Ny State Tax Form it 1099 R 2018

What is the NY State Tax Form IT-1099-R?

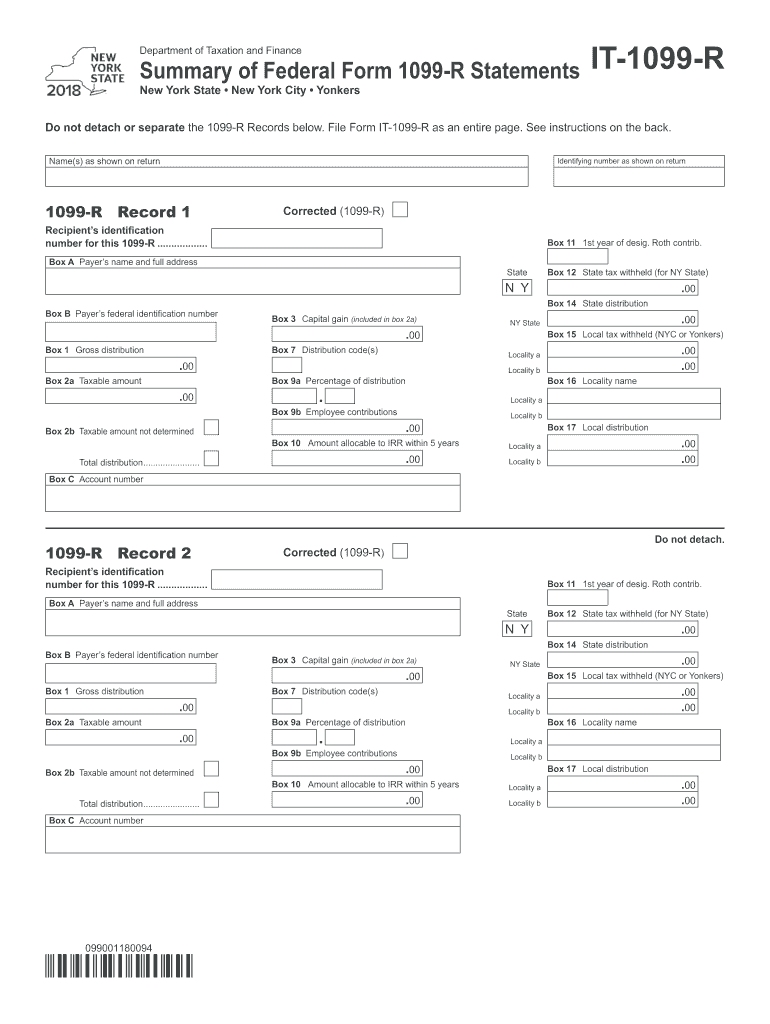

The NY State Tax Form IT-1099-R is a tax document used to report distributions from pensions, annuities, retirement plans, or other similar sources. This form is essential for individuals receiving retirement income, as it helps to ensure accurate reporting of taxable income to the New York State Department of Taxation and Finance. The IT-1099-R provides detailed information about the amounts distributed and any taxes withheld, which is crucial for proper tax filing and compliance with state regulations.

Steps to Complete the NY State Tax Form IT-1099-R

Completing the NY State Tax Form IT-1099-R involves several key steps:

- Gather necessary information: Collect all relevant documents, including your previous tax returns and any 1099 forms received.

- Fill in personal details: Enter your name, address, and taxpayer identification number accurately.

- Report distribution amounts: Input the total amount distributed to you during the tax year, as indicated on the form.

- Indicate federal tax withheld: If applicable, report any federal taxes that were withheld from your distributions.

- Review and verify: Double-check all entries for accuracy to minimize errors.

- Submit the form: Follow the submission guidelines to file the form either online or by mail.

How to Use the NY State Tax Form IT-1099-R

The NY State Tax Form IT-1099-R is primarily used to report income from retirement sources. Taxpayers should use this form to:

- Report distributions received from pensions or retirement accounts.

- Determine the taxable portion of the distributions for state tax purposes.

- Ensure compliance with state tax regulations by accurately reporting income.

Using this form correctly is vital for avoiding penalties and ensuring that taxpayers fulfill their obligations under New York State tax law.

Legal Use of the NY State Tax Form IT-1099-R

The legal use of the NY State Tax Form IT-1099-R is governed by state tax laws and IRS regulations. It is crucial for taxpayers to:

- Ensure that the form is filled out completely and accurately to avoid issues with the state tax authority.

- Retain copies of the completed form for personal records and future reference.

- File the form by the specified deadlines to maintain compliance and avoid penalties.

Understanding the legal implications of this form helps taxpayers navigate their tax responsibilities effectively.

Filing Deadlines / Important Dates

Filing deadlines for the NY State Tax Form IT-1099-R are typically aligned with federal tax deadlines. Important dates to keep in mind include:

- January 31: Deadline for issuers to provide recipients with their IT-1099-R forms.

- April 15: General deadline for filing state income tax returns, including any necessary forms like the IT-1099-R.

Staying aware of these dates is essential for timely and accurate tax filing.

Who Issues the Form?

The NY State Tax Form IT-1099-R is typically issued by financial institutions, pension funds, or retirement plan administrators. These entities are responsible for reporting the distributions made to individuals during the tax year. Recipients should expect to receive their forms by the end of January each year to facilitate timely tax filing.

Quick guide on how to complete form it 1099 r department of taxation and finance

Your assistance manual on how to prepare your Ny State Tax Form It 1099 R

If you’re interested in learning how to complete and submit your Ny State Tax Form It 1099 R, here are some concise recommendations on how to simplify tax submission.

First, you simply need to create your airSlate SignNow profile to change how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document solution that allows you to modify, draft, and finalize your tax documents with ease. With its editor, you can alternate between text, checkboxes, and eSignatures, and return to amend answers whenever necessary. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing options.

Follow the instructions below to complete your Ny State Tax Form It 1099 R in no time:

- Register your account and start working on PDFs within minutes.

- Utilize our catalog to locate any IRS tax form; browse through variants and schedules.

- Click Get form to launch your Ny State Tax Form It 1099 R in our editor.

- Fill in the necessary fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if applicable).

- Examine your document and correct any mistakes.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Be aware that paper filing can increase error rates and delay refunds. Of course, before e-filing your taxes, check the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form it 1099 r department of taxation and finance

FAQs

-

How much does it cost to outsource the printing and filing of 5000 1099 Misc forms?

Most of the larger places in the US will cost you around $4-6 per employee. 5000 is a lot, so I'm sure you'll find someone who will negotiate. So to do it "right" and full-service from a named payroll company, I'm guessing $20,000.Now retail, maybe $2-3 of that is for e-filing services and $2-3 is for printing/mailing. So if employees are printing their own, getting emails, or getting links to a secure FTP site, then maybe you can save half of that by not mailing. Check the rules, but that's pretty common. For the other half, I'd bet plenty of companies have really good deals, including the IRS--I'd bet money they allow you upload a 5,000 line CSV for free or next to it.Of course there's India and stuff--real outsourcing--but I'd have to quintuple check the legalities of sending employee information across international lines, HIPAA and all that. And even if an international outsource printed and enveloped it, you'd have to have it flown here to ship, and you'd have to solve the e-file aspect. As with everything it's a trade-off of how much risk you want to pay to transfer.So negotiating in the real world, I'd bet $10,000 to do it right. These are guesstimates--not quite guesses, but not quite estimates, but a start for your thoughts. Hopefully a payroll accountant will strike me down.

-

How do I fill out the BHU's form of B.Com in 2018 and crack it?

you can fill from to go through bhu portal and read all those instruction and download previous year question paper . that u will get at the portal and solve more and more question paper and read some basics from your study level .focus on study save ur time and energy .do best to achieve your goal .for more detail discus with gajendra ta mtech in iit bhu .AND PKN .good luck .

-

Can I print a notice of intent form to homeschool in Nevada, fill it out, and turn it in?

It's best to ask homeschoolers in your state. Every state has different laws. What works in one may not work in another.This looks like the information you need: Notice of Intent (NOI)

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

Create this form in 5 minutes!

How to create an eSignature for the form it 1099 r department of taxation and finance

How to create an eSignature for your Form It 1099 R Department Of Taxation And Finance in the online mode

How to generate an electronic signature for the Form It 1099 R Department Of Taxation And Finance in Google Chrome

How to make an eSignature for putting it on the Form It 1099 R Department Of Taxation And Finance in Gmail

How to generate an eSignature for the Form It 1099 R Department Of Taxation And Finance right from your smartphone

How to make an electronic signature for the Form It 1099 R Department Of Taxation And Finance on iOS devices

How to make an eSignature for the Form It 1099 R Department Of Taxation And Finance on Android

People also ask

-

What is an IT 1099 R fillable form?

An IT 1099 R fillable form is a tax document used to report distributions from pensions, annuities, retirement plans, and IRAs. Using airSlate SignNow, you can easily create, fill out, and sign this form electronically, ensuring all information is recorded accurately and securely.

-

How does airSlate SignNow help with the IT 1099 R fillable form?

airSlate SignNow offers a user-friendly interface that allows you to create and manage IT 1099 R fillable forms efficiently. The platform provides options for electronic signatures and secure document storage, streamlining the process of completing and submitting tax forms.

-

Is airSlate SignNow cost-effective for businesses needing IT 1099 R fillable forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses that frequently need IT 1099 R fillable forms. With flexible pricing plans tailored to various needs, you can select an option that fits your budget while still accessing essential features.

-

Can I integrate airSlate SignNow with other applications for my IT 1099 R fillable forms?

Absolutely! airSlate SignNow supports integrations with various third-party applications, allowing you to automate your processes and manage IT 1099 R fillable forms efficiently. This capability enhances workflow and reduces the time you spend on paperwork.

-

What are the benefits of using airSlate SignNow for IT 1099 R fillable forms?

Using airSlate SignNow for IT 1099 R fillable forms offers numerous benefits, including faster processing times, reduced errors, and improved compliance. The electronic signing feature accelerates the approval process, saving you time and resources.

-

Is it secure to use airSlate SignNow for my IT 1099 R fillable form?

Yes, airSlate SignNow employs industry-leading security measures to protect your data while you fill out IT 1099 R fillable forms. This includes encryption, secure document storage, and compliance with regulatory standards.

-

Do I need technical skills to use airSlate SignNow for IT 1099 R fillable forms?

No, airSlate SignNow is designed to be intuitive and user-friendly, requiring no advanced technical skills to complete IT 1099 R fillable forms. With on-screen instructions and helpful guides, users of all skill levels can navigate the platform effortlessly.

Get more for Ny State Tax Form It 1099 R

Find out other Ny State Tax Form It 1099 R

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template