Form 538 S Claim for Credit Refund of Sales Tax 2020

What is the Form 538 S Claim For Credit Refund Of Sales Tax

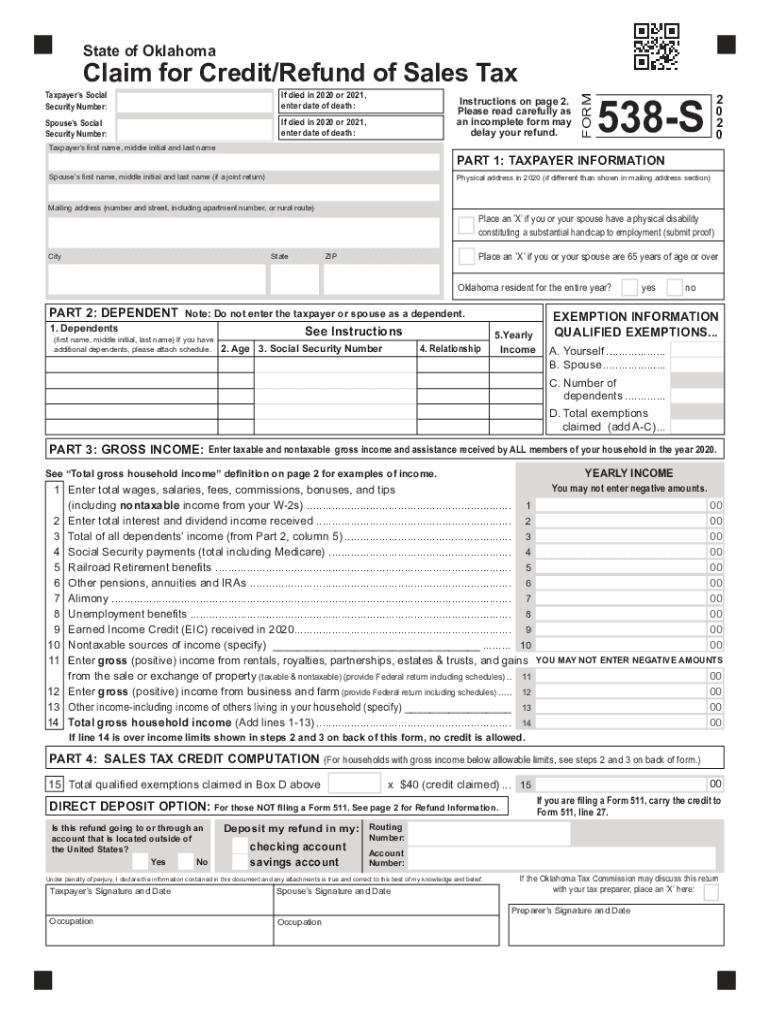

The Form 538 S is a tax form used in Oklahoma for claiming a credit refund of sales tax. This form is specifically designed for S corporations that have overpaid sales tax and are seeking a refund. It allows eligible businesses to recover funds that they may have erroneously paid, ensuring compliance with state tax regulations while also providing financial relief. Understanding this form is crucial for S corporations to navigate their tax obligations effectively.

Steps to complete the Form 538 S Claim For Credit Refund Of Sales Tax

Completing the Form 538 S requires careful attention to detail to ensure accuracy and compliance. The following steps outline the process:

- Gather necessary financial documents, including sales tax records and previous tax returns.

- Fill in the business information section, including the name, address, and federal tax identification number of the S corporation.

- Detail the sales tax amounts that were overpaid, ensuring that all calculations are accurate.

- Complete the refund request section, specifying the amount being claimed.

- Sign and date the form, certifying that the information provided is true and accurate.

Legal use of the Form 538 S Claim For Credit Refund Of Sales Tax

The Form 538 S is legally binding when completed correctly and submitted according to Oklahoma state tax laws. To ensure its legal standing, businesses must adhere to specific guidelines regarding documentation and submission. This includes maintaining accurate records of sales tax payments and ensuring that the claim is made within the designated timeframe set by the state. Proper use of this form helps protect the business from potential legal issues related to tax compliance.

Eligibility Criteria

To qualify for a refund using the Form 538 S, certain eligibility criteria must be met. These include:

- The business must be classified as an S corporation under IRS regulations.

- The corporation must have overpaid sales tax during the specified period.

- The claim must be filed within the time limits established by Oklahoma tax law.

Meeting these criteria is essential for a successful refund claim.

Form Submission Methods (Online / Mail / In-Person)

The Form 538 S can be submitted through various methods, providing flexibility for businesses. The submission options include:

- Online submission via the Oklahoma state tax website, which may offer a more streamlined process.

- Mailing the completed form to the appropriate tax office, ensuring that it is sent via a traceable method.

- In-person submission at designated tax offices, which allows for immediate confirmation of receipt.

Choosing the right submission method can impact the processing time of the refund.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for S corporations utilizing the Form 538 S. Typically, the deadline for submitting this form aligns with the annual tax return deadline for S corporations. Businesses should also be aware of any specific extensions or changes in deadlines that may occur due to state regulations or special circumstances. Keeping track of these dates ensures that businesses do not miss their opportunity for a refund.

Quick guide on how to complete 2020 form 538 s claim for credit refund of sales tax

Effortlessly prepare Form 538 S Claim For Credit Refund Of Sales Tax on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Form 538 S Claim For Credit Refund Of Sales Tax on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign Form 538 S Claim For Credit Refund Of Sales Tax without hassle

- Find Form 538 S Claim For Credit Refund Of Sales Tax and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form—via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 538 S Claim For Credit Refund Of Sales Tax and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 538 s claim for credit refund of sales tax

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 538 s claim for credit refund of sales tax

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the process to file a form to efile Oklahoma S Corp return?

To file a form to efile Oklahoma S Corp return, you need to gather all relevant financial documents and information about your corporation. Using our platform, you can easily fill out the necessary forms and submit them electronically, ensuring a smooth filing process. Don’t forget to check the state requirements regarding deadlines and additional filings.

-

How much does it cost to use airSlate SignNow for efiling my Oklahoma S Corp return?

The pricing for using airSlate SignNow to efile your Oklahoma S Corp return is designed to be cost-effective. Depending on the features you choose, our plans vary, but we offer affordable rates that can easily fit into any budget. Visit our pricing page for detailed information and to select the best option for your needs.

-

What features does airSlate SignNow offer for efiling Oklahoma S Corp returns?

airSlate SignNow offers several key features for efiling Oklahoma S Corp returns, including user-friendly templates, electronic signature capabilities, and secure document storage. Our platform simplifies the filing process, allowing for quick edits and modifications directly on the forms. This efficiency helps streamline your workflow and saves you valuable time.

-

Is it secure to use airSlate SignNow for efiling my form to efile Oklahoma S Corp return?

Yes, using airSlate SignNow to efile your form to efile Oklahoma S Corp return is secure. We prioritize data protection and employ advanced encryption techniques to keep your information safe. With our compliance measures in place, you can rest easy knowing that your sensitive data is well protected throughout the efiling process.

-

Can I integrate airSlate SignNow with other accounting tools for efiling my Oklahoma S Corp return?

Yes, airSlate SignNow easily integrates with various accounting tools to facilitate your efiling process for Oklahoma S Corp returns. This integration allows you to import necessary data and maintain consistency across your documentation. Check our integrations page for specific tools that work seamlessly with airSlate SignNow.

-

What should I do if I encounter issues while efiling my Oklahoma S Corp return?

If you encounter issues while efiling your form to efile Oklahoma S Corp return on airSlate SignNow, our dedicated support team is here to help. You can access our help center for troubleshooting tips or signNow out to our customer support for personalized assistance. We are committed to ensuring your efiling experience is smooth and successful.

-

Are there any benefits to using airSlate SignNow for efiling my Oklahoma S Corp return over traditional methods?

Using airSlate SignNow to efile your Oklahoma S Corp return has numerous benefits over traditional methods, including faster processing times and reduced paper usage. The electronic filing process is more efficient, allowing you to track your submission and receive immediate confirmations. Additionally, efiling minimizes the chances of errors compared to manual submissions.

Get more for Form 538 S Claim For Credit Refund Of Sales Tax

- Scientific notation and standard notation worksheet answer key form

- Icare prior authorization form

- Sutter eyberg student behavior inventory form

- Ccc 576 form

- Cluster diagram template word form

- Nastf vehicle security professional trp form

- Consent form 301170080

- Sober living contract template 432165378 form

Find out other Form 538 S Claim For Credit Refund Of Sales Tax

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now