Form IL 941 X Amended Illinois Withholding Income Tax

What is the Form IL 941 X Amended Illinois Withholding Income Tax

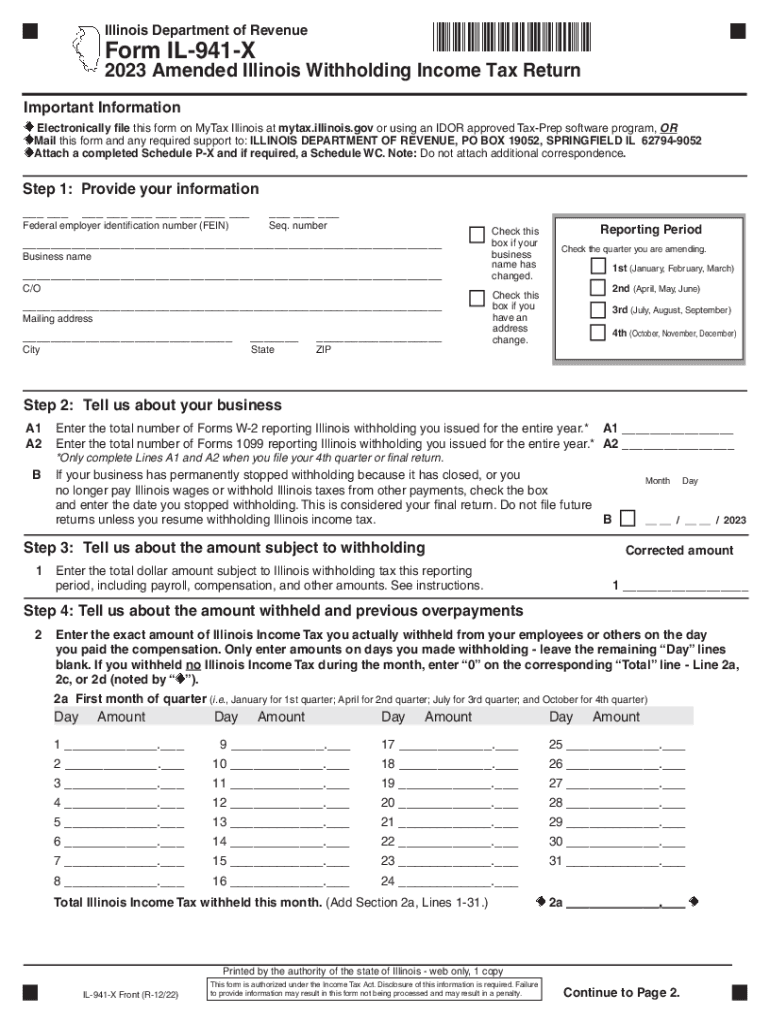

The Form IL 941 X is used to amend previously filed Illinois withholding income tax returns. This form allows employers to correct errors or make adjustments to their withholding tax submissions. It is essential for ensuring that the amounts reported are accurate and reflect any changes in employee wages or withholding calculations. The form is specifically designed for corrections related to the IL-941, which is the standard withholding income tax return for Illinois employers.

How to use the Form IL 941 X Amended Illinois Withholding Income Tax

To use the Form IL 941 X, employers must first identify the specific errors or changes that need to be amended from their original IL-941 filings. The form requires detailed information about the original return, including the tax period, the amounts that were originally reported, and the corrected amounts. Employers should fill out the form accurately, ensuring that all necessary fields are completed. Once completed, the form must be submitted to the Illinois Department of Revenue for processing.

Steps to complete the Form IL 941 X Amended Illinois Withholding Income Tax

Completing the Form IL 941 X involves several key steps:

- Gather the original IL-941 return and any supporting documents.

- Identify the specific errors or changes that need to be addressed.

- Fill out the Form IL 941 X, ensuring all required fields are completed accurately.

- Provide explanations for each amendment in the designated section of the form.

- Review the completed form for accuracy before submission.

- Submit the form to the Illinois Department of Revenue via the appropriate method.

Filing Deadlines / Important Dates

Filing deadlines for the Form IL 941 X are crucial to avoid penalties. Employers should be aware that amended returns should be filed as soon as errors are discovered. The Illinois Department of Revenue recommends submitting amendments within three years of the original filing date. Additionally, any tax due as a result of the amendment should be paid promptly to avoid interest and penalties.

Penalties for Non-Compliance

Failure to file the Form IL 941 X when necessary can result in penalties imposed by the Illinois Department of Revenue. These penalties may include fines for late filing or underpayment of taxes. It is important for employers to ensure that they comply with all filing requirements to avoid these financial repercussions. Regularly reviewing tax filings can help identify any necessary amendments before they lead to penalties.

Who Issues the Form

The Form IL 941 X is issued by the Illinois Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among employers. The department provides resources and guidance for completing the form, including instructions and FAQs, to assist employers in navigating the amendment process effectively.

Quick guide on how to complete form il 941 x amended illinois withholding income tax

Complete Form IL 941 X Amended Illinois Withholding Income Tax effortlessly on any device

Web-based document management has become favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without any holdups. Handle Form IL 941 X Amended Illinois Withholding Income Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to edit and eSign Form IL 941 X Amended Illinois Withholding Income Tax with ease

- Locate Form IL 941 X Amended Illinois Withholding Income Tax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of your documents or redact sensitive information using tools specifically designed for that by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your edits.

- Select your preferred delivery method for the form, whether by email, SMS, or link invitation, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Form IL 941 X Amended Illinois Withholding Income Tax to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form il 941 x amended illinois withholding income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the Illinois treasury?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents seamlessly. For those in Illinois treasury, it offers an efficient way to handle important financial documents securely and quickly, streamlining processes and enhancing compliance.

-

How does airSlate SignNow ensure compliance with Illinois treasury regulations?

airSlate SignNow adheres to stringent compliance standards, including those set by the Illinois treasury. The platform uses advanced encryption methods and secure servers to safeguard sensitive data, ensuring that all transactions meet regulatory requirements for eSignatures.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses, including those dealing with Illinois treasury functions. Pricing is competitive, designed to provide affordability while delivering comprehensive features suitable for document management and signing.

-

What features does airSlate SignNow offer for Illinois treasury customers?

airSlate SignNow provides a variety of features beneficial for Illinois treasury customers, including customizable templates, bulk sending options, and real-time tracking of document status. These features help streamline workflows, making it easier to manage and execute important financial documents.

-

Can airSlate SignNow integrate with other software used by Illinois treasury?

Yes, airSlate SignNow offers robust integrations with various popular software applications that Illinois treasury professionals may already use. Whether it’s CRM systems, document management software, or finance tools, seamless integration can enhance overall efficiency and productivity.

-

What are the benefits of using airSlate SignNow for Illinois treasury functions?

Using airSlate SignNow for Illinois treasury functions offers numerous benefits, including reduced turnaround time for document approvals and enhanced security for sensitive information. The ease of use and cost-effective nature of the platform also help businesses save time and resources.

-

Is airSlate SignNow suitable for small businesses in Illinois dealing with treasury operations?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises managing treasury operations in Illinois. Its user-friendly interface and scalable pricing plans make it an ideal choice for businesses looking to enhance their document management processes.

Get more for Form IL 941 X Amended Illinois Withholding Income Tax

Find out other Form IL 941 X Amended Illinois Withholding Income Tax

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy