Ny it 257 Instructions Form 2017

What is the Ny It 257 Instructions Form

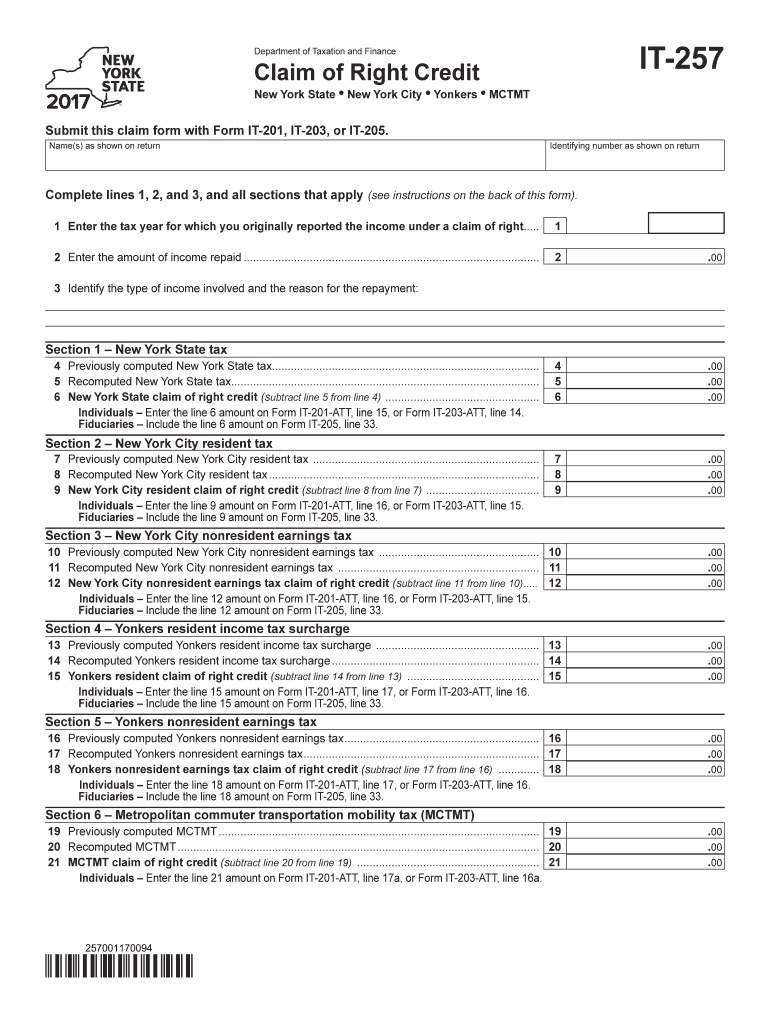

The Ny It 257 Instructions Form is a tax document used by residents of New York to report specific tax information to the state. This form provides guidance on how to accurately complete and submit the necessary information for tax purposes. It is essential for ensuring compliance with state tax regulations and for calculating any potential tax liabilities. Understanding this form is crucial for individuals and businesses alike, as it helps to clarify the requirements set forth by the New York State Department of Taxation and Finance.

How to use the Ny It 257 Instructions Form

Using the Ny It 257 Instructions Form involves several steps to ensure that all required information is accurately reported. First, gather all necessary documents, such as income statements and previous tax returns. Next, refer to the instructions provided with the form to understand the specific information required in each section. Fill out the form carefully, ensuring that all details are correct and complete. Once the form is filled out, review it for accuracy before submitting it to the appropriate state tax authority.

Steps to complete the Ny It 257 Instructions Form

Completing the Ny It 257 Instructions Form can be broken down into a few key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and any other income records.

- Read through the instructions accompanying the form to understand the specific requirements.

- Fill out the form carefully, ensuring that all fields are completed accurately.

- Double-check the information for any errors or omissions.

- Submit the completed form by the designated deadline, either online or by mail.

Legal use of the Ny It 257 Instructions Form

The Ny It 257 Instructions Form is legally recognized as a valid document for reporting tax information in New York. It must be completed in accordance with state regulations to ensure compliance and avoid penalties. The form serves as a formal declaration of income and tax obligations, and its proper use is essential for maintaining good standing with the New York State Department of Taxation and Finance. Failure to use the form correctly can result in legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Ny It 257 Instructions Form are crucial for taxpayers to adhere to in order to avoid penalties. Typically, the form must be submitted by April fifteenth of each year, coinciding with the federal tax filing deadline. However, it is important to check for any state-specific extensions or changes to the deadline, especially in light of recent events or updates from the New York State Department of Taxation and Finance. Staying informed about these dates helps ensure timely submission and compliance.

Form Submission Methods (Online / Mail / In-Person)

The Ny It 257 Instructions Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically through the state’s online portal, which offers a streamlined process.

- Mail: The completed form can be printed and mailed to the appropriate address as specified in the instructions.

- In-Person: Some individuals may choose to submit their forms in person at designated tax offices, allowing for direct interaction with tax officials.

Quick guide on how to complete ny it 257 instructions 2017 form

Your assistance manual on how to prepare your Ny It 257 Instructions Form

If you’re wondering how to finalize and submit your Ny It 257 Instructions Form, here are some brief instructions on how to make tax filing simpler.

To begin, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document platform that enables you to modify, generate, and finalize your tax documents effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and return to adjust responses as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Ny It 257 Instructions Form in just a few minutes:

- Create your account and begin working on PDFs shortly.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your Ny It 257 Instructions Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Signature Tool to add your legally-recognized eSignature (if needed).

- Review your document and rectify any errors.

- Save changes, print a copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to mistakes in returns and postpone refunds. Of course, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ny it 257 instructions 2017 form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

The Mh CET 2017 application forms were released yesterday. Is it better to fill out the form now or later?

No hard and fast rule for that!It would be better if you fill it early as possible.Because later the traffic will go on increasing and these Government websites are more likely to crash when the traffic is high.fill the forms in initial days if you can..

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

Create this form in 5 minutes!

How to create an eSignature for the ny it 257 instructions 2017 form

How to create an electronic signature for your Ny It 257 Instructions 2017 Form online

How to generate an electronic signature for the Ny It 257 Instructions 2017 Form in Chrome

How to make an electronic signature for putting it on the Ny It 257 Instructions 2017 Form in Gmail

How to make an electronic signature for the Ny It 257 Instructions 2017 Form right from your smartphone

How to create an eSignature for the Ny It 257 Instructions 2017 Form on iOS

How to generate an eSignature for the Ny It 257 Instructions 2017 Form on Android OS

People also ask

-

What is the NY IT 257 Instructions Form and why do I need it?

The NY IT 257 Instructions Form is a crucial document for taxpayers in New York who are seeking to claim their tax credits. It provides specific guidelines on how to accurately complete your tax return. Understanding this form will ensure that you maximize your eligible credits and simplify the filing process.

-

How can airSlate SignNow assist me in completing the NY IT 257 Instructions Form?

airSlate SignNow offers a user-friendly platform that streamlines the process of completing the NY IT 257 Instructions Form. With features like document templates and e-signature capabilities, it enables you to fill out and submit your form securely and efficiently. This ensures compliance while saving you time and effort.

-

Is there a cost associated with using airSlate SignNow to fill out the NY IT 257 Instructions Form?

Yes, there is a pricing structure for airSlate SignNow that varies based on the features you choose. However, many users find that the cost is justified given the benefits of enhanced workflow and efficiency when completing forms like the NY IT 257 Instructions Form. Exploring the pricing options can help you find a plan that suits your needs.

-

Can I integrate airSlate SignNow with other applications to complete the NY IT 257 Instructions Form?

Absolutely! airSlate SignNow provides various integration options with popular applications and software. This makes it easy to import data and documents necessary for the NY IT 257 Instructions Form, streamlining your entire tax filing process.

-

What are the main benefits of using airSlate SignNow for the NY IT 257 Instructions Form?

Using airSlate SignNow for the NY IT 257 Instructions Form offers several advantages, including quick electronic signatures and simplified document management. The platform assures that your information is secure and easily accessible, allowing you to focus on filing rather than paperwork. It also enhances collaboration, especially if multiple parties are involved.

-

How does airSlate SignNow ensure the security of my NY IT 257 Instructions Form data?

airSlate SignNow prioritizes security by employing robust encryption and compliant data handling practices. Your NY IT 257 Instructions Form and associated data are protected, ensuring privacy and compliance with regulations. Regular security updates further safeguard your information from potential threats.

-

What customer support options are available for assistance with the NY IT 257 Instructions Form?

airSlate SignNow offers a variety of customer support channels, including live chat, email support, and a comprehensive knowledge base. Should you have questions or challenges when completing the NY IT 257 Instructions Form, the support team is ready to assist you. This ensures that you get the help you need when it matters most.

Get more for Ny It 257 Instructions Form

- I hope this finds you book pdf download form

- Aer budget sheet form

- Animal mortality renewal application horses only form

- Centrelink mod r form

- Tax organizer forms

- Credit card authorization form wholesale electric supply

- Credit application and agreement form

- This master services agreement agreement is made and entered into this day of the form

Find out other Ny It 257 Instructions Form

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online