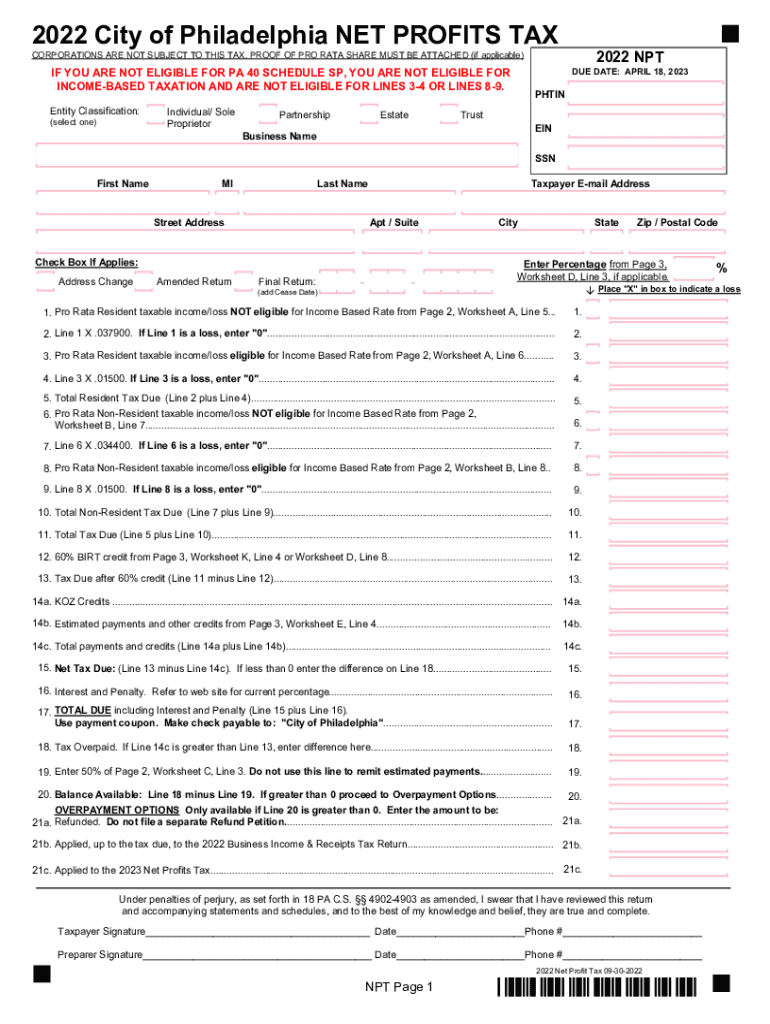

City of Philadelphia NET PROFITS TAX Form

What is the City Of Philadelphia Net Profits Tax?

The City of Philadelphia Net Profits Tax (NPT) is a tax imposed on the profits of businesses operating within the city. This tax applies to various business entities, including corporations, partnerships, and sole proprietorships. The NPT is calculated based on the net income generated by the business, ensuring that local businesses contribute to the city's revenue. Understanding the specifics of this tax is crucial for compliance and effective financial planning.

How to Use the City Of Philadelphia Net Profits Tax

To effectively use the City of Philadelphia Net Profits Tax, businesses must first determine their taxable income. This involves calculating total revenue and subtracting allowable deductions, such as business expenses. Once the net income is established, businesses can apply the appropriate tax rate to determine their tax liability. This process is essential for accurate reporting and compliance with local tax regulations.

Steps to Complete the City Of Philadelphia Net Profits Tax

Completing the City of Philadelphia Net Profits Tax involves several key steps:

- Gather financial records, including income statements and expense reports.

- Calculate total revenue and allowable deductions to determine net income.

- Apply the current tax rate to the net income to find the tax owed.

- Complete the 2022 NPT form, ensuring all information is accurate and complete.

- Submit the form by the designated deadline, either online or via mail.

Filing Deadlines / Important Dates

Filing deadlines for the City of Philadelphia Net Profits Tax are critical for compliance. Typically, the tax return is due on the fifteenth day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the deadline is April 15. It's important to be aware of any extensions or changes to these dates to avoid penalties.

Required Documents

To file the City of Philadelphia Net Profits Tax, businesses must prepare several documents, including:

- Income statements detailing total revenue.

- Expense reports for allowable deductions.

- The completed 2022 NPT form.

- Any supporting documentation that verifies income and expenses.

Having these documents ready will streamline the filing process and ensure accuracy.

Penalties for Non-Compliance

Failure to comply with the City of Philadelphia Net Profits Tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to meet all filing requirements and deadlines to avoid these consequences. Regularly reviewing tax obligations and maintaining accurate records can help mitigate the risk of non-compliance.

Quick guide on how to complete city of philadelphia net profits tax

Effortlessly Prepare City Of Philadelphia NET PROFITS TAX on Any Device

Web-based document management has gained traction among businesses and individuals. It offers a superb eco-conscious alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without interruptions. Manage City Of Philadelphia NET PROFITS TAX on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and Electronically Sign City Of Philadelphia NET PROFITS TAX with Ease

- Find City Of Philadelphia NET PROFITS TAX and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs within a few clicks from any device you choose. Modify and electronically sign City Of Philadelphia NET PROFITS TAX and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of philadelphia net profits tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 Philadelphia NPT and how does airSlate SignNow relate to it?

The 2022 Philadelphia NPT refers to the Notary Public Test that was held in Philadelphia. While airSlate SignNow does not specifically administer the NPT, it provides a seamless eSignature solution that can aid notaries in managing their documentation efficiently, whether they are preparing for the test or conducting their services afterwards.

-

What pricing options are available for airSlate SignNow in relation to the 2022 Philadelphia NPT?

AirSlate SignNow offers various pricing plans designed to accommodate different business needs. While there is no specific plan aligned with the 2022 Philadelphia NPT, our competitive pricing ensures that you can select a package that fits your budget and workflow, making document signings more streamlined and cost-effective.

-

Are there any features of airSlate SignNow that benefit participants of the 2022 Philadelphia NPT?

Absolutely! Participants of the 2022 Philadelphia NPT can benefit from features like customizable templates, automated workflows, and robust security measures. These functionalities ensure that all necessary documents for the NPT can be managed efficiently and securely, enhancing the overall experience.

-

How can airSlate SignNow enhance my document workflow during the 2022 Philadelphia NPT process?

Using airSlate SignNow can greatly enhance your document workflow by allowing you to create, edit, and send documents for eSigning in just a few clicks. For anyone involved in the 2022 Philadelphia NPT, this means less time worrying about paperwork and more time focusing on preparation and success.

-

What integrations does airSlate SignNow offer that may assist with the 2022 Philadelphia NPT?

AirSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and Microsoft Office. These integrations can assist those preparing for the 2022 Philadelphia NPT by allowing them to access, share, and sign documents from their preferred platforms effortlessly.

-

Can airSlate SignNow help streamline the notarization process for the 2022 Philadelphia NPT?

Yes, airSlate SignNow is designed to streamline the notarization process signNowly. Participants of the 2022 Philadelphia NPT can utilize its user-friendly interface to quickly complete necessary documents, ensuring that all signatures are captured accurately and efficiently.

-

What are the advantages of using airSlate SignNow for the 2022 Philadelphia NPT?

The advantages of using airSlate SignNow include enhanced efficiency, lower processing costs, and the ability to sign documents from anywhere at any time. For those participating in the 2022 Philadelphia NPT, these benefits can lead to a more organized and stress-free experience during a critical time.

Get more for City Of Philadelphia NET PROFITS TAX

- Form 4 11 2016 2019

- Victim impact statement virginia 2015 2019 form

- Request to defer traffic infraction chelan county co chelan wa 6964441 form

- Enter the name and address of form

- County in which this case is form

- Fa 4161 2010 2019 form

- Pr 1801 2018 2019 form

- Biographies of house members west virginia legislature form

Find out other City Of Philadelphia NET PROFITS TAX

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT