Td1ab Form 2023

What is the Td1ab Form

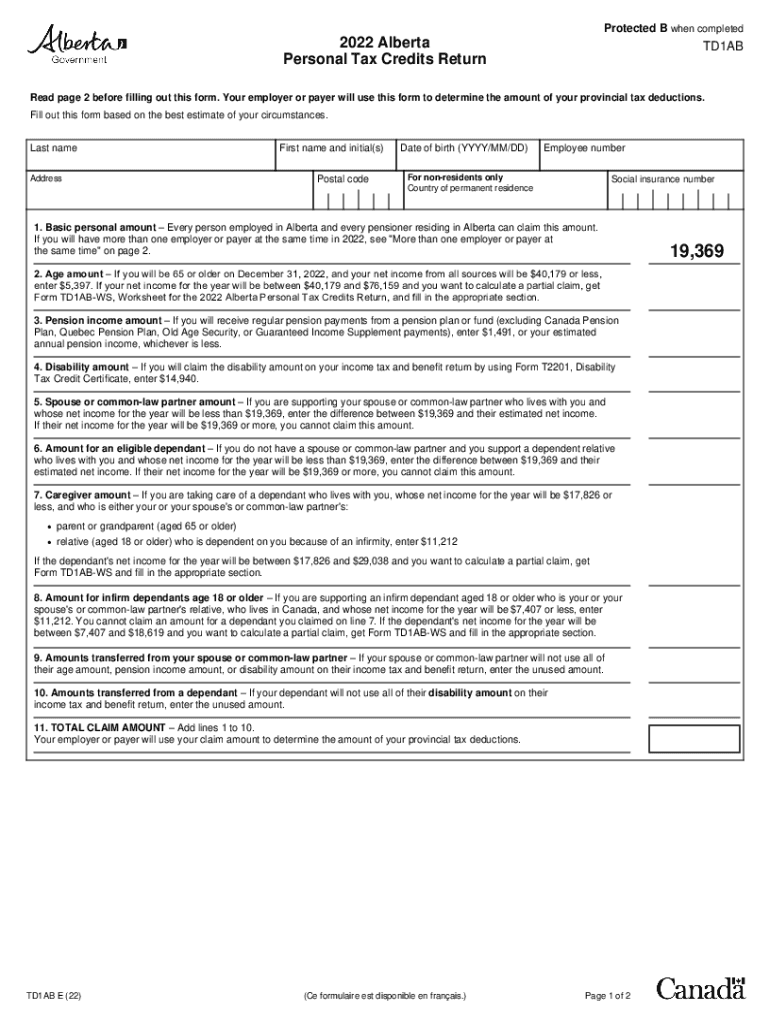

The Td1ab form is a crucial document used in Canada for personal tax purposes. It is specifically designed to help individuals determine their tax credits and deductions for the year. By filling out this form, taxpayers can ensure that they are accurately reporting their income and claiming the appropriate credits, which can significantly affect their overall tax liability. Understanding the Td1ab form is essential for anyone looking to navigate the Canadian tax system effectively.

How to use the Td1ab Form

Using the Td1ab form involves a straightforward process. First, individuals need to gather all relevant financial information, including income sources and potential deductions. Next, taxpayers should carefully fill out the form, ensuring that all sections are completed accurately. This includes providing personal information, income details, and any applicable credits. Once completed, the form can be submitted to the appropriate tax authority, either electronically or by mail, depending on the individual's preference and the guidelines set forth by the Canada Revenue Agency (CRA).

Steps to complete the Td1ab Form

Completing the Td1ab form requires several key steps:

- Gather necessary documents, such as income statements and previous tax returns.

- Fill out personal identification information, including name, address, and social insurance number.

- Report all sources of income, including employment, investments, and any other earnings.

- Claim applicable tax credits by providing the required details and supporting documentation.

- Review the completed form for accuracy before submission.

Legal use of the Td1ab Form

The legal use of the Td1ab form is governed by Canadian tax laws, which stipulate that individuals must provide accurate and truthful information when filing their taxes. Failing to do so can result in penalties or audits by the CRA. It is essential for taxpayers to understand that the information provided on the Td1ab form can be subject to verification, and any discrepancies may lead to legal consequences. Therefore, using the form correctly and ensuring compliance with all legal requirements is paramount.

Filing Deadlines / Important Dates

Filing deadlines for the Td1ab form are critical for taxpayers to keep in mind. Generally, individuals must submit their personal tax returns by April 30 of each year to avoid penalties. If April 30 falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable for taxpayers to mark their calendars and prepare their documents well in advance to ensure timely submission and compliance with tax regulations.

Required Documents

To complete the Td1ab form effectively, several documents are required. These may include:

- Income statements from employers or other income sources.

- Documentation for any tax credits being claimed, such as receipts or proof of eligibility.

- Previous tax returns, if applicable, to provide context and ensure consistency.

Having these documents ready will facilitate a smoother and more accurate filing process.

Quick guide on how to complete td1ab form

Complete Td1ab Form seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to craft, modify, and eSign your documents swiftly without unnecessary holdups. Manage Td1ab Form on any platform using the airSlate SignNow Android or iOS applications and simplify your document-related tasks now.

How to modify and eSign Td1ab Form with ease

- Find Td1ab Form and click on Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your alterations.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Td1ab Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct td1ab form

Create this form in 5 minutes!

How to create an eSignature for the td1ab form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to canada personal tax return fill using airSlate SignNow?

To canada personal tax return fill using airSlate SignNow, simply upload your tax documents onto our platform. You can then prepare and eSign your personal tax return with ease, ensuring that all necessary fields are completed correctly. Our intuitive interface guides you through the steps, making the process efficient and straightforward.

-

How much does airSlate SignNow cost for canada personal tax return fill?

airSlate SignNow offers competitive pricing for its eSigning solutions, including the canada personal tax return fill feature. You can select from different subscription plans based on your needs, whether you require a single user solution or a comprehensive package for multiple users. Pricing details can be found on our website.

-

What features does airSlate SignNow offer for canada personal tax return fill?

Our platform for canada personal tax return fill includes features such as document uploads, customizable templates, and secure eSign capabilities. You can also track document status, set reminders, and store completed tax returns securely in your account. These features are designed to streamline your tax filing process.

-

Can I integrate airSlate SignNow with other software for my canada personal tax return fill?

Yes, airSlate SignNow offers integrations with various accounting and tax software, which can enhance your canada personal tax return fill experience. This allows for seamless data transfer and ensures that all your information is accurately reflected, reducing the risk of errors. Check our integrations page for specific applications.

-

Is airSlate SignNow secure for canada personal tax return fill?

Absolutely! airSlate SignNow employs industry-standard encryption and security measures to ensure that your data remains protected while you canada personal tax return fill. Our platform is compliant with GDPR and other regulations, giving you peace of mind when handling sensitive information.

-

Can I save templates for canada personal tax return fill in airSlate SignNow?

Yes, you can easily create and save templates for your canada personal tax return fill in airSlate SignNow. This feature allows you to reuse common forms and fields across different tax returns, saving you time and ensuring consistency in your submissions. Customize your templates to fit your specific needs.

-

Are there any limits on the number of documents I can canada personal tax return fill?

The limits on the number of documents you can submit depend on your chosen pricing plan with airSlate SignNow. Most plans provide ample room for multiple submissions, including canada personal tax return fill. For heavy users, we also offer custom solutions to accommodate your needs.

Get more for Td1ab Form

- Medical check up form 13268081

- California net tangible benefit disclosure form

- Union bank of india form 60 pdf

- Personnel action no classificationonthejob traini form

- Symptom directed physical exam form

- Va form 26 6382 766654099

- Parent handbook preschool amp daycare serving round form

- Chain of custody tracking form ca gov

Find out other Td1ab Form

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe