additional information necessary for specific tax situations. The TC106A is designed to collect essential data from taxpayers, ensuring that all relevant details are accurately reported to the Internal Revenue Service (IRS). This form is crucial for individuals and businesses alike, as it helps to clarify tax obligations and entitlements.

How to Use the TC106A

Using the TC106A involves several straightforward steps. First, ensure you have the latest version of the form, which can be obtained from authorized sources. Next, gather all necessary information, such as your personal identification details, income records, and any relevant deductions. Carefully fill out the form, ensuring that all sections are completed accurately. Once completed, review the form for any errors before submitting it to the appropriate tax authority.

Steps to Complete the TC106A

Completing the TC106A requires attention to detail. Follow these steps for a smooth process:

- Download the TC106A form from a reliable source.

- Gather necessary documents, including your Social Security number, income statements, and previous tax returns.

- Fill in your personal information accurately in the designated fields.

- Provide income details and any applicable deductions or credits.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or via mail, depending on your preference and the submission guidelines.

Legal Use of the TC106A

The TC106A is legally recognized as a valid document when completed and submitted according to IRS guidelines. To ensure its legal standing, it is essential to adhere to all relevant laws and regulations governing tax submissions. This includes providing accurate information and maintaining compliance with deadlines. Utilizing secure and compliant platforms for electronic submission can further enhance the legal validity of your form.

Required Documents for the TC106A

When preparing to fill out the TC106A, certain documents are essential. These typically include:

- Social Security number or Individual Taxpayer Identification Number (ITIN).

- W-2 forms or 1099 forms that report income.

- Records of any deductions or credits you plan to claim.

- Previous year’s tax return for reference.

Having these documents ready will streamline the completion process and help ensure accuracy.

Filing Deadlines for the TC106A

Filing deadlines for the TC106A are crucial to avoid penalties. Typically, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to filing deadlines and to submit your form in a timely manner to ensure compliance with IRS regulations.

Quick guide on how to complete tc106sup supplemental form

Set up tc106sup supplemental form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, amend, and electronically sign your documents promptly without any holdups. Manage tc106a from any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign tc106sup supplemental form effortlessly

- Obtain tc106sup and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Modify and electronically sign tc106a and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to tc106sup

Create this form in 5 minutes!

How to create an eSignature for the tc106a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask tc106sup

-

What is the tc106a feature in airSlate SignNow?

The tc106a feature in airSlate SignNow streamlines the process of sending and signing documents electronically. With tc106a, users can easily create, manage, and track their documents, ensuring a hassle-free experience for both senders and signers.

-

How much does airSlate SignNow cost for using tc106a?

Pricing for airSlate SignNow's tc106a feature is competitive and based on the plan you choose. There are different tiers available, allowing businesses of all sizes to find a cost-effective solution that meets their needs while still benefiting from the powerful capabilities of tc106a.

-

What are the main benefits of using the tc106a feature?

Using the tc106a feature in airSlate SignNow signNowly improves workflow efficiency and reduces the time spent on document management. It ensures secure eSigning and enhances collaboration among teams, making it an ideal choice for businesses looking to streamline their processes.

-

Is tc106a suitable for all types of businesses?

Yes, the tc106a feature in airSlate SignNow is designed to cater to businesses of all sizes and industries. Whether you're a small startup or a large corporation, tc106a offers customizable solutions that can be tailored to fit your specific requirements.

-

Can I integrate tc106a with other applications?

Absolutely! The tc106a feature in airSlate SignNow supports integrations with various applications such as CRMs, project management tools, and more. This flexibility allows you to enhance your overall workflow by connecting tc106a with the tools you already use.

-

How secure is the tc106a signature process?

The tc106a signing process in airSlate SignNow is highly secure, employing industry-standard encryption and authentication protocols. This ensures that your documents are safe and compliant with regulations, providing peace of mind while digitally signing important papers.

-

What types of documents can I send using tc106a?

With the tc106a feature in airSlate SignNow, you can send a wide variety of document types including contracts, agreements, forms, and more. This versatility makes tc106a an essential tool for any business looking to digitize their documentation processes.

Get more for tc106a

- 2021 form 3581 tax deposit refund and transfer request

- Ia 1065 instructions 41 017 iowa department of revenue form

- Injured spouse claims vermont department of taxes form

- Do not file this draft form cloudfrontnet

- Dr 133 florida department of revenue form

- Handbook for reproduction of department of revenue forms

- 2022 form 8995 qualified business income deduction simplified computation

- 2022 form 2220 underpayment of estimated tax by corporations

Find out other tc106sup supplemental form

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now