EMPLOYER39S QUARTERLY BTAXb and BWAGE REPORTb PART I Bb 2014-2026

What is the Employer's Quarterly Tax and Wage Report?

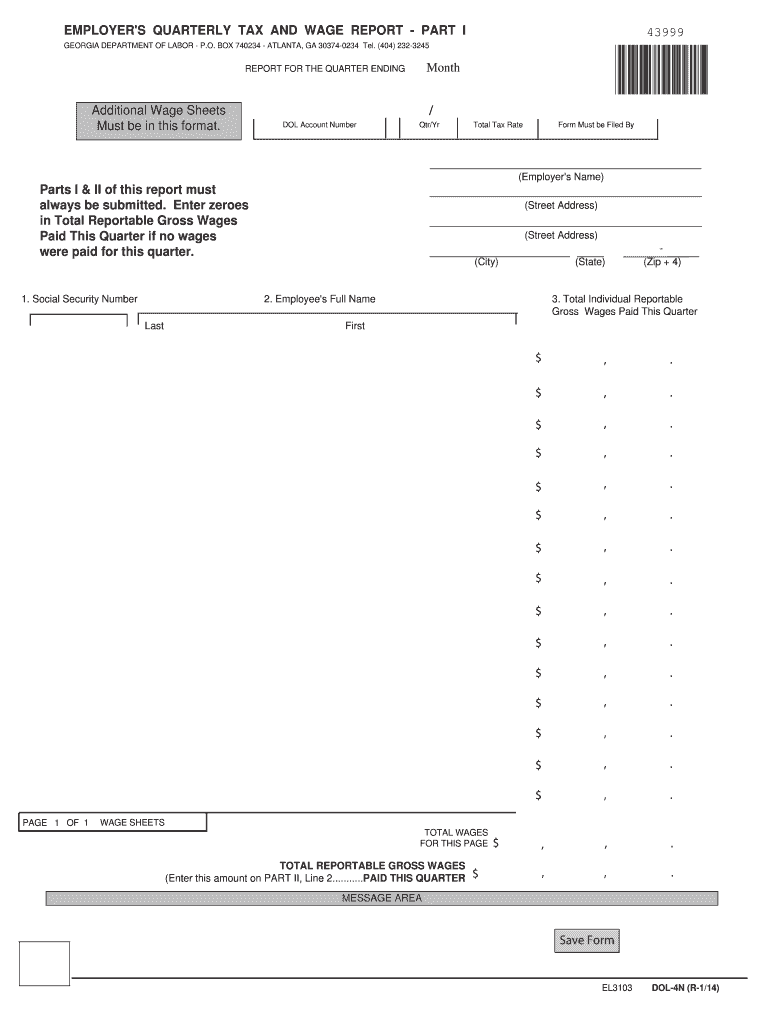

The Employer's Quarterly Tax and Wage Report, commonly referred to in Georgia as the DOL 4n form, is a crucial document that employers must submit to the Georgia Department of Labor. This report provides a summary of wages paid to employees and the taxes withheld during a specific quarter. It is essential for ensuring compliance with state tax laws and for accurately reporting employee earnings to the state.

Steps to Complete the Employer's Quarterly Tax and Wage Report

Completing the DOL 4n form involves several key steps:

- Gather Employee Information: Collect details for all employees, including their names, Social Security numbers, and total wages paid during the quarter.

- Calculate Taxes Withheld: Determine the total amount of state and federal taxes withheld from employee wages.

- Fill Out the Form: Accurately enter the gathered information into the DOL 4n form, ensuring all fields are completed correctly.

- Review for Accuracy: Double-check all entries for accuracy to avoid potential penalties or issues with submission.

- Submit the Form: File the completed form with the Georgia Department of Labor by the specified deadline.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for submitting the DOL 4n form. The form is due on the last day of the month following the end of each quarter. This means:

- For the first quarter (January to March), the deadline is April 30.

- For the second quarter (April to June), the deadline is July 31.

- For the third quarter (July to September), the deadline is October 31.

- For the fourth quarter (October to December), the deadline is January 31 of the following year.

Legal Use of the Employer's Quarterly Tax and Wage Report

The DOL 4n form is legally required for all employers in Georgia. Submitting this report accurately and on time is essential for compliance with state labor laws. Failure to submit the report or inaccuracies can lead to penalties, including fines and potential audits by the Georgia Department of Labor.

Form Submission Methods

Employers have multiple options for submitting the DOL 4n form:

- Online Submission: The preferred method is through the Georgia Department of Labor's online portal, which allows for quick and efficient filing.

- Mail Submission: Employers can also print the completed form and mail it to the appropriate address provided by the Georgia Department of Labor.

- In-Person Submission: For those who prefer face-to-face interactions, forms can be submitted in person at local Georgia Department of Labor offices.

Key Elements of the Employer's Quarterly Tax and Wage Report

When completing the DOL 4n form, several key elements must be included:

- Employer Information: Name, address, and identification number of the employer.

- Employee Details: Comprehensive list of employees, including their total wages and taxes withheld.

- Quarterly Totals: A summary of total wages paid and total taxes withheld for the reporting period.

Quick guide on how to complete employer39s quarterly btaxb and bwage reportb part i bb

Prepare EMPLOYER39S QUARTERLY BTAXb AND BWAGE REPORTb PART I Bb seamlessly on any device

Online document management has gained prominence among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage EMPLOYER39S QUARTERLY BTAXb AND BWAGE REPORTb PART I Bb on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign EMPLOYER39S QUARTERLY BTAXb AND BWAGE REPORTb PART I Bb with ease

- Find EMPLOYER39S QUARTERLY BTAXb AND BWAGE REPORTb PART I Bb and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Revise and eSign EMPLOYER39S QUARTERLY BTAXb AND BWAGE REPORTb PART I Bb to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct employer39s quarterly btaxb and bwage reportb part i bb

Create this form in 5 minutes!

How to create an eSignature for the employer39s quarterly btaxb and bwage reportb part i bb

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the Georgia Department of Labor?

airSlate SignNow is a versatile eSignature solution that allows businesses to send and sign documents electronically. It can be particularly useful for organizations that need to submit forms or applications to the Georgia Department of Labor efficiently. With our user-friendly platform, you can streamline document processes and remain compliant with state requirements.

-

How can airSlate SignNow help businesses comply with Georgia Department of Labor regulations?

By using airSlate SignNow, businesses can ensure they are adhering to the Georgia Department of Labor's documentation requirements. Our platform provides templates and workflows tailored for HR needs, helping organizations maintain compliance and avoid potential fines. This proactive approach highlights your commitment to regulatory adherence.

-

What are the pricing options for airSlate SignNow for Georgia businesses?

AirSlate SignNow offers competitive pricing plans tailored to various business needs, particularly for those operating in Georgia. Our plans are designed to be cost-effective while ensuring compliance with the Georgia Department of Labor regulations. You can choose from individual or team plans that best fit your organizational size and usage.

-

What features does airSlate SignNow offer that are beneficial for Georgia Department of Labor processes?

AirSlate SignNow offers a range of features that streamline document management for the Georgia Department of Labor and similar agencies. Key features include templates for various forms, eSigning, and document tracking. These features enhance efficiency and reduce the risk of errors during submissions.

-

Can airSlate SignNow integrate with other tools used by businesses in Georgia?

Yes, airSlate SignNow seamlessly integrates with various popular business applications, facilitating easier document management for Georgia-based organizations. This means your company can work with its existing software and still meet the requirements of the Georgia Department of Labor. Integrations help maintain workflow continuity and improve productivity.

-

How secure is the airSlate SignNow platform for handling sensitive documents for the Georgia Department of Labor?

At airSlate SignNow, security is paramount, especially when handling sensitive documents related to the Georgia Department of Labor. Our platform employs industry-standard encryption and complies with legal regulations to ensure that all your data is protected. You can confidently process and store important documents, knowing they are secure.

-

What benefits does airSlate SignNow provide for small businesses in Georgia?

Small businesses in Georgia can greatly benefit from using airSlate SignNow due to its affordability and ease of use. Our solution simplifies the eSigning process, helping small businesses efficiently manage their documents while ensuring compliance with the Georgia Department of Labor. This not only saves time but also reduces costs associated with traditional printing and shipping.

Get more for EMPLOYER39S QUARTERLY BTAXb AND BWAGE REPORTb PART I Bb

Find out other EMPLOYER39S QUARTERLY BTAXb AND BWAGE REPORTb PART I Bb

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast