Form 60 Nd

What is the Form 60 Nd

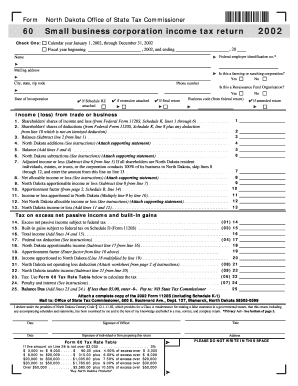

The Form 60 Nd is a specific document used primarily for tax purposes in the United States. It serves as a declaration for individuals who need to report certain financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with tax regulations and helps facilitate accurate reporting of income and deductions. Understanding the purpose of this form is crucial for taxpayers, as it can impact their overall tax liability.

How to use the Form 60 Nd

Using the Form 60 Nd involves several key steps to ensure proper completion and submission. First, gather all necessary financial documents and information required to fill out the form accurately. This may include income statements, previous tax returns, and any relevant deductions or credits. Next, carefully complete each section of the form, ensuring that all information is correct and up-to-date. Once completed, review the form for any errors before submitting it to the IRS by the specified deadline.

Steps to complete the Form 60 Nd

Completing the Form 60 Nd requires a systematic approach to ensure accuracy. Start by downloading the form from the IRS website or obtaining a physical copy. Follow these steps:

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your income sources, ensuring all amounts are accurate and supported by documentation.

- List any deductions or credits you are eligible for, making sure to reference the appropriate sections of the IRS guidelines.

- Double-check all entries for accuracy and completeness before signing the form.

- Submit the form either electronically or via mail, depending on your preference and the IRS guidelines.

Key elements of the Form 60 Nd

The Form 60 Nd includes several critical elements that must be accurately filled out. These elements typically consist of:

- Personal Information: Name, address, and Social Security number.

- Income Details: Comprehensive reporting of all income sources.

- Deductions and Credits: Information on any applicable tax deductions or credits.

- Signature: Required to validate the information provided on the form.

Legal use of the Form 60 Nd

The Form 60 Nd is legally binding and must be used in accordance with IRS regulations. Failing to complete the form accurately or submitting it late can lead to penalties or legal repercussions. It is essential for taxpayers to understand their obligations under the law and to use the form correctly to avoid any issues with the IRS. Consulting a tax professional can provide additional guidance on legal requirements associated with this form.

Filing Deadlines / Important Dates

Timely filing of the Form 60 Nd is crucial to avoid penalties. The IRS typically sets specific deadlines for submitting tax forms, which can vary based on the type of income and individual circumstances. Generally, the deadline for filing personal income tax returns is April fifteenth of each year. However, if additional time is needed, taxpayers may apply for an extension, but it is important to understand that this does not extend the time to pay any taxes owed. Always check the IRS website for the most current deadlines and updates.

Quick guide on how to complete form 60 nd

Effortlessly Create [SKS] on Any Device

Digital document management has become prevalent among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed papers, enabling you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to generate, modify, and electronically sign your documents efficiently without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign [SKS] With Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all entered information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign [SKS] to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 60 nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 60 Nd?

Form 60 Nd is a crucial document used in various transactions to declare the details of a person who does not have a Permanent Account Number (PAN) in India. With airSlate SignNow, you can easily prepare, send, and eSign Form 60 Nd, making the process simple and efficient.

-

How does airSlate SignNow facilitate the signing of Form 60 Nd?

airSlate SignNow provides a user-friendly platform that allows you to digitally sign Form 60 Nd in just a few clicks. This eliminates the need for traditional paper signing methods, ensuring faster processing times and enhanced security for your documents.

-

Is there a cost associated with using airSlate SignNow for Form 60 Nd?

Yes, airSlate SignNow offers various pricing plans to cater to your needs, allowing you to choose the best option for handling documents like Form 60 Nd. These plans are designed to be cost-effective, providing great value for businesses of all sizes.

-

What features are available in airSlate SignNow for managing Form 60 Nd?

airSlate SignNow offers several features for managing Form 60 Nd, including document templates, secure cloud storage, and advanced tracking capabilities. These features streamline the workflow and ensure that your documents are securely managed from start to finish.

-

Can I integrate airSlate SignNow with other tools for Form 60 Nd?

Absolutely! airSlate SignNow supports integration with various applications, allowing you to seamlessly connect your existing systems for handling Form 60 Nd. This integration enhances productivity by letting you manage your documents directly within your preferred tools.

-

What are the benefits of using airSlate SignNow for Form 60 Nd?

Using airSlate SignNow for Form 60 Nd offers numerous benefits, including reduced turnaround time, enhanced security, and improved counterparty trust. The platform ensures that all your document signing processes are efficient and compliant with industry standards.

-

Is it safe to use airSlate SignNow for eSigning Form 60 Nd?

Yes, airSlate SignNow employs industry-standard encryption and security protocols to ensure that the eSigning of Form 60 Nd is entirely safe. You can trust that your sensitive information will remain confidential and protected through our robust security measures.

Get more for Form 60 Nd

Find out other Form 60 Nd

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors