Pennsylvania Pa 1 Form

What is the Pennsylvania PA-1 Form?

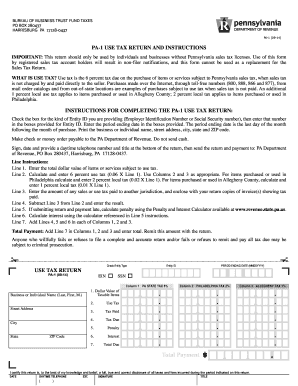

The Pennsylvania PA-1 form, also known as the Pennsylvania PA-1 Revenue, is a crucial document used for various tax-related purposes within the state of Pennsylvania. This form is primarily utilized by individuals and businesses to report income and calculate state tax obligations. Understanding the PA-1 form is essential for ensuring compliance with Pennsylvania tax laws and regulations.

Steps to Complete the Pennsylvania PA-1 Form

Completing the Pennsylvania PA-1 form involves several key steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, accurately fill out each section of the form, ensuring that all information is complete and correct. Pay attention to specific instructions regarding income reporting, deductions, and credits. After completing the form, review it thoroughly for any errors before submission.

How to Obtain the Pennsylvania PA-1 Form

The Pennsylvania PA-1 form can be easily obtained through the Pennsylvania Department of Revenue's official website. Users can download a printable version of the form or request a physical copy to be mailed. Additionally, various tax preparation software programs may offer the PA-1 form as part of their services, allowing for electronic completion and submission.

Legal Use of the Pennsylvania PA-1 Form

The legal use of the Pennsylvania PA-1 form is governed by state tax laws. When completed and submitted correctly, the form serves as a legally binding document that outlines an individual's or business's tax obligations. It is essential to ensure that all information provided is accurate, as discrepancies may lead to penalties or legal issues with the Pennsylvania Department of Revenue.

Form Submission Methods

The Pennsylvania PA-1 form can be submitted through various methods. Taxpayers have the option to file the form online through the Pennsylvania Department of Revenue’s e-filing system, which offers a convenient and efficient way to submit tax information. Alternatively, the form can be mailed to the appropriate address provided in the instructions or submitted in person at designated state offices. Each method has its own processing times and requirements, so it is important to choose the one that best fits individual circumstances.

Required Documents for the Pennsylvania PA-1 Form

When completing the Pennsylvania PA-1 form, certain documents are required to support the information provided. These may include W-2 forms, 1099 forms, and any other relevant income statements. Additionally, documentation for deductions and credits, such as receipts or tax forms, should be included to substantiate claims made on the PA-1 form. Having all necessary documents ready will streamline the filing process and help ensure compliance with state tax regulations.

Quick guide on how to complete pennsylvania pa 1

Complete Pennsylvania Pa 1 effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an excellent sustainable alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly and without complications. Handle Pennsylvania Pa 1 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest method to edit and eSign Pennsylvania Pa 1 without any hassle

- Locate Pennsylvania Pa 1 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose your preferred method for delivering your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Pennsylvania Pa 1 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pennsylvania pa 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PA1 form and why is it important for businesses?

The PA1 form is a crucial document used for various administrative purposes, including formal requests and submissions. Businesses utilize the PA1 form to ensure compliance with relevant regulations, making it an essential aspect of operational efficiency.

-

How can airSlate SignNow assist with completing a PA1 form?

airSlate SignNow simplifies the process of completing a PA1 form by providing an intuitive platform for digital signatures and document management. Users can easily fill out the form online, saving time and reducing errors that commonly occur with paper documents.

-

Is there a pricing plan for using airSlate SignNow for PA1 form submissions?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes, ensuring you get the best value when submitting a PA1 form. Each plan includes features tailored to enhance document management and eSigning functionality.

-

Can I integrate airSlate SignNow with other applications for handling PA1 forms?

Absolutely! airSlate SignNow seamlessly integrates with multiple applications, facilitating smoother workflows when handling the PA1 form. This allows businesses to streamline their processes by automating tasks across various platforms.

-

What features does airSlate SignNow offer for managing PA1 forms?

airSlate SignNow provides a range of features for managing PA1 forms, including customizable templates, secure eSigning, and comprehensive document tracking. These features help ensure that your documents are well-organized and accessible when needed.

-

How secure is the transmission of a PA1 form via airSlate SignNow?

Security is a top priority for airSlate SignNow. When submitting a PA1 form, your documents are encrypted and securely transmitted, protecting sensitive information from unauthorized access and ensuring compliance with data protection regulations.

-

Do I need to download software to work with my PA1 form on airSlate SignNow?

No, airSlate SignNow is a cloud-based solution, meaning you do not need to download any software to work with your PA1 form. You can access the platform from any internet-enabled device, making it convenient and user-friendly.

Get more for Pennsylvania Pa 1

Find out other Pennsylvania Pa 1

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple