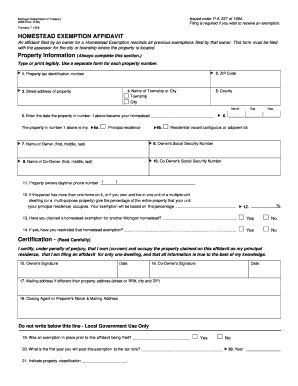

Michigan Department of Treasury Form 2368

What is the Michigan Department Of Treasury Form 2368

The Michigan Department Of Treasury Form 2368 is a crucial document utilized for reporting specific tax-related information. This form is typically associated with the state’s tax administration processes and is essential for ensuring compliance with Michigan tax laws. It is important for individuals and businesses to understand the purpose of this form, as it helps facilitate accurate reporting and timely submission of tax obligations.

How to use the Michigan Department Of Treasury Form 2368

Using the Michigan Department Of Treasury Form 2368 involves several steps to ensure that all required information is accurately provided. First, gather all necessary documentation related to your tax situation. Next, carefully fill out the form, ensuring that all fields are completed as required. Once the form is filled out, review it for accuracy before submitting it to the appropriate tax authority. Utilizing digital solutions can streamline this process, making it easier to fill out and sign the form securely.

Steps to complete the Michigan Department Of Treasury Form 2368

Completing the Michigan Department Of Treasury Form 2368 requires a systematic approach. Follow these steps:

- Collect all relevant financial documents, including income statements and previous tax returns.

- Access the form through the Michigan Department of Treasury website or a trusted digital platform.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide the necessary financial details as required by the form.

- Review the completed form for accuracy and completeness.

- Sign the form electronically or manually, depending on your submission method.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Michigan Department Of Treasury Form 2368

The legal use of the Michigan Department Of Treasury Form 2368 is governed by state tax laws and regulations. For the form to be considered valid, it must be completed accurately and submitted within the specified deadlines. Electronic signatures are legally binding under U.S. law, provided that the signing process meets the necessary legal requirements. This includes using a compliant digital signature solution that ensures the authenticity and integrity of the document.

Form Submission Methods

The Michigan Department Of Treasury Form 2368 can be submitted through various methods, catering to the preferences of individuals and businesses. Common submission methods include:

- Online: Utilize a secure digital platform to fill out and submit the form electronically.

- Mail: Print the completed form and send it to the designated address via postal service.

- In-Person: Deliver the form directly to a local Michigan Department of Treasury office.

Eligibility Criteria

To utilize the Michigan Department Of Treasury Form 2368, individuals and businesses must meet specific eligibility criteria. Typically, this includes being a resident of Michigan or conducting business within the state. Additionally, the form may be required for specific tax situations, such as income reporting or tax credits. It is essential to review the eligibility requirements to ensure compliance and proper use of the form.

Quick guide on how to complete michigan department of treasury form 2368

Effortlessly prepare Michigan Department Of Treasury Form 2368 on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without interruptions. Manage Michigan Department Of Treasury Form 2368 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and electronically sign Michigan Department Of Treasury Form 2368 with ease

- Locate Michigan Department Of Treasury Form 2368 and click Get Form to begin.

- Use the tools available to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Michigan Department Of Treasury Form 2368 while ensuring effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan department of treasury form 2368

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan Department Of Treasury Form 2368?

The Michigan Department Of Treasury Form 2368 is a necessary document for certain tax-related purposes in Michigan. It is primarily used by businesses and organizations to report and submit specific tax information. Ensuring accurate completion of this form is crucial for compliance with Michigan tax regulations.

-

How can airSlate SignNow help with the Michigan Department Of Treasury Form 2368?

airSlate SignNow offers a seamless solution for electronically signing and sending the Michigan Department Of Treasury Form 2368. Our platform allows businesses to complete, eSign, and share this form securely, ensuring timely submission to the relevant authorities without the hassle of paperwork.

-

Is airSlate SignNow cost-effective for managing the Michigan Department Of Treasury Form 2368?

Yes, airSlate SignNow provides a cost-effective solution for managing the Michigan Department Of Treasury Form 2368. With our pricing plans tailored for businesses of all sizes, you can save time and resources while ensuring your forms are handled efficiently and securely.

-

What features does airSlate SignNow offer for the Michigan Department Of Treasury Form 2368?

airSlate SignNow offers a variety of features to assist with the Michigan Department Of Treasury Form 2368. Key features include customizable templates, secure eSignature capabilities, and easy document sharing, all designed to streamline the form submission process and enhance productivity.

-

Can I integrate airSlate SignNow with my existing systems for the Michigan Department Of Treasury Form 2368?

Absolutely! airSlate SignNow can be integrated with various third-party applications and systems. This means you can easily incorporate the Michigan Department Of Treasury Form 2368 into your existing workflows for greater efficiency and ease of use.

-

What are the benefits of using airSlate SignNow for the Michigan Department Of Treasury Form 2368?

Using airSlate SignNow for the Michigan Department Of Treasury Form 2368 streamlines the signing and submission process, saving time and reducing errors. The platform enhances document security and allows for easy tracking of submissions, ensuring compliance and peace of mind for businesses.

-

Is airSlate SignNow user-friendly for completing the Michigan Department Of Treasury Form 2368?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete the Michigan Department Of Treasury Form 2368. Our intuitive interface enhances the user experience, allowing for quick navigation through the form and signature processes.

Get more for Michigan Department Of Treasury Form 2368

- Form ct 636 alcoholic beverage production credit tax year

- Partners instructions for form it 204 ip taxnygov

- Form ct 3 general business corporation franchise tax

- Tax year end and fiscal period canadaca form

- Form it 201 att other tax credits and taxes taxnygov

- Adobe acrobat pro free download ampamp trial form

- Form it 280 nonobligated spouse allocation tax year 2022

- Your drivers form

Find out other Michigan Department Of Treasury Form 2368

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online