Forma 1040 Pr 2018

What is the Forma 1040 Pr

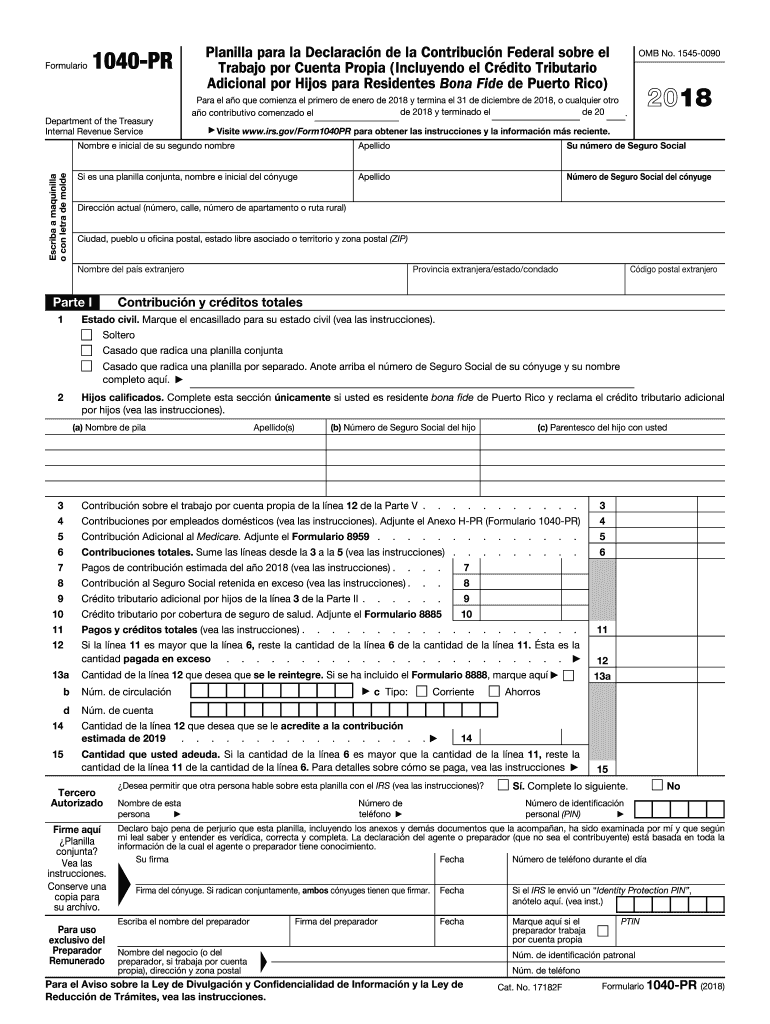

The Forma 1040 Pr is a tax form used by residents of Puerto Rico to report their income to the Internal Revenue Service (IRS). This form is specifically designed for individuals who are subject to U.S. tax laws while living in Puerto Rico. The 1040 Pr allows taxpayers to calculate their tax liability, claim deductions, and report various types of income. It's essential for ensuring compliance with U.S. tax regulations while taking into account the unique tax structure applicable to Puerto Rico residents.

Steps to complete the Forma 1040 Pr

Completing the Forma 1040 Pr involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, ensuring accuracy in name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and interest.

- Claim any applicable deductions, such as those for dependents or education expenses.

- Calculate your total tax liability using the provided tax tables or software.

- Review the completed form for accuracy before submission.

How to obtain the Forma 1040 Pr

The Forma 1040 Pr can be obtained through various channels. Taxpayers can download the form directly from the IRS website or request a physical copy through mail. Additionally, many tax preparation software programs include the 1040 Pr as part of their offerings, making it easy to fill out and file electronically. It's important to ensure that you are using the most current version of the form, as outdated forms may not be accepted by the IRS.

Legal use of the Forma 1040 Pr

Using the Forma 1040 Pr legally requires adherence to IRS guidelines. Taxpayers must ensure that they are eligible to file this form based on their residency status and income sources. It is crucial to provide accurate information and report all income to avoid penalties. Filing the 1040 Pr correctly helps maintain compliance with U.S. tax laws and ensures that taxpayers receive any refunds or credits they may be entitled to.

Filing Deadlines / Important Dates

Filing deadlines for the Forma 1040 Pr typically align with the general tax filing deadlines set by the IRS. For most taxpayers, the deadline is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It’s advisable to check the IRS website for any updates on deadlines and to ensure timely submission to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Forma 1040 Pr can be submitted through various methods. Taxpayers have the option to file electronically using approved tax software, which often simplifies the process and allows for faster processing times. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person filing is generally not available, as most submissions are handled electronically or via mail. Ensuring that the form is sent to the correct address is crucial for timely processing.

Quick guide on how to complete 1040pr 2017 2018 2019 form

Explore the most efficient method to complete and sign your Forma 1040 Pr

Are you still squandering time preparing your legal documents on paper instead of doing it digitally? airSlate SignNow offers a superior way to complete and sign your Forma 1040 Pr and associated forms for public services. Our advanced electronic signature solution equips you with all the necessary tools to manage documents swiftly and in compliance with official standards - robust PDF editing, organizing, safeguarding, signing, and sharing functionalities all within a user-friendly interface.

Only a few steps are needed to finalize filling out and signing your Forma 1040 Pr:

- Load the fillable template into the editor using the Get Form button.

- Verify what information you need to enter in your Forma 1040 Pr.

- Navigate through the fields using the Next button to ensure you don’t miss anything.

- Utilize Text, Check, and Cross tools to complete the fields with your details.

- Enhance the content with Text boxes or Images from the top toolbar.

- Emphasize what is crucial or Obscure fields that are no longer relevant.

- Press Sign to create a legally enforceable electronic signature using any method you prefer.

- Insert the Date next to your signature and finish your task with the Done button.

Store your finalized Forma 1040 Pr in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our solution also offers versatile file sharing. There’s no requirement to print your templates when you need to send them to the appropriate public office - do so using email, fax, or by requesting a USPS “snail mail” dispatch from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 1040pr 2017 2018 2019 form

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

Create this form in 5 minutes!

How to create an eSignature for the 1040pr 2017 2018 2019 form

How to generate an eSignature for your 1040pr 2017 2018 2019 Form online

How to create an eSignature for your 1040pr 2017 2018 2019 Form in Chrome

How to create an electronic signature for putting it on the 1040pr 2017 2018 2019 Form in Gmail

How to make an eSignature for the 1040pr 2017 2018 2019 Form from your mobile device

How to create an eSignature for the 1040pr 2017 2018 2019 Form on iOS

How to create an eSignature for the 1040pr 2017 2018 2019 Form on Android OS

People also ask

-

What is the Forma 1040 Pr and how does it work?

The Forma 1040 Pr is a comprehensive tax form designed for U.S. citizens and residents to report their income and calculate their tax obligations. By using the airSlate SignNow platform, you can easily fill out, sign, and submit your Forma 1040 Pr electronically, streamlining the tax filing process.

-

How can airSlate SignNow help me with my Forma 1040 Pr?

airSlate SignNow simplifies the process of completing your Forma 1040 Pr by providing an intuitive interface for document editing and eSigning. You can collaborate with tax professionals and securely send your completed forms, ensuring that your tax filing is efficient and compliant.

-

Is there a cost associated with using airSlate SignNow for the Forma 1040 Pr?

Yes, there are pricing plans available for airSlate SignNow that cater to different needs, including features specifically designed for managing documents like the Forma 1040 Pr. With competitive pricing, you can choose a plan that fits your budget while benefiting from a robust eSigning solution.

-

What features does airSlate SignNow offer for managing the Forma 1040 Pr?

airSlate SignNow offers a range of features for the Forma 1040 Pr, including customizable templates, automated workflows, and secure document storage. These tools help you streamline the completion and submission of your tax forms, making the process more efficient.

-

Can I integrate airSlate SignNow with other software for my Forma 1040 Pr?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, enhancing your experience with the Forma 1040 Pr. This integration allows for easy data transfer and ensures that your tax information is accurate and up-to-date.

-

What are the benefits of using airSlate SignNow for the Forma 1040 Pr?

Using airSlate SignNow for your Forma 1040 Pr provides several benefits, including reduced paperwork, increased efficiency, and enhanced security for your sensitive tax information. The platform's user-friendly design also makes it accessible for users of all skill levels.

-

Is airSlate SignNow secure for submitting my Forma 1040 Pr?

Yes, airSlate SignNow prioritizes security by implementing industry-standard encryption and compliance measures. When you submit your Forma 1040 Pr through our platform, you can trust that your data is protected against unauthorized access.

Get more for Forma 1040 Pr

- No trespassing forms for print

- Change of beneficiary form americo

- Certificate of compliance with mandatory disclosure form

- Finding the main idea in paragraphs bteach nologycomb form

- Ct 10u consumers compensating use tax returns and instructions rev 1 23 form

- Schedule k 1 form 1041 beneficiarys share of income deductions credits etc

- Megs security authorization form

- Pit b 240580200 new mexico allocation and a form

Find out other Forma 1040 Pr

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation