Form CT 1096 ConnecticutForm CT 1096 2021Form CT 1096 ConnecticutForm CT 1096 Connecticut 2021

What is the Form CT 1096?

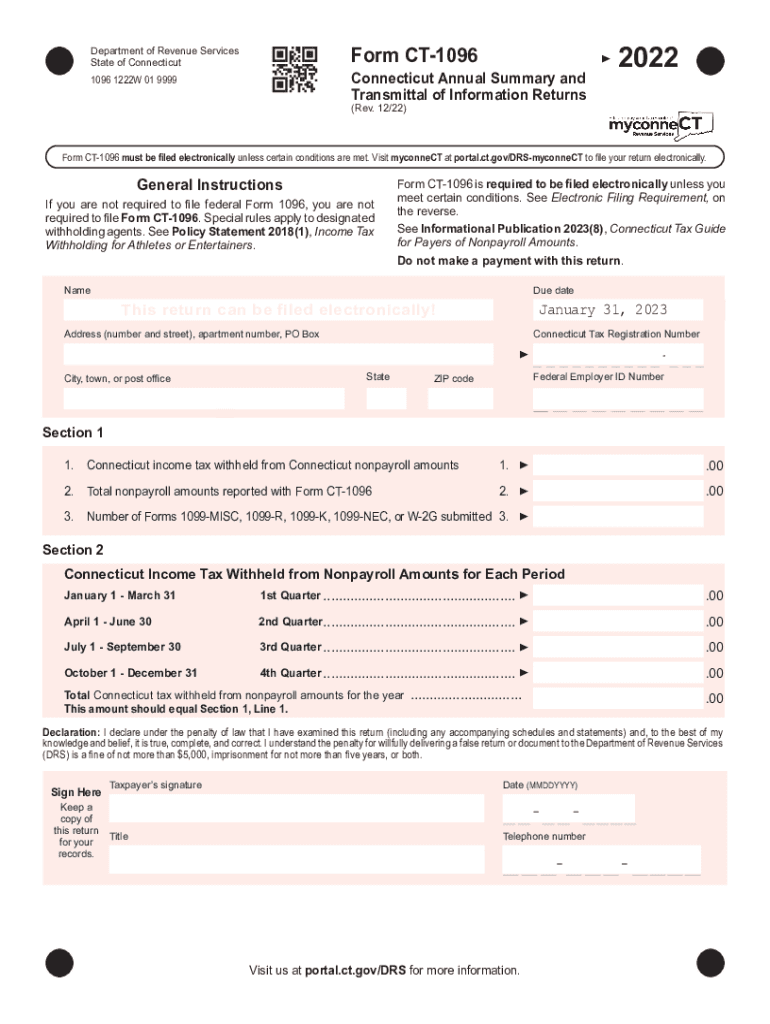

The Form CT 1096 is a state-specific information return used in Connecticut. It is primarily utilized by businesses to report certain types of payments made during the tax year. This form serves as a summary of various information returns, such as Forms 1099, which report income paid to independent contractors, freelancers, and other non-employees. Understanding the purpose of the CT 1096 is essential for compliance with state tax regulations.

How to Use the Form CT 1096

Using the Form CT 1096 involves gathering the necessary information regarding payments made throughout the year. Businesses must compile data from all applicable Forms 1099 and other relevant documents. Once the information is consolidated, it can be entered into the CT 1096 form accurately. This form must be submitted to the Connecticut Department of Revenue Services to ensure proper reporting and compliance with state tax laws.

Steps to Complete the Form CT 1096

Completing the Form CT 1096 requires several steps:

- Gather all relevant information returns, such as Forms 1099.

- Fill in the payer's information, including name, address, and federal employer identification number (FEIN).

- Report the total number of information returns submitted and the total amount paid to recipients.

- Review the form for accuracy before submission.

Once completed, the form can be submitted electronically or via mail, depending on the preferred method of filing.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Form CT 1096. Generally, the form must be submitted by the last day of February following the end of the tax year. For example, for the tax year 2022, the deadline would be February 28, 2023. Adhering to these deadlines helps avoid penalties and ensures compliance with Connecticut tax regulations.

Key Elements of the Form CT 1096

The Form CT 1096 includes several key elements that must be accurately reported. These elements include:

- Payer's name and address

- Payer's federal employer identification number (FEIN)

- Total number of information returns filed

- Total amount paid to recipients

Each of these elements plays a vital role in ensuring that the information reported is complete and compliant with state requirements.

Digital vs. Paper Version

The Form CT 1096 is available in both digital and paper formats. The digital version allows for easier data entry and submission, while the paper version can be filled out manually. Businesses may choose the format that best suits their operational needs. However, submitting the form electronically may expedite processing and reduce the risk of errors.

Quick guide on how to complete form ct 1096 connecticutform ct 1096 2021form ct 1096 connecticutform ct 1096 connecticut

Effortlessly Prepare Form CT 1096 ConnecticutForm CT 1096 2021Form CT 1096 ConnecticutForm CT 1096 Connecticut on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle Form CT 1096 ConnecticutForm CT 1096 2021Form CT 1096 ConnecticutForm CT 1096 Connecticut on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Easily Modify and Electronically Sign Form CT 1096 ConnecticutForm CT 1096 2021Form CT 1096 ConnecticutForm CT 1096 Connecticut

- Locate Form CT 1096 ConnecticutForm CT 1096 2021Form CT 1096 ConnecticutForm CT 1096 Connecticut and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize key sections of your documents or redact sensitive information using the tools provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form CT 1096 ConnecticutForm CT 1096 2021Form CT 1096 ConnecticutForm CT 1096 Connecticut and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1096 connecticutform ct 1096 2021form ct 1096 connecticutform ct 1096 connecticut

Create this form in 5 minutes!

How to create an eSignature for the form ct 1096 connecticutform ct 1096 2021form ct 1096 connecticutform ct 1096 connecticut

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form ct 1096 and how is it used?

Form CT 1096 is a summary form used by businesses in Connecticut to report certain types of payments, including those from independent contractors. This form is essential for ensuring compliance with state tax regulations and provides a summary of all Forms 1099 issued by a business. Properly completing form ct 1096 is crucial for accurate tax filings.

-

How can airSlate SignNow help with completing form ct 1096?

airSlate SignNow simplifies the process of completing form ct 1096 by providing a user-friendly platform where businesses can easily fill out and electronically sign documents. With features such as templates and collaboration tools, it streamlines the entire preparation and submission process, ensuring your forms are accurate and timely.

-

Is airSlate SignNow a cost-effective solution for managing form ct 1096?

Yes, airSlate SignNow offers a cost-effective solution for managing form ct 1096. With flexible pricing plans, businesses can access essential eSigning features without breaking the bank. This affordability makes it a great choice for businesses of all sizes looking to simplify their document management process.

-

What features does airSlate SignNow offer for form ct 1096?

airSlate SignNow provides robust features essential for managing form ct 1096, including document editing, eSignature options, and audit trails. Users can also utilize templates and integration capabilities to streamline their workflow and ensure compliance with state regulations efficiently. These features make handling tax-related forms convenient and efficient.

-

Can I integrate other applications with airSlate SignNow for processing form ct 1096?

Absolutely! airSlate SignNow offers a variety of integration options with popular applications such as Google Drive and Dropbox. This allows businesses to easily import and export documents related to form ct 1096, enhancing workflow efficiency and ensuring all necessary data is easily accessible.

-

How secure is airSlate SignNow when handling sensitive documents like form ct 1096?

airSlate SignNow prioritizes security, using advanced encryption and compliance measures to protect sensitive documents, including form ct 1096. Rest assured, your data is protected and secure during the signing and transmission processes, keeping your business compliant and safe from potential bsignNowes.

-

What benefits do I gain by using airSlate SignNow for form ct 1096?

By using airSlate SignNow for form ct 1096, businesses can experience increased efficiency, reduced paperwork, and enhanced compliance. The platform allows for quick electronic signatures, saving time, and facilitating faster processing. Moreover, the user-friendly interface enhances accessibility for all team members involved in the document preparation.

Get more for Form CT 1096 ConnecticutForm CT 1096 2021Form CT 1096 ConnecticutForm CT 1096 Connecticut

- Tuition tax credit parentguardian claim form

- Contractor ampamp trades licensure psi onlinenew mexico contractor licenselicense searchcontractor ampamp trades licensure psi form

- Trf radio garage sale gram submission form this form and payment must be dropped off during regular business hours monday

- F 5720 state of minnesota department of form

- Claim for payment from form

- Frassati 5k runwalk ampamp kidfamily fun run in person registration form

- Hononegah phone app form

- Tryout registration form

Find out other Form CT 1096 ConnecticutForm CT 1096 2021Form CT 1096 ConnecticutForm CT 1096 Connecticut

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online