Form 538 S Claim for Credit Refund of Sales Tax 2021

What is the Form 538 S Claim For Credit Refund Of Sales Tax

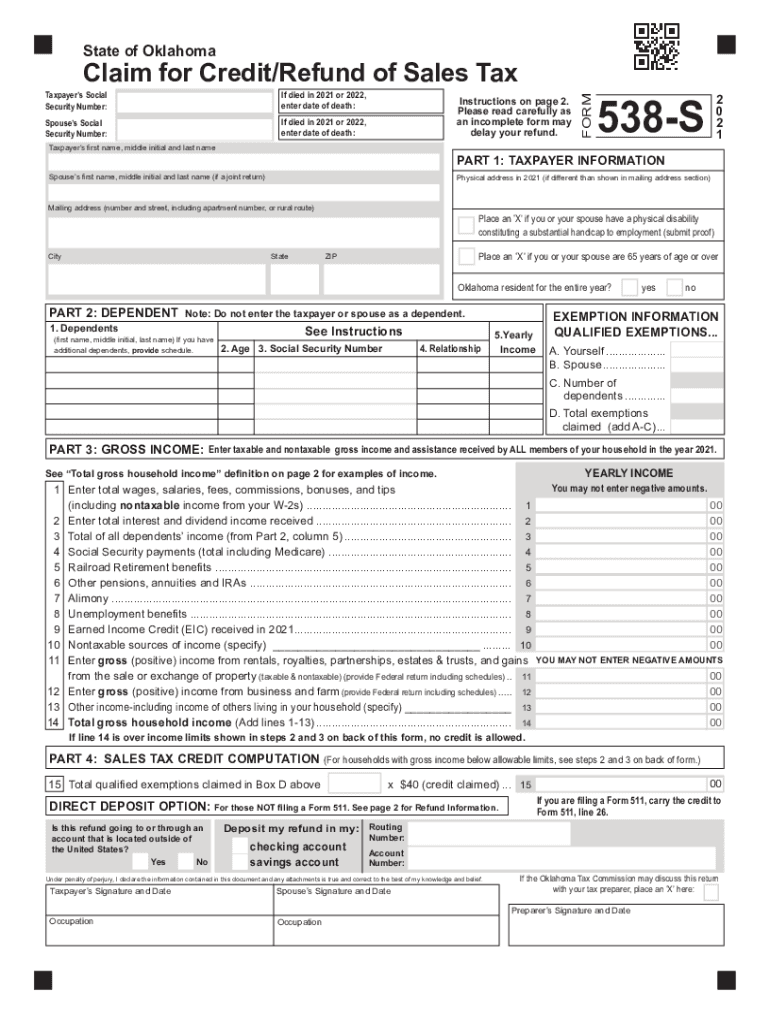

The Form 538 S, also known as the Claim for Credit Refund of Sales Tax, is a document used by taxpayers in Oklahoma to request a refund for overpaid sales tax. This form is specifically designed for individuals or businesses that have paid sales tax on purchases that are eligible for a refund. Understanding the purpose of this form is crucial for ensuring that you can reclaim any excess sales tax you may have inadvertently paid.

How to use the Form 538 S Claim For Credit Refund Of Sales Tax

Using the Form 538 S involves several steps to ensure that your claim is processed correctly. First, gather all necessary documentation that supports your claim, such as receipts or invoices showing the sales tax paid. Next, accurately fill out the form, providing all required information, including your personal details and the amount of sales tax you are claiming. Finally, submit the completed form to the appropriate state agency for processing.

Steps to complete the Form 538 S Claim For Credit Refund Of Sales Tax

Completing the Form 538 S requires attention to detail. Follow these steps:

- Download the form from the Oklahoma Tax Commission website or obtain a physical copy.

- Fill in your name, address, and taxpayer identification number.

- Detail the sales tax amounts you are claiming for refund, along with the corresponding purchase information.

- Attach any supporting documents, such as receipts or invoices.

- Review the form for accuracy before submission.

Legal use of the Form 538 S Claim For Credit Refund Of Sales Tax

The Form 538 S is legally recognized as a valid document for claiming sales tax refunds in Oklahoma, provided it is completed correctly and submitted within the designated time frame. Compliance with state regulations is essential to ensure that your claim is processed without issues. The form must be signed and dated by the claimant, affirming that all information is true and accurate.

Eligibility Criteria

To be eligible to file the Form 538 S, taxpayers must have paid sales tax on purchases that qualify for a refund. This typically includes situations where the sales tax was charged in error or on items that are exempt from sales tax under Oklahoma law. Additionally, the claim must be submitted within the specified period set by the Oklahoma Tax Commission to be considered valid.

Required Documents

When submitting the Form 538 S, it is important to include supporting documentation. Required documents may include:

- Receipts or invoices that detail the sales tax paid.

- Any relevant correspondence with vendors regarding the sales tax charged.

- Proof of exemption, if applicable.

Form Submission Methods (Online / Mail / In-Person)

The Form 538 S can be submitted through various methods. Taxpayers may choose to file online through the Oklahoma Tax Commission's website, which offers a streamlined process. Alternatively, the form can be mailed to the designated address provided on the form, or it can be submitted in person at local tax offices. Each method has its own processing times, so it is advisable to choose the one that best fits your needs.

Quick guide on how to complete 2021 form 538 s claim for credit refund of sales tax

Effortlessly Prepare Form 538 S Claim For Credit Refund Of Sales Tax on Any Device

Digital document management has become increasingly favored by organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage Form 538 S Claim For Credit Refund Of Sales Tax across any platform with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Modify and eSign Form 538 S Claim For Credit Refund Of Sales Tax Effortlessly

- Locate Form 538 S Claim For Credit Refund Of Sales Tax and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive details using tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 538 S Claim For Credit Refund Of Sales Tax and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 538 s claim for credit refund of sales tax

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 538 s claim for credit refund of sales tax

The best way to create an e-signature for your PDF file in the online mode

The best way to create an e-signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

How to make an e-signature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

How to make an e-signature for a PDF file on Android

People also ask

-

What is the role of ok s tax in eSigning documents?

The term 'ok s tax' refers to the specific tax implications or requirements associated with electronically signing documents. With airSlate SignNow, businesses can easily understand how eSigning impacts their tax compliance, ensuring that all signed documents meet legal and tax standards.

-

How does airSlate SignNow help with ok s tax documentation?

airSlate SignNow streamlines the eSigning process, making it simple to generate documents that require 'ok s tax' considerations. This helps users stay organized and compliant by providing templates and tracking tools tailored for tax-related documents.

-

Is airSlate SignNow affordable for small businesses dealing with ok s tax?

Yes, airSlate SignNow offers pricing plans that cater to small businesses, making it an affordable solution for those who need to handle 'ok s tax' documents. With various tiers and features, users can choose the plan that fits their budget and requirements.

-

What features does airSlate SignNow offer for managing ok s tax forms?

airSlate SignNow provides features like customizable templates, secure storage, and compliance tracking, all essential for managing 'ok s tax' forms. These tools streamline the eSigning process and ensure that all documents are easily accessible and compliant with tax regulations.

-

Can airSlate SignNow integrate with other software for ok s tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing the workflow for 'ok s tax' requirements. This means you can automate processes and ensure all signed documents are transferred automatically to your accounting system.

-

What are the benefits of using airSlate SignNow for ok s tax compliance?

Using airSlate SignNow helps businesses maintain compliance with 'ok s tax' regulations through secure and legally binding eSignatures. Additionally, it offers audit trails and document history, giving you peace of mind that your tax documents are properly managed.

-

How secure is airSlate SignNow when handling ok s tax documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive 'ok s tax' documents. The platform uses advanced encryption protocols and complies with industry standards to ensure that all signed documents are safe and secure.

Get more for Form 538 S Claim For Credit Refund Of Sales Tax

- Florida southern district bankruptcy guide and forms package for chapters 7 or 13 florida

- Bill of sale with warranty by individual seller florida form

- Bill of sale with warranty for corporate seller florida form

- Florida bill sale form

- Bill of sale without warranty by corporate seller florida form

- Florida marriage 497303245 form

- Correction statement and agreement florida form

- Florida closing 497303248 form

Find out other Form 538 S Claim For Credit Refund Of Sales Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors