Real Estate Withholding Return for 2022

What is the Real Estate Withholding Return For

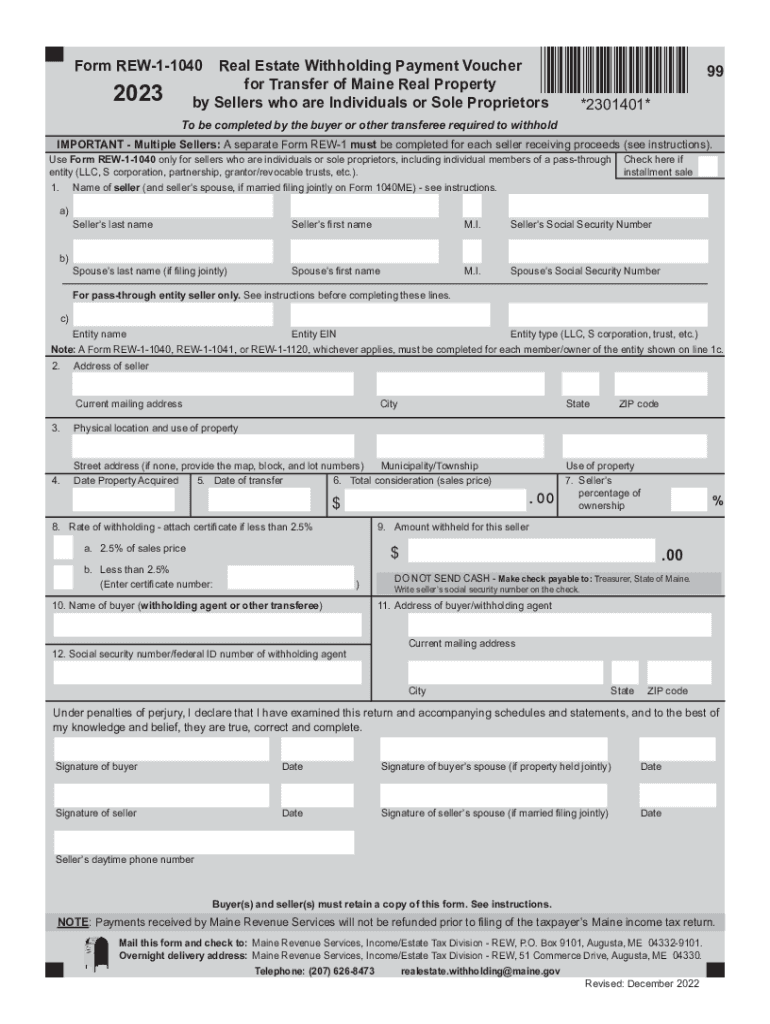

The Real Estate Withholding Return For is a tax form used in the United States to report the sale of real estate by a non-resident seller. This form ensures that any applicable taxes are withheld from the proceeds of the sale, which helps to prevent tax evasion. The withholding is typically a percentage of the sale price and is remitted to the IRS on behalf of the seller. This process is crucial for compliance with federal tax obligations, particularly for non-residents who may not have a tax presence in the U.S.

How to use the Real Estate Withholding Return For

To use the Real Estate Withholding Return For, the seller must complete the form accurately before the sale is finalized. This involves providing details such as the seller's information, property address, and sale price. The form must be submitted to the appropriate tax authority, often alongside the payment of the withholding amount. Ensuring that all information is correct is essential to avoid delays or penalties. After submission, the seller should retain a copy for their records, as it may be needed for future tax filings.

Steps to complete the Real Estate Withholding Return For

Completing the Real Estate Withholding Return For involves several key steps:

- Gather necessary information, including the seller's name, address, and taxpayer identification number.

- Provide details about the property being sold, including its address and sale price.

- Calculate the withholding amount based on the sale price and applicable percentage.

- Complete the form accurately, ensuring all fields are filled out correctly.

- Submit the form to the appropriate tax authority along with the payment for the withholding amount.

Filing Deadlines / Important Dates

Filing deadlines for the Real Estate Withholding Return For are critical to ensure compliance. Generally, the form must be filed at the time of the real estate transaction. Specific deadlines may vary by state, so it is important to check local regulations. Additionally, the payment of the withholding amount should coincide with the filing of the form to avoid penalties. Keeping track of these dates helps sellers meet their tax obligations without incurring additional fees.

Required Documents

When completing the Real Estate Withholding Return For, several documents may be required:

- Proof of identity, such as a driver's license or passport.

- Documentation of the property sale, including the purchase agreement.

- Any relevant tax identification numbers, such as a Social Security Number or Employer Identification Number.

- Records of any prior tax filings related to the property, if applicable.

Penalties for Non-Compliance

Failure to comply with the requirements of the Real Estate Withholding Return For can result in significant penalties. Non-resident sellers who do not submit the form or pay the required withholding amount may face fines and interest on unpaid taxes. Additionally, the IRS may pursue collection actions against the seller, which can complicate future transactions. Understanding these penalties emphasizes the importance of timely and accurate filing.

Quick guide on how to complete real estate withholding return for

Prepare Real Estate Withholding Return For effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed documents, as you can easily locate the right form and securely retain it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents rapidly without any holdups. Handle Real Estate Withholding Return For on any system with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and electronically sign Real Estate Withholding Return For without hassle

- Find Real Estate Withholding Return For and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from your preferred device. Alter and electronically sign Real Estate Withholding Return For and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct real estate withholding return for

Create this form in 5 minutes!

How to create an eSignature for the real estate withholding return for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Real Estate Withholding Return For?

A Real Estate Withholding Return For is a tax form used by sellers of real estate to report the sale and withhold a portion of the transaction amount to cover potential tax liabilities. This form ensures that the seller pays the necessary taxes on profits made from the sale. Understanding this process is crucial for real estate transactions.

-

Why do I need a Real Estate Withholding Return For when closing a sale?

You need a Real Estate Withholding Return For to comply with tax regulations set by the government. The withholding amount collected helps prevent sellers from avoiding tax payments on capital gains from the sale. Proper filing ensures a smooth closing process for real estate transactions.

-

How can airSlate SignNow help with my Real Estate Withholding Return For?

AirSlate SignNow simplifies the process of completing your Real Estate Withholding Return For by allowing you to eSign and send documents quickly and securely. Our platform provides templates and tools that ensure your forms are filled out correctly and submitted on time. This minimizes errors and speeds up the transaction process.

-

What features does airSlate SignNow offer for Real Estate Withholding Returns?

AirSlate SignNow offers features like customizable templates, secure eSigning, and integration with popular real estate software. These tools help you manage your Real Estate Withholding Return For efficiently. You can track the completion status of documents, making it easier to keep all parties informed.

-

Is airSlate SignNow a cost-effective solution for my Real Estate Withholding Return For?

Yes, airSlate SignNow provides a cost-effective solution for managing your Real Estate Withholding Return For. By minimizing the need for physical paper and in-person signings, our service reduces overhead costs. You'll save both time and money while ensuring compliance with tax requirements.

-

Can I integrate airSlate SignNow with other real estate tools for my withholding returns?

Absolutely! AirSlate SignNow seamlessly integrates with various real estate software solutions. This capability allows you to manage your Real Estate Withholding Return For within your current workflow without interruption, enhancing efficiency and productivity.

-

What are the benefits of using airSlate SignNow for my Real Estate Withholding Return For?

Using airSlate SignNow for your Real Estate Withholding Return For provides enhanced security, faster turnaround times, and a user-friendly experience. Our platform allows you to track documents and stay organized throughout the transaction process. This ensures that you meet tax obligations without unnecessary delays.

Get more for Real Estate Withholding Return For

- Application form do not call register

- Form 2c general form of joint application in the district

- Traditionalsep required minimum distribution age 70 and ally form

- Lpkp form

- Surrender withdrawal form for investment linked policy

- Nhs low income scheme form

- 99 year lease agreement template form

- 2 year lease agreement template form

Find out other Real Estate Withholding Return For

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free