it 257 2018

What is the It 257

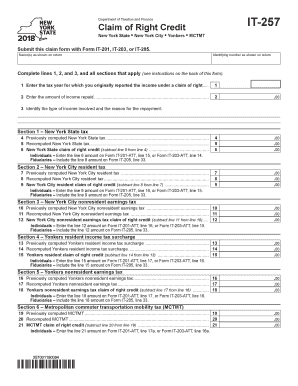

The It 257 form is a tax document used by residents of New York to claim a credit for certain taxes paid. Specifically, it allows taxpayers to report and claim the 2018 New York credit, which can help reduce the overall tax liability. This form is essential for individuals who qualify for the credit, ensuring they receive the financial benefits available to them under state tax law.

How to use the It 257

Using the It 257 form involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary documentation related to their income and previous tax payments. Once the form is filled out, it should be reviewed for accuracy before submission. It is crucial to follow the specific guidelines provided by the New York State Department of Taxation and Finance to avoid any errors that could delay processing or result in penalties.

Steps to complete the It 257

Completing the It 257 form requires careful attention to detail. Here are the general steps:

- Gather required documents, including income statements and previous tax returns.

- Fill out the form with accurate personal information and tax details.

- Calculate the credit amount based on the instructions provided.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or via mail, as per the guidelines.

Legal use of the It 257

The It 257 form is legally recognized by the New York State government for tax purposes. It must be completed in accordance with state laws and regulations to ensure its validity. Taxpayers should be aware of the legal implications of submitting false information or failing to file the form on time, as these actions can lead to penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the It 257 form are critical for taxpayers to adhere to in order to avoid penalties. Generally, the form must be submitted by the due date of the income tax return for the year in which the credit is being claimed. It is advisable to check the New York State Department of Taxation and Finance website for any updates or changes to deadlines, especially in light of potential extensions or changes in tax law.

Required Documents

To successfully complete the It 257 form, taxpayers must have several key documents on hand. These typically include:

- W-2 forms from employers, detailing income earned.

- 1099 forms for any additional income sources.

- Previous year’s tax returns for reference.

- Documentation supporting any claims for the credit.

Form Submission Methods (Online / Mail / In-Person)

The It 257 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing the completed form to the appropriate tax office address.

- In-person submission at designated tax offices, if necessary.

Quick guide on how to complete ny it 257 instructions 2018 2019 form

Your assistance manual on how to prepare your It 257

If you’re wondering how to create and dispatch your It 257, below are a few straightforward recommendations on how to simplify tax submission.

To begin, you'll need to register for your airSlate SignNow profile to alter how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document tool that enables you to edit, draft, and finalize your tax forms effortlessly. Using its editor, you can toggle between text, checkboxes, and eSignatures, and return to modify information as necessary. Enhance your tax processing with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your It 257 in just a few minutes:

- Set up your account and start editing PDFs in moments.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Click Get form to access your It 257 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to attach your binding eSignature (if required).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can lead to more errors and delayed refunds. Before e-filing your taxes, be sure to consult the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ny it 257 instructions 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How do I fill out the BHU's form of B.Com in 2018 and crack it?

you can fill from to go through bhu portal and read all those instruction and download previous year question paper . that u will get at the portal and solve more and more question paper and read some basics from your study level .focus on study save ur time and energy .do best to achieve your goal .for more detail discus with gajendra ta mtech in iit bhu .AND PKN .good luck .

-

Is it advantageous to fill out the JEE Mains 2018 form as soon as possible?

Yes. It is advantageous to fill out the JEE Mains 2018 form as soon as possible? Click here to know more about what are the advantage of filling JEE Main Application Form Earlier.

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

-

Is it possible to apply or fill out a form for the CPT June attempt 2018 now or tomorrow?

Dear friend,The time is up for registration for CPT June attempt.If you already attempted cpt and this is second time ( orpre than that) then you can apply for CPT December exam.Through ICAI official website.Thank you.

Create this form in 5 minutes!

How to create an eSignature for the ny it 257 instructions 2018 2019 form

How to create an eSignature for the Ny It 257 Instructions 2018 2019 Form online

How to create an electronic signature for your Ny It 257 Instructions 2018 2019 Form in Google Chrome

How to generate an electronic signature for putting it on the Ny It 257 Instructions 2018 2019 Form in Gmail

How to create an electronic signature for the Ny It 257 Instructions 2018 2019 Form from your smart phone

How to generate an electronic signature for the Ny It 257 Instructions 2018 2019 Form on iOS

How to make an eSignature for the Ny It 257 Instructions 2018 2019 Form on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to it 257?

airSlate SignNow is a powerful eSignature solution that enables businesses to efficiently send and sign documents. Specifically, it 257 focuses on enhancing productivity by streamlining the document management process, making it easier for users to handle signatures digitally.

-

How much does it 257 cost with airSlate SignNow?

Pricing for airSlate SignNow varies depending on the chosen plan, but it is designed to be cost-effective for businesses of all sizes. With competitive pricing structures, it 257 offers great value, ensuring that even small businesses can benefit from seamless eSigning capabilities.

-

What features does airSlate SignNow offer in its it 257 package?

The it 257 package of airSlate SignNow includes essential features such as customizable templates, real-time tracking of document status, and advanced security measures. These features ensure that users can efficiently manage their document workflows while complying with necessary regulations.

-

Can I integrate airSlate SignNow with other applications for it 257?

Yes, airSlate SignNow supports a variety of integrations with popular applications such as Google Drive, Salesforce, and more. These integrations complement the it 257 functionality, allowing businesses to connect their existing tools and simplify their digital workflow.

-

What are the benefits of using airSlate SignNow for it 257 eSigning?

Using airSlate SignNow for it 257 eSigning provides numerous benefits including improved turnaround times, reduced paper usage, and enhanced security. Businesses can streamline their processes while ensuring that all documents are signed quickly and securely in a digital format.

-

Is the airSlate SignNow platform user-friendly for it 257 needs?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy to navigate even for individuals with limited technical skills. This user-friendly interface specifically supports it 257 needs by allowing quick adoption and efficient training for team members.

-

How does airSlate SignNow handle document security in relation to it 257?

Document security is a top priority for airSlate SignNow. The platform encrypts all documents and employs additional security features, making it a reliable choice for it 257 that require stringent data protection methods to safeguard sensitive information.

Get more for It 257

Find out other It 257

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed