Orangeburg County Legal Residence Application Form

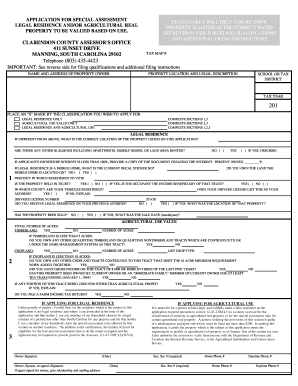

What is the Orangeburg County Legal Residence Application Form

The Orangeburg County Legal Residence Application Form is a crucial document used by residents of Orangeburg County, South Carolina, to establish their legal residence for various administrative purposes. This form is often required for voting registration, tax assessments, and eligibility for local services. By completing this form, individuals declare their primary residence within the county, which can affect their legal status and access to community resources.

How to use the Orangeburg County Legal Residence Application Form

Using the Orangeburg County Legal Residence Application Form involves several straightforward steps. First, obtain the form from an authorized source, such as the county's official website or local government office. Next, carefully fill out the required fields, ensuring that all information is accurate and complete. Once completed, the form can be submitted electronically or in person, depending on the guidelines provided by the county. It is important to keep a copy of the submitted form for your records.

Steps to complete the Orangeburg County Legal Residence Application Form

Completing the Orangeburg County Legal Residence Application Form requires attention to detail. Follow these steps:

- Gather necessary documents that verify your identity and residence, such as a driver's license or utility bill.

- Fill out the form with your personal information, including your name, address, and date of birth.

- Review the form for accuracy, ensuring all required fields are completed.

- Sign and date the form, acknowledging the truthfulness of the information provided.

- Submit the form according to the county's submission guidelines.

Legal use of the Orangeburg County Legal Residence Application Form

The Orangeburg County Legal Residence Application Form is legally binding once it has been completed and submitted according to the county's regulations. This form serves as a declaration of residency, which can have implications for voting rights, tax obligations, and eligibility for local programs. It is essential to provide truthful information, as any discrepancies could lead to legal consequences or denial of services.

Eligibility Criteria

To complete the Orangeburg County Legal Residence Application Form, applicants must meet specific eligibility criteria. Generally, individuals must be residents of Orangeburg County and provide proof of their primary residence. This may include documentation such as a lease agreement, mortgage statement, or utility bills. Additionally, applicants should be of legal age or have a parent or guardian submit the form on their behalf if they are minors.

Form Submission Methods

The Orangeburg County Legal Residence Application Form can be submitted through various methods to accommodate residents' preferences. Options typically include:

- Online submission through the county's official website.

- Mailing the completed form to the designated county office.

- In-person submission at local government offices.

Each method has its own guidelines, so it is advisable to check the specific instructions provided by the county.

Quick guide on how to complete orangeburg county legal residence application form

Complete [SKS] seamlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without interruptions. Handle [SKS] on any gadget using airSlate SignNow apps for Android or iOS and enhance any document-centric task today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or hide sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require new copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Orangeburg County Legal Residence Application Form

Create this form in 5 minutes!

How to create an eSignature for the orangeburg county legal residence application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Orangeburg County Legal Residence Application Form?

The Orangeburg County Legal Residence Application Form is a document used by residents to establish their legal residency status in Orangeburg County. This form is essential for various administrative processes, including voting and accessing county services.

-

How can I complete the Orangeburg County Legal Residence Application Form using airSlate SignNow?

You can easily complete the Orangeburg County Legal Residence Application Form by logging into airSlate SignNow, selecting the document, and filling out the required fields. Our platform allows you to eSign and submit the form online, simplifying the process signNowly.

-

Is the Orangeburg County Legal Residence Application Form available for free on airSlate SignNow?

While airSlate SignNow offers various pricing plans, accessing the Orangeburg County Legal Residence Application Form may come with a nominal fee based on your subscription. However, the service provides excellent value with its user-friendly features and secure eSigning capabilities.

-

What features does airSlate SignNow offer for the Orangeburg County Legal Residence Application Form?

AirSlate SignNow provides features such as customizable templates, real-time collaboration, and mobile access to complete the Orangeburg County Legal Residence Application Form seamlessly. Users can also enjoy audit trails for tracking changes and signatures.

-

How does airSlate SignNow ensure the security of my Orangeburg County Legal Residence Application Form?

At airSlate SignNow, security is a top priority. We utilize advanced encryption protocols and secure cloud storage to protect your Orangeburg County Legal Residence Application Form, ensuring that your personal information remains confidential and safe.

-

Can I integrate airSlate SignNow with other applications when completing the Orangeburg County Legal Residence Application Form?

Yes, airSlate SignNow offers integration with popular applications such as Google Drive, Dropbox, and Microsoft Office. This allows you to streamline your workflow and access your Orangeburg County Legal Residence Application Form from your preferred platforms.

-

What are the benefits of using airSlate SignNow for my Orangeburg County Legal Residence Application Form?

Using airSlate SignNow for your Orangeburg County Legal Residence Application Form offers numerous benefits, including time savings, convenience, and enhanced accuracy. You can complete and submit your application from anywhere, reducing the hassle of paperwork.

Get more for Orangeburg County Legal Residence Application Form

Find out other Orangeburg County Legal Residence Application Form

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online